Summary

- Polymarket's monthly active traders numbered 477,850 in October, marking an all-time high.

- October monthly trading volume totaled $3.02 billion, a significant increase from before.

- Attention is focused on future growth prospects amid plans to re-enter the U.S. market and recent regulatory easing.

User activity on decentralized prediction market platform Polymarket surged in October, reaching record highs. Competing platform Kalshi continued to demonstrate market dominance with monthly trading volume exceeding $4.4 billion.

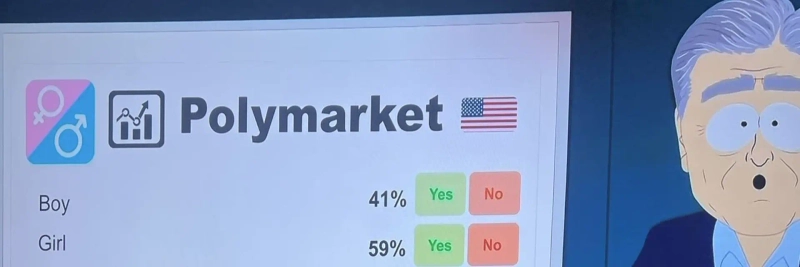

On the 3rd (local time), The Block reported that Polymarket's monthly active traders reached 477,850 in October, an all-time high. This surpasses the previous record in January (462,600) and represents a 93.7% increase from September (246,610). Monthly trading volume also rose to $3.02 billion, far exceeding the roughly $1 billion levels seen from February through August. The number of newly created markets reached 38,270, nearly triple that of August.

Nick Ruck, LVRG Research Director, said, "The surge in trading in October was due to Polymarket's decentralized structure enabling active liquidity provision, arbitrage, and strategy trading that exploits information asymmetry," and added, "In particular, rising expectations of a token launch have increased participation beyond simple political and sports betting, unlike last year."

The platform aims to relaunch in the United States by the end of this month. Polymarket withdrew from the U.S. market after being fined $1.4 million by the U.S. Commodity Futures Trading Commission (CFTC) in 2022, but recent easing of the CFTC's stance toward recognizing prediction markets as an innovative financial experiment has created conditions for a return.

Meanwhile, regulated U.S. prediction market platform Kalshi maintained its lead, with October trading volume of $4.4 billion, ahead of Polymarket.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit