Summary

- eToro reported a 48% increase in Q3 net profit and announced a $150 million share buyback program, sending the stock higher.

- Assets under administration rose 76% to $20.8 billion, and the number of funded accounts expanded 16%, showing growth.

- eToro announced plans to launch a crypto wallet supporting tokenization, prediction markets, and lending products, raising investor expectations.

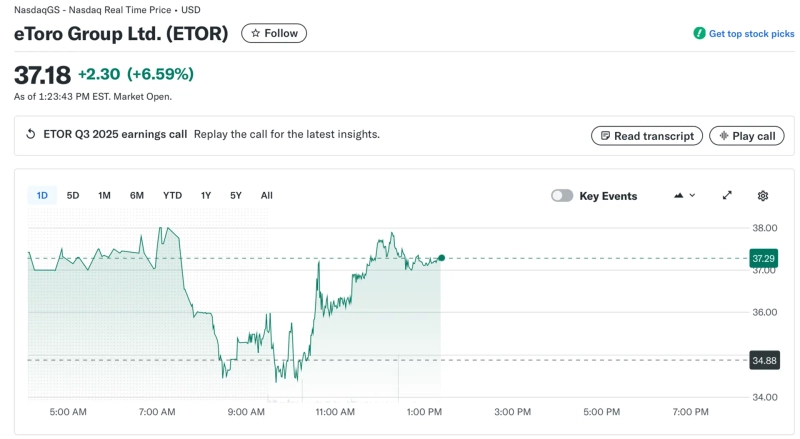

Social trading and investment platform eToro saw its stock surge after reporting strong Q3 results and announcing a $150 million share buyback program.

On the 11th (local time), Cointelegraph reported that Nasdaq-listed eToro's assets under administration (AUA) rose 76% year-on-year to $20.8 billion. Net contribution was $215 million, up 28% from $167 million a year earlier.

Also, U.S. GAAP net income was $57 million, up 48% from $39 million in the same period a year earlier. The number of funded accounts expanded 16% to 3.73 million, which is seen as an integration effect of the Australian investing app Spaceship acquired in 2024. On that day, eToro's stock jumped as much as 7% intraday on Nasdaq.

According to eToro, there were 5 million crypto transactions on its platform during October, an 84% increase year-on-year for the same month. The average investment per trade was $320 (up 52%), and interest-earning assets amounted to $8.7 billion, up 55% year-on-year.

In addition, eToro announced plans to launch a cryptocurrency wallet within the coming quarter that will support prediction markets, tokenization, and lending products.

Yoni Assia, CEO, said, "We are focusing on product innovation centered on AI and copy trading," and "We recently launched the AI-based investment analysis tool 'Tori' to provide personalized investment insights."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit