Editor's PiCK

Bitcoin Catches Its Breath… Ethereum ‘Holds the Line,’ XRP Wobbles [Lee Soo-hyun’s Coin Radar]

공유하기

Summary

- Bitcoin said profit-taking selling and net outflows from spot ETFs have made support at $90,000 and the ability to establish itself above $90,500 the key inflection points for the next direction.

- Ethereum said that despite weakening U.S. institutional demand, inflows of bridged liquidity and expanded staking are helping it hold $3,000, and that a break above $3,324 could open the possibility of $3,700.

- XRP and Solana said ETF flow trends and Morgan Stanley’s trust product and an expansion in RWA tokenization, respectively, are the key variables, with the former raising the prospect of $3 and the latter of a retest of its all-time high.

<Lee Soo-hyun’s Coin Radar> is a weekly column that takes stock of moves in the virtual asset (cryptocurrency) market and explains what is driving them. Going beyond a simple price rundown, it provides a multidimensional analysis of global macro issues and investor positioning, offering insights to help gauge the market’s direction.

Major coins

1. Bitcoin (BTC)

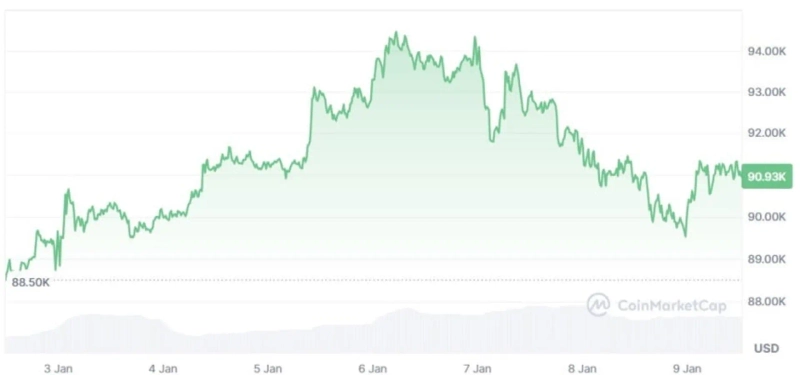

Bitcoin briefly reclaimed $94,000 on last weekend’s rebound, but slid again from the 7th and at one point dipped below $90,000 intraday. As of the 9th, it is trading around $91,000 on CoinMarketCap.

Profit-taking supply and a slowdown in exchange-traded fund (ETF) flows are cited as the direct drivers of the decline. As the price moved up into the $94,000–$95,000 zone, thick sell orders were stacked there, and the market failed to break through as buying interest was not strong enough to absorb them.

BeInCrypto, a digital-asset outlet, said the pullback steepened as short-term investors’ profit-taking hit the market all at once at that level. The analysis links the adjustment directly to roughly $100 million in profit-taking sales.

Demand for U.S. spot Bitcoin ETFs also failed to support the topside. Aside from one day early this week, large net outflows were recorded for three consecutive sessions from the 6th through the 8th, leaving the rebound short of incremental capital—another headwind.

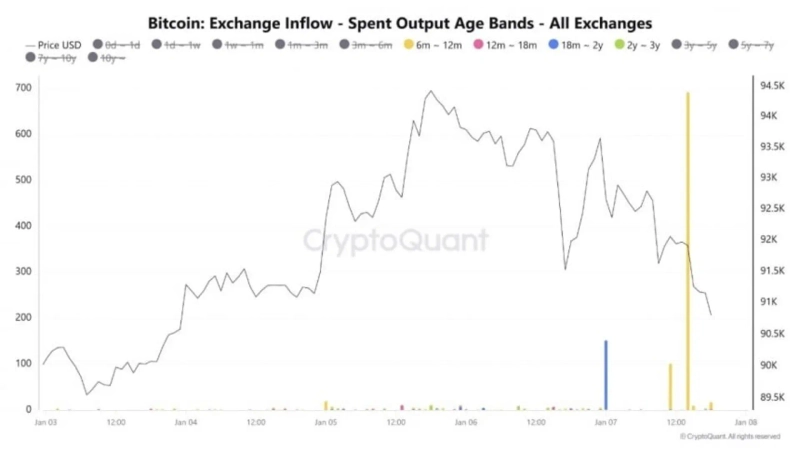

Moves in long-dormant Bitcoin are also being flagged as a key factor in this pullback. According to CryptoQuant, the SOAB (Spent Output Age Bands) metric showed a large activation of coins that had not moved for a long time, flowing into exchanges, followed by a price correction. The possibility is being raised that medium- to long-term holders—not short-term traders—are recognizing risk near highs and adjusting positions.

