Editor's PiCK

South Korea's '100-fold' increase in 10 years... Reasons for warnings of a long-term 'high exchange rate'

Summary

- It reported that over the past 10 years South Korea's net external assets have increased about 100-fold, creating a persistent structural high exchange rate pressure.

- It stated that aggressive overseas investment by individuals, pension funds, and corporations has led to rapid dollar outflows from the country, keeping the exchange rate in the 1,400-won range for a prolonged period.

- Experts diagnosed that slowing productivity and capital outflows are likely to lead to domestic investment stagnation and lower growth rates.

It's not even a sovereign default crisis... 'High exchange rate' has become commonplace

Sustained in the 1,400-won range... structural change in foreign currency supply and demand

Korean retail investors and pension funds increase overseas investment despite tolerating high exchange rates

Net external assets up 100-fold in 10 years... pressure for exchange rate increases continues

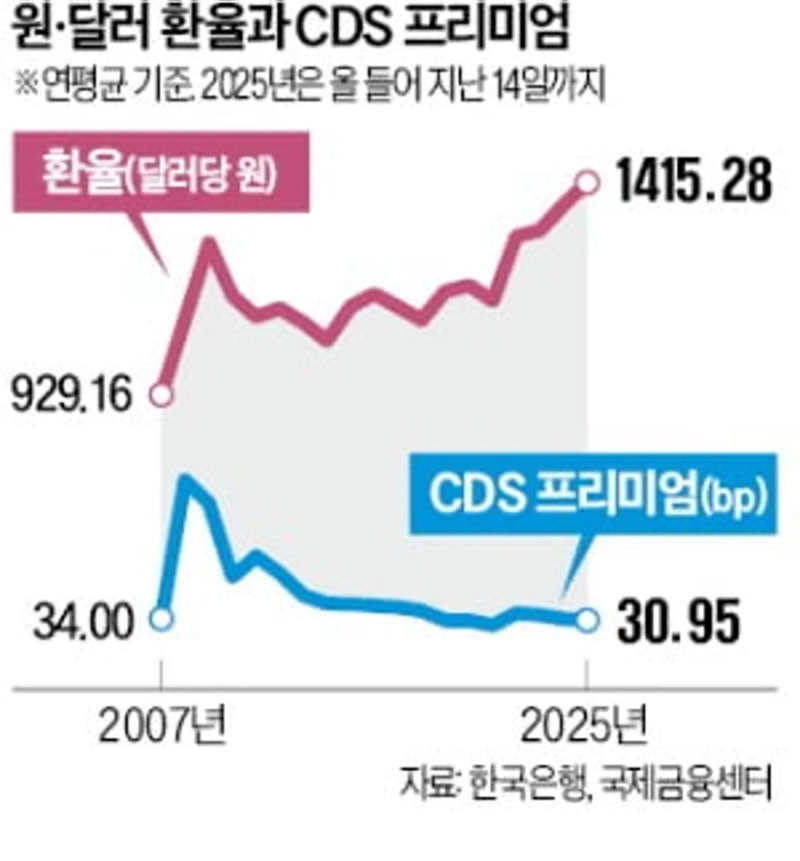

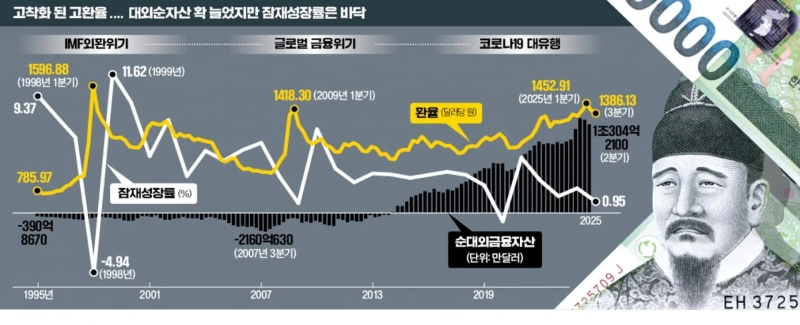

This year the average won–dollar exchange rate was higher than during the 1998 foreign exchange crisis and immediately after the 2009 global financial crisis. But the pattern differs from past crises. Volatility is low while the high exchange rate (weak won) persists. Experts say this reflects a structural change in foreign currency supply and demand, and that it will be difficult for the exchange rate to return to past levels for the time being. This is why calls are growing to prepare for a long period of high exchange rates.

According to the Seoul foreign exchange market, through the 17th the average won–dollar exchange rate this year is 1,415 won 50 jeon. That is higher than 1998's 1,394 won 97 jeon and 2009's 1,276 won 35 jeon. But the exchange rate trend is different. During the foreign exchange crisis the rate surged from 900 won to 1,900 won per dollar, and during the financial crisis it jumped from 900 won to 1,500 won per dollar, showing extreme volatility. By contrast this year the difference between the high point (1,484 won 10 jeon) and the low point (1,350 won) is only about 130 won.

The credit default swap (CDS) premium, which indicates sovereign default risk, remained low at 22.48bp (1bp=0.01% point) as of the 14th. That is about one-fifteenth the peak of 699.0bp (October 27, 2008) during the financial crisis. A foreign exchange authority official said, "The recent rise in the exchange rate is far from a sign of crisis."

