"Behind the 'AI bubble' is the nightmare of yen-carry liquidation? The real reasons stocks and crypto weakened [Binnanse's Wall Street Without Gaps]"

Summary

- "It reported that the core causes of the weakness in risky assets are dollar liquidity shortage, yen weakness, and the resulting risk of yen-carry trade liquidations."

- "It stated that for a rebound in tech stocks and crypto, improvement in the dollar liquidity environment is essential, and especially Treasury cash inflows and the Fed's end of quantitative tightening (QT) are important variables."

- "Wall Street is watching NVIDIA's earnings and Bitcoin price stabilization as potential triggers for a rebound, but ultimately said that restoration of risk appetite and increased liquidity supply will be key to investment flows."

Beneath the weakness in risky assets

there is a shortage of dollar liquidity

Uncertainty over Fed rate cuts

Continued quantitative tightening and prolonged shutdown

With a broken brake on yen weakness

'The nightmare of yen-carry liquidation could be replayed'

"Market liquidity improvement

is an important indicator for risky assets"

On the 19th (local time), ahead of the fate-deciding NVIDIA earnings release, shares of key AI companies started the day higher for the first time in a while. For about an hour after the open, NVIDIA rose more than 3% from the previous close, Broadcom rose over 4%, and Google, which unveiled the latest AI model Gemini 3.0 the day before, jumped nearly 6%. Are worries about an 'AI bubble' finally subsiding?

In fact, there were many uneasy points about attributing the recent declines in risky assets such as stocks and Bitcoin solely to an AI bubble. The AI bubble concern is not a new story. Doubts about whether the astronomical AI data center investments would ever bear profitable fruit have been growing since Alphabet (Google)'s earnings report in the second half of last year.

Of course, in recent months there have been many factors that have fueled AI bubble concerns: the circular investment structure around OpenAI and NVIDIA; vendor financing reminiscent of the dot-com bubble; hyperscalers starting to finance their massive AI investments with debt that could exceed $5 trillion over five years; potential supply shortages that could dampen AI demand; and an increased dependence of AI-related stocks on the stock market. In particular, investors have increasingly paid attention to the point that large AI investments by hyperscalers could ultimately squeeze these companies' free cash flow → slow share buybacks and raise funding costs → lower stock valuations.

But even so, there must have been other triggers behind the market narrative shifting from AI optimism to AI bubble concerns and a rapid contraction in risk appetite.

