Editor's PiCK

Is the sell-off over...? Ethereum, withdrawal queue shrinks and staking surges

공유하기

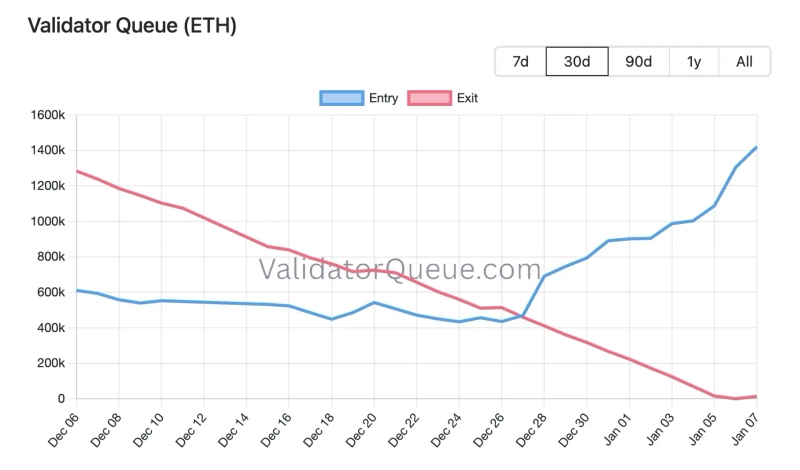

- In the Ethereum (ETH) market, the validator withdrawal queue has sharply decreased, easing immediate selling pressure.

- Meanwhile, the staking entry queue has surged to 1.44 million ETH, and large institutional investors are actively staking.

- They reported that Ethereum holdings on exchanges have fallen to their lowest level, increasing expectations of a price rise.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

The amount of validator withdrawal queue, previously regarded as potential selling pressure in the Ethereum (ETH) market, has significantly decreased. Meanwhile, the entry queue for staking (deposits) has surged, raising expectations of a price increase due to a supply-demand imbalance.

On the 6th (local time), according to ValidatorQueue (validatorqueue), the Ethereum validator withdrawal queue once plunged to around 32 ETH. The waiting time is only about 1 minute. This means the queued amount, which had reached 2.67 million ETH in mid-September, has been almost 100% depleted, indicating that the immediate selling pressure that had weighed on the market has been relieved. The withdrawal queue has slightly risen to 9472ETH.

Meanwhile, new entry demand is exploding. The staking entry queue has surged to 1.44 million ETH, marking the highest level since mid-November.

Moves by large institutional investors are particularly notable. Bitmain began staking on the 26th of last month and on the 3rd alone deposited an additional 82,560 ETH. Bitmain is currently staking 659,219 ETH. Bitmain's total Ethereum holdings are 4.1 million ETH, about 3.4% of the total supply.

The fact that Ethereum holdings on exchanges have fallen to their lowest levels in years also supports a price increase, because fewer coins held on exchanges make immediate selling more difficult. On the day, Ethereum is trading at 3250 dollars on the Binance Tether (USDT) market, up about 1% from the previous day.

!["Venezuela crude oil 'indefinitely' controlled... will make them buy U.S. goods" [Lee Sang-eun's Washington Now]](https://media.bloomingbit.io/PROD/news/6ea6d2d5-43a3-45c7-a3af-e09a951d764b.webp?w=250)

![Alphabet surpasses Apple for first time in over six years… Three major indices mixed [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/55f71ee7-ac56-4049-8a0d-3e566e27ba22.webp?w=250)