Key events on the horizon are creating both pressure and upside hopes. Most immediately, a U.S. Supreme Court ruling on tariffs scheduled for the 9th (local time) is in focus. If reciprocal tariffs are deemed unlawful, concerns over the U.S. fiscal burden could resurface, and greater Treasury-yield volatility could weigh on risk assets in the short term. Over the medium to long term, however, an adverse tariff ruling could again highlight weakening institutional trust in the dollar and U.S. Treasuries, and there is also a view that Bitcoin—along with gold—could be reassessed as an alternative store of value.

Legislative events also matter. On the 15th, a markup vote is set for the CLARITY Act, a U.S. digital-asset market structure bill. A markup is a key committee-stage process in which lawmakers review and revise provisions. While it is too early to say the bill will pass soon, the signal that “the legislative process is advancing” could be read meaningfully by the market. At the same time, forecasts suggest final passage could be pushed back to 2027 due to political conflict over conflict-of-interest provisions.

On the price outlook, the key in the near term is whether Bitcoin can settle firmly above $90,500. Analyst Ayush Jindal said, “If it holds this zone, it can move through $91,400 and $92,500 and attempt $94,000 again,” adding, “Conversely, if $90,000 breaks, $89,000 comes into view, and if it slips further, the mid-$86,000s must also be considered.”

Some also expect a prolonged rangebound phase. Ju Ki-young, CEO of CryptoQuant, said “capital inflows into Bitcoin have effectively dried up,” projecting that “for the next few months, a boring sideways market could persist rather than sharp rallies or selloffs.”

2. Ethereum (ETH)

Ethereum has also retreated alongside Bitcoin’s correction, dropping from the $3,200 range to trade around $3,100. Still, it is holding the $3,000 level relatively firmly. While the tone is weak, it is not collapsing outright—closer to a phase of holding up.

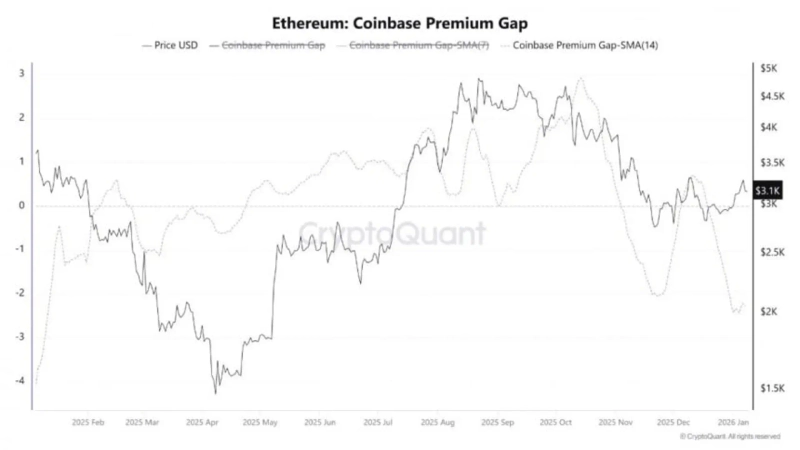

On-chain data show bearish signals and structural support factors at the same time. The most notable bearish sign is waning U.S. institutional demand. According to a CryptoQuant analysis on the 8th, Ethereum’s Coinbase premium fell to its lowest level in 10 months, and the 14-day simple moving average dropped to -2.285. The indicator reflects the balance of buying versus selling by U.S.-based investors, and it suggests selling pressure is currently dominant.

