Editor's PiCK

Venezuela effect?…"Bitcoin could retake $100,000 this month"

공유하기

- After the U.S. airstrike on Venezuela, Bitcoin surpassed $93,000, improving investor sentiment.

- The probability of Bitcoin surpassing $100,000 this month rose to 47%, and a bullish trend continues without panic selling.

- Expectations of falling inflation and a shift in Venezuela toward pro-crypto policies could positively impact Bitcoin investment.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Despite U.S. airstrike on Venezuela

Bitcoin exceeds $93,000

"No signs of panic selling"

47% chance to exceed $100,000

Bitcoin (BTC) surpassed $93,000 for the first time in about a month. Analysts say the U.S. attack on Venezuela raised expectations of easing inflation, stimulating risk-asset preference such as Bitcoin. Some predict Bitcoin could reclaim the $100,000 level this month.

On the 5th, according to crypto market tracker CoinMarketCap, Bitcoin at one point rose into the $93,000 range. It was the first time Bitcoin exceeded $93,000 since the 10th of last month—about a month ago. After trading in the mid-$80,000 range since mid-last month, it succeeded in a rebound.

Bitcoin broke out of the range immediately after the U.S. attacked Venezuela. Earlier, on the 3rd, the U.S. carried out a military intervention that forcibly removed Venezuelan President Nicolás Maduro. Immediately after the news, Bitcoin surpassed $90,000, and two days later it rose more than 2% and temporarily exceeded $93,000.

"Absorbing safe-haven demand"

Investor sentiment also improved. According to analytics firm Alternative, the crypto Fear & Greed Index shifted from 'extreme fear' to 'fear' that day. Markus Thielen, founder of 10x Research, said, "Both Bitcoin and Ethereum (ETH) have moved into a bullish phase, improving market sentiment." U.S. crypto outlet CoinDesk reported, "Bitcoin's rebound was triggered in conjunction with geopolitical tensions sparked by the U.S. airstrike on Venezuela," adding, "a signal that crypto is absorbing demand for safe-haven assets."

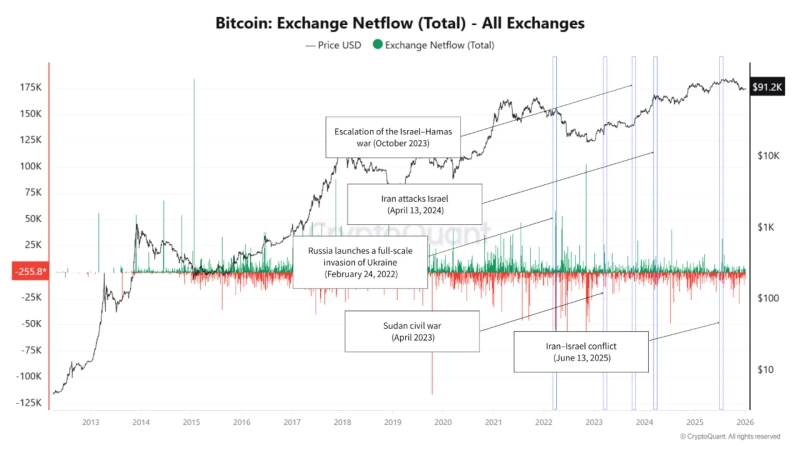

This contrasts with past instances when Bitcoin took a direct hit amid geopolitical risks. Notable examples include February 2022 just before the Russia-Ukraine war and June last year when Israel struck Iran. A CryptoQuant contributor at XWIN Research Japan wrote, "The crypto market has increased its resilience to localized military conflicts since 2023," noting, "there were no observed signs of large-scale Bitcoin inflows to exchanges amid the Venezuela incident." He added, "This means panic selling is not occurring," and "the market is cautious about Venezuela but not gripped by fear."

There are also views that Bitcoin could break $100,000 soon. On Polymarket, the world's largest prediction market, the probability that Bitcoin would exceed $100,000 this month briefly reached 47% that day. Compared to 21% on the 2nd—just before the U.S. airstrike on Venezuela—the probability more than doubled in three days. Over the same period, the likelihood of Bitcoin exceeding $95,000 this month jumped from the 50% range to the 80% range, an increase of about 30 percentage points. Thielen said, "Year-end tax-driven selling pressure has eased, and with the new year, institutional investors may have more capacity to allocate funds to risk assets."

"Seen as an alternative to the Venezuelan bolívar"

The key issue is inflation. Venezuela is considered the world's top oil country with oil reserves amounting to 300 billion barrels. U.S. President Donald Trump announced plans immediately after the strike to deploy U.S. oil companies to Venezuela to increase crude production. Forbes noted, "If oil production rises and oil prices fall, inflation in the U.S. and worldwide could be contained over the next year," adding, "lower inflation could have a positive effect on Bitcoin."

The industry is also paying attention to the fact that Maria Corina Machado, last year's Nobel Peace Prize laureate, is pro-crypto. Machado, touted as a likely next leader of Venezuela, said last year, "Bitcoin has evolved from a humanitarian tool into an important means of resistance," and expressed hope that a new democratic Venezuela would actively utilize Bitcoin.

U.S. crypto outlet Cointelegraph said, "If a Machado-led Venezuelan government emerges, a rapid shift to free-market reforms would occur," suggesting, "such reforms could include using Bitcoin as a means to replace the Venezuelan bolívar, whose value collapsed by more than 99.99% after Maduro's administration took office in 2013."