Editor's PiCK

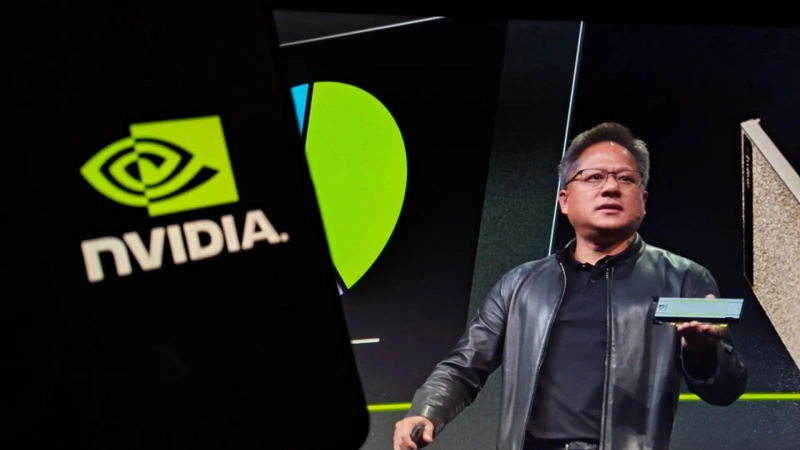

Wall Street on edge ahead of NVIDIA earnings... employment data also to be released [New York·Shanghai stock market weekly outlook]

Summary

- In the New York market, NVIDIA's earnings announcement was reported to potentially give investors significant volatility amid debates over an AI bubble.

- Walmart and Home Depot results, and the September employment data release, were noted as key indicators of U.S. consumer and economic health.

- In the Shanghai market, the People's Bank of China LPR decision was reported as potentially a short-term positive amid concerns about an economic slowdown.

Walmart·Home Depot also draw market attention

People's Bank of China to publish Loan Prime Rate (LPR) on the 20th

It serves as China's benchmark interest rate

Investors in the New York stock market are expected to focus on NVIDIA's earnings announcement this week (17–21). With controversy growing over an artificial intelligence (AI) bubble, if NVIDIA's results, due on the 19th (local time), fall short of expectations, the market impact could be significant. On Wall Street, this quarter's NVIDIA revenue is expected to be $54.8 billion, and earnings per share (EPS) are projected to be around $1.17 to $1.25.

Home Depot, which reports results on the 18th, and Walmart, which is scheduled to report on the 20th, are also companies investors are watching closely. Both firms are important indicators for assessing the health of U.S. consumer spending and could further spur volatility across the market.

With the six-week-long, record-long federal government shutdown having ended, the release of awaited economic data is also scheduled. The indicator attracting the most attention is the September employment report. The Bureau of Labor Statistics (BLS) will release the September unemployment rate and nonfarm payroll figures on the 20th. As this is the first key data that can assess the health of the U.S. labor market before the shutdown, investors are closely watching it. In addition, the August international trade balance is scheduled for the 19th.

On the Shanghai stock market, attention is focused on the People's Bank of China's November Loan Prime Rate (LPR) announcement scheduled for the 20th. The LPR functions as China's de facto benchmark interest rate. The People's Bank gathers rate reports from 18 major commercial banks, averages them, and publishes the result around the 20th of each month. If the People's Bank first adjusts the policy rate (MLF), commercial banks reflect that when setting the LPR, meaning the People's Bank effectively determines market lending rates.

Key economic indicators such as October industrial production and retail sales, released on the 15th, came in slightly below market expectations, reaffirming concerns about an economic slowdown. As a result, the importance of the LPR decision has grown more than ever.

Markets expect the People's Bank to keep both the 1-year and 5-year LPR unchanged. However, if a 'surprise cut' is implemented, it would be interpreted as a signal that the government is deploying strong 'ammunition' to revive the depressed property market and domestic demand, which could be a short-term positive for the stock market.

New York=Park Shin-young, correspondent nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)