Notably, even as prices have stalled, capital flows appear to be converging on Ethereum. Net inflows of so-called bridged liquidity—funds moving via cross-chain bridges—totaled about $35 million over 24 hours as of the 8th, the second-largest among all networks.

The inflows were identified as coming from layer-2 networks such as Base (BASE) and Polygon (POL). This return of funds from layer 2 to the mainnet suggests activity within the network could increase, centered on ERC-20 tokens.

An expansion in staking is also cited as a structural support factor. With rising institutional participation, large players are continuing sizable staking, and Bitmine is reported to have deposited about 780,000 ETH into staking. Network-wide, more than 1.3 million ether are in the staking queue, while validator exit queues are effectively near zero, according to ValidatorQueue. As staking increases, fewer tokens are readily released into circulation, which can limit selling pressure over the longer term even if short-term volatility persists.

While views diverge, the near-term focus is whether Ethereum can break above resistance at $3,324. CryptoQuant analyst FellineyPA assessed that, with open interest around $7.8 billion in a neutral zone, “If it holds $3,000 and open interest rises, a stable spot-led advance is possible, opening the door to $3,700.” He added, however, that failure to clear resistance could bring a return to a more volatile trading environment.

3. XRP (XRP)

XRP posted a double-digit gain this week and at one point surged to around $2.4, but as of the 9th it has given back most of the advance and is barely holding the $2.1 level.

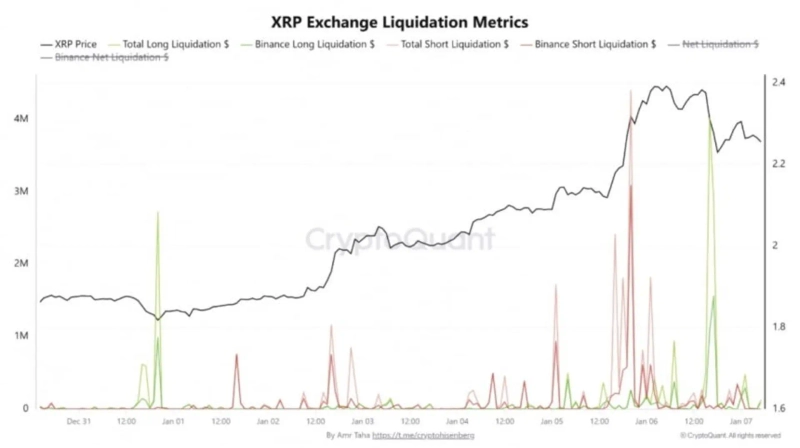

The prevailing view is that derivatives had a larger impact than spot. The initial spike was driven heavily by short liquidations. CryptoQuant data show that on January 5, about $4.4 million in short liquidations pushed the price up near $2.4, suggesting the rebound was more short covering than strong spot buying. The next day, as prices entered a pullback phase, about $4.0 million in long liquidations occurred.

NewsBTC, a digital-asset outlet, assessed it as “a bounce created by liquidations, not a rally led by spot buying.” Given Binance’s large share of XRP derivatives trading, the interpretation is that repeated two-way liquidations made prices choppy.

The IPO issue around Ripple, XRP’s issuer, also worked to cool sentiment. While there had been expectations that a Ripple listing would be positive for XRP, Ripple President Monica Long drew a line by saying the company would “maintain its private-company stance for the time being,” tempering market expectations.

ETF flows also shifted. An XRP spot ETF that had posted uninterrupted net inflows since launch recorded its first net outflow on the 7th—about $40.8 million (about KRW 60 billion). Still, the amount was less than 3% of cumulative inflows, so the scale itself was not large.

