Editor's PiCK

Government to push for the introduction of spot crypto ETFs… also accelerating legislation for stablecoins

공유하기

Summary

- The government said it is officially pushing to introduce spot crypto ETFs and will improve investor convenience through spot digital-asset ETFs.

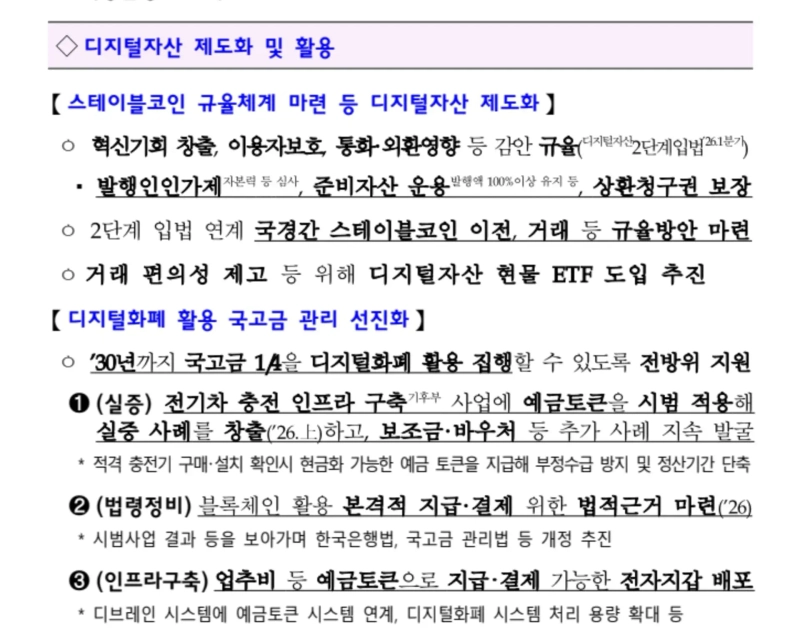

- The government said it will institutionalize the stablecoin market within the first quarter, requiring issuer authorization and capital screening and mandating holdings of safe assets equal to at least 100% of issuance.

- The government said it will disburse one quarter of total treasury funds in digital currency by 2030 and will pilot deposit tokens (Deposit Token) starting in the first half of this year.

The government is officially moving to introduce spot exchange-traded funds (ETFs) for virtual assets (cryptocurrencies). It also decided to establish a regulatory framework for stablecoins within the first quarter of this year to legitimize companies’ cross-border fund transfers.

On the 9th, the Ministry of Finance and Economy announced the “2026 Economic Growth Strategy,” including these measures, at the “National Briefing on the Economic Growth Strategy” held at the Blue House. Deputy Prime Minister and Minister of Finance and Economy Koo Yun-cheol stressed that “alongside the great AI transition, we will lead the way in the economy’s rebound through innovation in digital assets.”

To improve convenience for investors, the government will push in earnest for the introduction of “spot digital-asset ETFs.” This is seen as an intention to keep pace with the trend in major countries such as the United States, which have approved spot Bitcoin and Ethereum ETFs and brought them into the regulated financial system.

In tandem, it plans to institutionalize the stablecoin (fiat-pegged virtual asset) market by completing “phase-two digital-asset legislation” within the first quarter.

Going forward, stablecoin issuers will be required to obtain government authorization and pass capital-adequacy screening. In particular, to prevent failures such as the “Terra–Luna incident,” the government will mandate that issuers hold safe assets worth at least 100% of the amount issued and will legally guarantee users’ redemption rights. With the legal foundation in place, companies’ cross-border stablecoin transfers and transactions are also expected to become possible within a legal framework.

The government’s treasury cash management system will also be revamped on a blockchain basis. The government presented a goal of disbursing one quarter of total treasury funds in digital currency by 2030.

Starting in the first half of this year, “deposit tokens (Deposit Token)” will be piloted in projects to build EV charging infrastructure. The idea is to pay subsidies in tokens rather than cash to block fraudulent claims at the source and shorten complex settlement periods. Under the scheme, tokens that can be immediately converted into cash will be paid once the installation of eligible chargers is verified.

To this end, the government plans to revise relevant laws and regulations—including the Bank of Korea Act and the Treasury Funds Management Act—within this year, and to distribute official e-wallets that allow payments such as public officials’ operating expenses to be made in deposit tokens, linking them with the national fiscal system.

![[Analysis] "Bitcoin open interest at its lowest level since 2022…could be a precursor to a rebound"](https://media.bloomingbit.io/PROD/news/a37221f6-d367-4cce-a3bf-9def20b45757.webp?w=250)