Editor's PiCK

Digital asset investment products, net inflow of 582 million dollars last week… selective buying centered on altcoins

공유하기

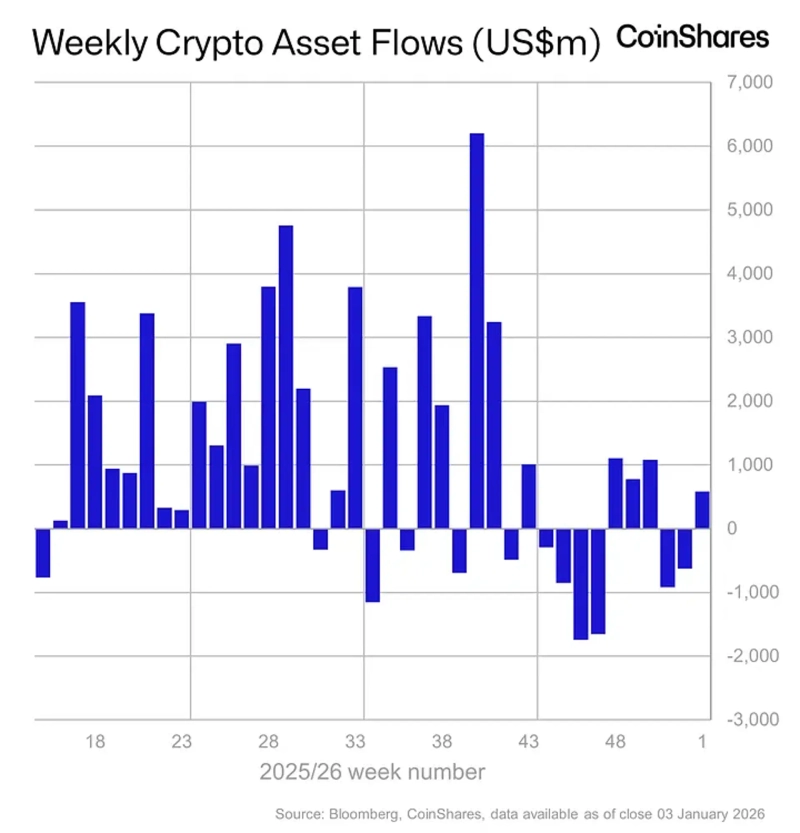

- CoinShares said that last week the digital asset investment products market had net inflows of 582 million dollars.

- It reported that inflows were concentrated in some altcoins such as Ethereum, XRP, Solana, and that net inflows into Bitcoin and other altcoins decreased.

- Analysis suggested that market fund flows are selective buying rather than an overall market-wide strength.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

The digital asset investment products market experienced a net inflow of 582 million dollars last week, but analysis shows that fund flows still tend to be concentrated in certain assets.

According to CoinShares, a crypto asset manager, a total of 582 million dollars flowed into global digital asset investment products last week. There was about 89 million dollars of net outflow in the early part of the week, but buying interest flowed in later in the week, turning it into a weekly net inflow.

On a year-to-date basis, net inflows into digital asset investment products in 2025 totaled 47.2 billion dollars. This is close to the 48.7 billion dollars recorded in 2024, and despite year-end volatility, the annual fund inflow size is assessed to remain near historical peaks.

By region, the United States led the overall flow with annual net inflows of 47.2 billion dollars. However, this is about a 12% decrease from the previous year.

There were clear differences in flows by asset. Bitcoin recorded annual net inflows of 26.9 billion dollars, a 35% decrease compared to last year. It is assessed that buying intensity has weakened in the short term as the price adjustment phase continues. In contrast, Ethereum saw annual inflows of 12.7 billion dollars, an increase of 138% from the previous year.

Among altcoins, inflows to XRP and Solana stood out. XRP had annual inflows of 3.7 billion dollars, about a 500% increase from the previous year, and Solana surged to 3.6 billion dollars, about a 1000% increase. By contrast, inflows to other altcoins amounted to only 318 million dollars, a 30% decrease from the previous year.

James Butterfill, head of research at CoinShares, said, "On an annual basis the size of fund inflows remains robust, but the recent flow is closer to a selective rotation into certain assets rather than a broad market rally," adding, "It is still limited to interpret this as a signal of a broad recovery in risk appetite."