"The 1,400-won range exchange rate reflects Korea's fundamentals…No downward factors"

Summary

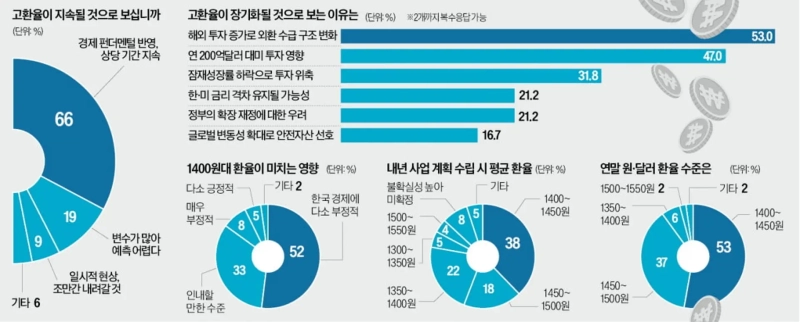

- 66%% of domestic foreign exchange market experts said they expect the high exchange rate to persist for a considerable period.

- They analyzed that the won–dollar exchange rate will remain above 1,400 won next year due to increased overseas investment by domestic investors and the Korea-U.S. growth rate and interest rate gap.

- Experts said that despite intervention by authorities, the exchange rate could rise to 1,500 won, and advised investors to be cautious about exchange risk.

Entrenched High Exchange Rate

(3) Emergency survey of 100 company, financial institution, and foreign exchange experts

66% "High exchange rate to persist for a considerable period"

Seohak-gaemi investment and expansion of investment in the U.S.

Causing 'supply-demand imbalance' in the foreign exchange market

"Volatility will increase if authorities intervene"

Possible additional depreciation next year

Prediction of '1,400 won~1,450 won' by the end of this year

"Unable to narrow the Korea-U.S. growth rate and interest rate gap

"Could rise to the low 1,500-won range next year"

"We are planning our business assuming next year's won-dollar exchange rate will be 1,450–1,500 won. I hope the uncertainty of sudden exchange rate swings decreases so that the burden on corporate decision-making is reduced." (Byun Sang-bong, Chief Financial Officer of JYP Entertainment)

Foreign exchange market experts forecast that the mid-to-late 1,400-won range for the won–dollar exchange rate will be prolonged. Many expected that the high exchange rate phase above 1,400 won will continue next year. Structural dollar demand is increasing due to the rise in overseas investment by domestic investors including Seohak-gaemi and the expansion of corporate investment in the U.S. Donghyun An, Professor of Economics at Seoul National University, said, "Capital is continuously flowing out of the country due to weakening economic fundamentals," and added, "As foreign exchange authorities continue to intervene, volatility in the foreign exchange market is likely to increase next year."

66% of experts say the high exchange rate will persist

According to an emergency exchange rate survey conducted by the Korea Economic Daily from the 17th to the 19th among 100 domestic foreign exchange market experts, 66% of respondents said, "The recent high exchange rate trend will continue for the time being." By contrast, only 9% responded that "It is a temporary phenomenon and will fall soon."

Among the 66% (66 people) of experts who said the high exchange rate would continue for the time being, the most common reason cited (multiple responses possible) was "Because foreign exchange supply and demand has structurally changed due to increased overseas investment by domestic residents" (53.0%). The analysis was that the increase in overseas stock investment by Seohak-gaemi and the increase in domestic institutions' global asset allocations have steadily raised dollar demand, thereby increasing upward pressure on the exchange rate.

According to the Bank of Korea, at the end of September, the country's external financial assets (external investment) reached a record high of US$2.7976 trillion. Of the external financial assets, residents' securities investment was US$1.214 trillion, up US$114.8 billion from the end of June. During the same period, corporate direct investment also rose by US$8.7 billion to US$813.5 billion.

Other respondents cited that "annual US$20 billion investment in the U.S. acted as upward pressure on the exchange rate" (47.0%), "domestic investment has contracted in the medium to long term due to lower potential growth" (31.8%), and "the Korea-U.S. interest rate gap is likely to be maintained for the time being" (21.2%). Some experts also answered that "concerns over fiscal soundness due to expansionary government fiscal policy played a role" (21.2%) or that "the won weakened as a risky asset amid global stock market volatility" (16.7%).

"Expect intervention by foreign exchange authorities … 1,480 won upper bound"

Nine out of ten foreign exchange market experts judged that the exchange rate would not break the 1,400-won mark by the end of this year. They reasoned that with domestic fundamentals weakening, there is little to reverse the outflow of capital abroad.

About half of the experts (around 53%) expected the year-end exchange rate to be '1,400 won or more but less than 1,450 won.' This was followed by '1,450 won or more but less than 1,500 won' (37%), '1,350 won or more but less than 1,400 won' (6%), and '1,500 won or more but less than 1,550 won' (2%).

Some analyses suggested that intervention by foreign exchange authorities and the National Pension Service would make 1,480 won an upper bound. Park Beom-seok, funds team manager at Toss Bank, said, "It appears the National Pension Service's foreign exchange hedge intervention range is 1,450–1,480 won," adding, "This range will act as an upper bound for the time being."

With no card left to curb the won's depreciation, there were also views that the exchange rate could surge to 1,500 won next year. Park Geon-young, CEO of Brain Asset Management, who forecast next year's exchange rate at 1,500–1,550 won, said, "Given that the Korea-U.S. growth rate and policy rate gap are unlikely to narrow and the emergence of U.S. tariff barriers, dollar demand will persist," and "the won's value could be further depreciated next year."

Kim Ik-hwan / Kang Jin-gyu reporters lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)