[Analysis] Decline in long-term Bitcoin holders' holdings…"Profit-taking increases around $100,000"

Minseung Kang

Summary

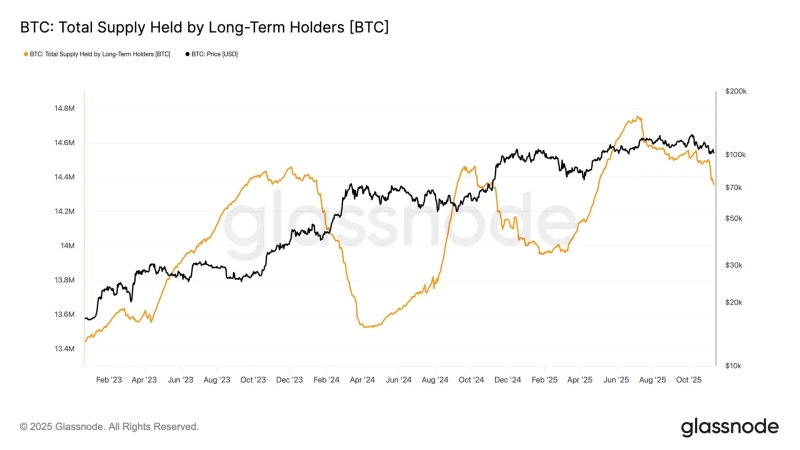

- On-chain indicators indicate that selling pressure from Bitcoin long-term holders is rising again.

- Glassnode reported that the supply of long-term holders is rapidly decreasing and the Net Position Change is moving into negative territory.

- They explained that amid bullish momentum, profit-taking by long-term holders is intensifying around the $100,000 level.

On-chain indicators show that selling pressure from Bitcoin (BTC) long-term holders is rising again.

On the 13th, on-chain analytics firm Glassnode (glassnode) said on X (formerly Twitter), "The supply held by Bitcoin long-term holders (Long-term Holders·LTH) is rapidly decreasing, and the Net Position Change is moving into a clearly negative zone." This is analyzed as long-term holders realizing profits and selling at recent price levels.

Glassnode explained, "As bullish momentum defends the $100,000 level, LTHs are increasing profit-taking activity."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)