South Korea posted a cumulative current account surplus of 82.77 billion dollars through the third quarter of this year. That is a 23% increase from the same period last year (67.23 billion dollars). Nevertheless, through the 17th the exchange rate has been above 1,400 won for more than half of the 212 trading days this year, or 118 trading days. This is because dollars are leaving the country much faster due to expanded overseas investment by individuals, pension funds, and companies than dollars are coming in through exports.

Korea's net external assets (external claims - external liabilities) reached 1.0304 trillion dollars in the second quarter, nearly 100 times the 12.7 billion dollars recorded in the third quarter of 2014 when it first turned positive. Investors expand overseas investment despite tolerating high exchange rates because expected returns abroad are higher. Experts say that unless productivity is raised and capital markets are revitalized so that corporate and investor funds return domestically, upward pressure on the exchange rate will persist.

The Korea Development Institute (KDI) said in a report earlier this month that "the recent increase in overseas investment is due to a slowdown in total factor productivity growth," and that "productivity slowdown triggers capital outflows and leads to a GDP decline 1.5 times larger."

National Pension Service, retail investors, and companies surge overseas investment... 'Dollar drought' despite record current surplus

High exchange rate as the new normal - (1) Net external assets increased 100-fold in 10 years... pressure for a high exchange rate

In the late 1990s foreign exchange crisis and the 2008 global financial crisis, Korean authorities paid close attention to short-term external debt flows. If demands for foreign currency debt repayment surged, rapid capital outflows could occur and the exchange rate could spike. But since 2014 authorities assess that such burdens have mostly disappeared. Overseas investment has increased and Korea has become a net external asset country.

Replacing the risk of sudden capital flight and sharp exchange rate spikes has been a steady rise in the exchange rate. Analysts say overseas investments by companies, individuals, and the National Pension Service are structurally exerting upward pressure on the exchange rate.

◇ Net external assets 100-fold in 10 years

On the 17th the Bank of Korea reported that Korea's net external financial assets (external assets − external liabilities) turned positive at 12.7 billion dollars in the third quarter of 2014. About 11 years later, as of the second quarter this year, net external assets ballooned to about 1.0304 trillion dollars, nearly 100 times larger.

The surge in Korea's net external assets stems from active overseas investment by economic agents. The National Pension Service is a prime example. The NPS began overseas investment in 2001, but growth was slow initially. Until the 2000s it invested mainly in bonds, but after the global financial crisis it shifted to aggressive equity-focused investing. In 2016 assets under management including overseas stocks and bonds exceeded 100 trillion won, and have since grown more than fivefold to 580 trillion won.

After the sharp correction in global markets due to COVID-19, the term 'seohak gaemi' first appeared. The scale of individual investors' overseas equity investment increased eightfold from 15.2 billion dollars in 2020 to 116.1 billion dollars at the end of last year. Last month they net-purchased 6.8 billion dollars worth in a single month, the largest amount since statistics began in 2011.

Companies are increasing overseas direct investment. According to the Ministry of Economy and Finance and the Ministry of Trade, Industry and Energy, overseas direct investment by firms reached a record 81.7 billion dollars in 2022. Although overseas direct investment was 29.9 billion dollars in the first half of this year, down from a year earlier, it still exceeded the 28.8 billion dollars invested in 2014 in a full year.

Foreign investment in Korea, a source of dollar supply domestically, is also increasing but falls far short of outflows. Bank of Korea Governor Lee Chang-yong recently explained, "Even with the largest current account surplus, the exchange rate is rising because four times more domestic money is going abroad than foreigners are investing in Korea."

The reason the recent rise in the exchange rate is not likely to ease quickly is that this structural flow of dollar outflows is likely to continue. Shinhan Investment Corp. economist Lee Jin-kyung said, "There is a high likelihood that capital will structurally continue to leave for the United States next year," and added, "I expect the won–dollar exchange rate to remain above 1,400 won next year."

◇ Growth deterioration → dollar outflow 'vicious cycle'

Some view structural high exchange rates as resulting from differences in fundamentals between advanced foreign countries and Korea. It is natural for investment assets to move to places with higher growth potential. According to OECD standards, Korea's potential growth rate this year is 1.94%, below 2%. It has fallen to less than half from about 5% in the early 2000s. By contrast, the United States, where innovation continues, has succeeded in reversing its potential growth rate.

The same applies when compared with neighboring competitors. Taiwan, which is expected to grow close to 6% this year, recorded an exchange rate of 30.64 Taiwan dollars to the U.S. dollar on the 17th. That is a downward trend in the exchange rate (currency appreciation) compared with trading around 32 Taiwan dollars at the beginning of the year.

The problem is that continued capital outflows could lead to weaker domestic investment and a lower growth rate, creating a vicious cycle. KDI research fellow Kim Jun-hyung said, "Similar to the pattern observed in Japan after a long-term slump, Korea is experiencing slowing productivity that leads to lower capital returns and shifts domestic investment to overseas investment," and added, "Economic structural reforms to boost productivity are urgent."

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)