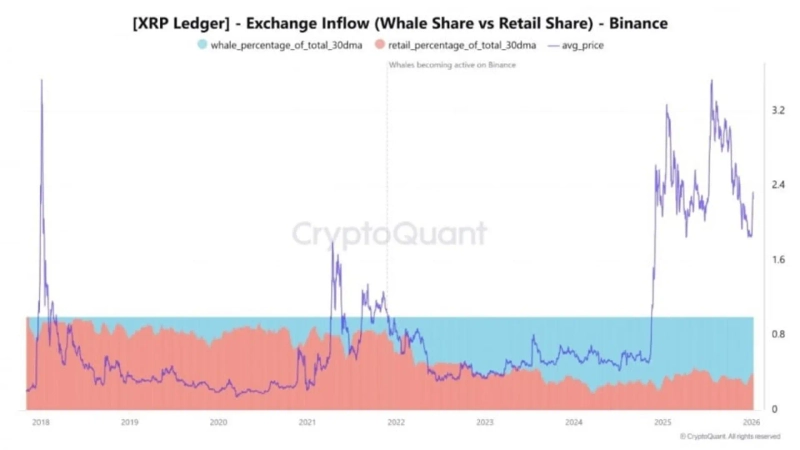

Positive signals also exist. Whales were observed accumulating during the pullback.

This week, large wallets holding 10 million to 100 million XRP reportedly accumulated an additional roughly 60 million XRP, estimated at more than $100 million at market prices.

Inflows into Binance are also declining. According to CryptoQuant, the share of exchange inflows accounted for by whales topped 70% late last year but fell to the low 60% range as of the 8th. This is interpreted as a sign that direct selling pressure is easing.

In the near term, ETF flow trends are seen as the key variable. Rachel Lucas, an analyst at BTC Markets, said, “This net outflow is a symbolic change, but the amount is small, so it is too early to see it as a trend reversal,” adding, “If inflows resume, a retest of $3 is also possible.”

Technically, the ability to break above $2.46 and $2.54 is important. BeInCrypto analyzed that “if it successfully establishes itself at those levels, the $3.3 range could also open up.” Conversely, if $2.13 breaks, forecasts suggest the possibility of a pullback to $1.95 and $1.77 must also be kept on the table.

Issue coin

Solana (SOL)

Solana is up close to 10% on the week on CoinMarketCap as of the 9th, trading around $140. Even as the broader market has paused, it is showing relatively resilient performance.

This appears to have been influenced by a rebound in the memecoin market, which drove Solana’s rally early last year. According to Cointelegraph, total memecoin market capitalization rose from about $38.0 billion on the 29th of last month to more than $47.7 billion on the 5th. That is an increase of more than 23% in just a week. Trading volume also jumped from $2.17 billion to $8.7 billion over the same period—nearly quadrupling. With Solana having been the ecosystem that saw the fastest inflows in such phases, the interpretation is that Solana benefited.

Institutional moves also drew attention. On the 5th, Morgan Stanley submitted an application to the U.S. Securities and Exchange Commission (SEC) to launch a Solana trust product. The fact that a global investment bank is adding Solana to its product lineup helped bolster expectations.

Solana’s growing presence in the RWA (real-world asset tokenization) market is also providing support. According to The Motley Fool, a specialist investing outlet, the scale of tokenized assets on Solana surged from $174 million in early 2025 to $872 million now. That is up 9.5% from 30 days earlier. The outlet interpreted the move as reflecting “a shift of frequently traded assets such as stocks and bonds to Solana due to its processing speed and low fees.”

Many assess that the path ahead will depend on how strongly the stablecoin and tokenization narratives persist. Global asset manager Bitwise said, “This year, stablecoins and tokenization are an unstoppable mega trend, and Solana—along with Ethereum—is likely to be the biggest beneficiary,” adding, “If the CLARITY Act passes, it could act as a powerful upside catalyst, making it highly likely that Solana will set a new all-time high.”

Coinbase also projected in its annual report that Solana’s growth will continue alongside Ethereum, analyzing that Solana expanded its buyer base through the spread of digital-asset treasury (DAT) companies, the launch of U.S. spot ETFs, and the introduction of tokenized stocks.

Reporter Lee Soo-hyun, Bloomingbit shlee@bloomingbit.io

![[Analysis] "Bitcoin open interest at its lowest level since 2022…could be a precursor to a rebound"](https://media.bloomingbit.io/PROD/news/a37221f6-d367-4cce-a3bf-9def20b45757.webp?w=250)