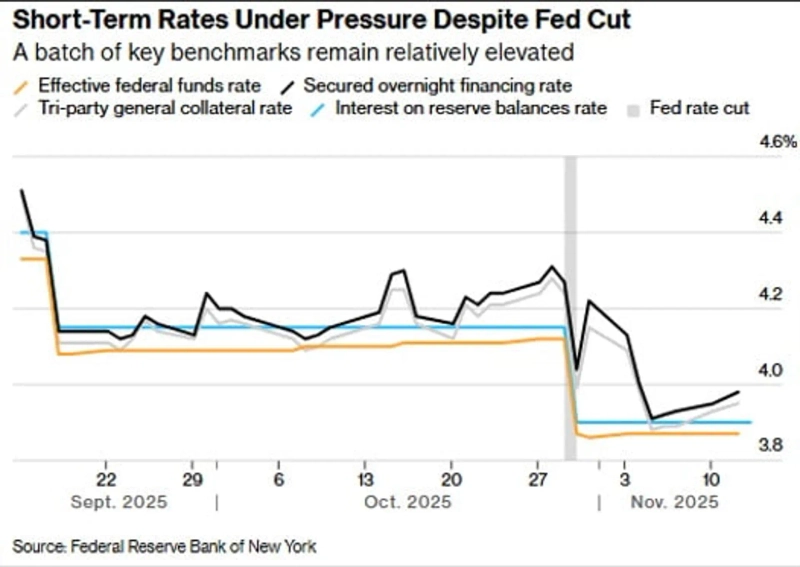

Dollar liquidity shortage shown by Bitcoin's weakness

An important driver was the rapid collapse in the market's confidence in a December Fed rate cut, which the market was certain of just a month ago. But more fundamentally, Wall Street points to a shortage of dollar liquidity. Despite the Fed's announcement last month of rate cuts and the end of quantitative tightening (QT), dollar liquidity stress has not been resolved. The fact that ultra-short-term market rates such as the Secured Overnight Financing Rate (SOFR) and repo rates have not meaningfully come down shows this. It means that among some institutions, competition to secure dollar cash by offering higher rates is underway.

The Secured Overnight Financing Rate (SOFR, black) and the general repo rate (gray) remain above the Fed policy rate. Source = Bloomberg

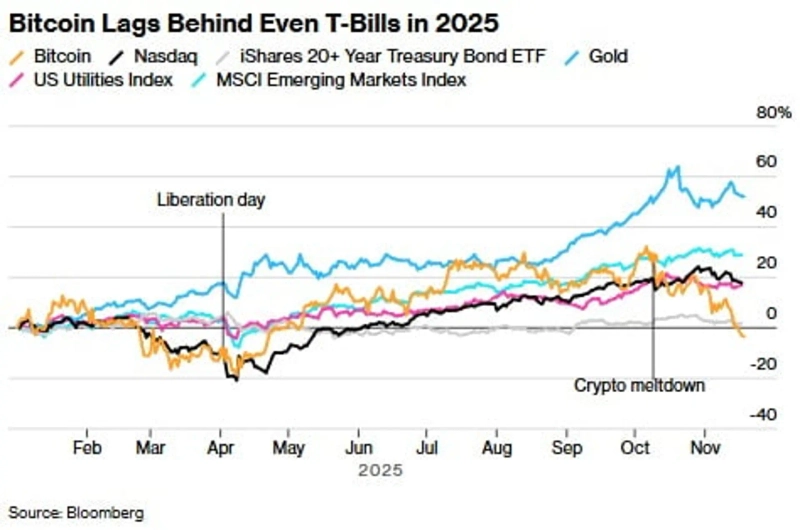

The crypto market is the clearest place where this liquidity stress is immediately reflected in prices. On the 19th, Bitcoin fell below $90,000 again, and Ether dropped below $3,000. Bitcoin, which had been trading sideways since this summer, was even left out during the 'everything rally' in August–September, and has taken another direct hit from the recent stock market decline and risk-off sentiment. Once at $126,000, Bitcoin has now given back this year's gains and moved into negative territory.

Bitcoin has lagged year-to-date performance compared to the Nasdaq (black), gold (blue), the U.S. utilities sector index (pink), a U.S. long-term bond ETF (gray), and the MSCI Emerging Markets Index (sky blue). Source = Bloomberg

The cryptocurrency market is more dependent on liquidity than other risky assets. With a high share of leveraged investment and a lot of margin trading, it inevitably reacts more sensitively to funding costs and short-term liquidity. During the 'repo-calypse' in September 2019, when repo rates surged and risky assets fell, Bitcoin also plunged 20%, falling 20 times more than the stock market.

That these cryptocurrencies are showing weakness most plainly indicates that dollars are not circulating smoothly in the market. When dollar liquidity tightens → funding costs rise for institutions that invest with leverage such as hedge funds (repo rates and SOFR rise) → risk appetite contracts. In the process of adjusting and maintaining positions, institutions likely realized gains on assets that had risen in price to raise cash. Against this backdrop, the AI bubble narrative has gained ground in the current market.

Reasons for the dollar liquidity shortage

So why is dollar liquidity lacking? It may be hard to understand that liquidity is scarce when governments and central banks around the world are printing money. Broad measures of money (M2) have indeed continued to grow. But market participants are loudly pointing out that dollar cash that financial institutions can immediately access and use is scarce.

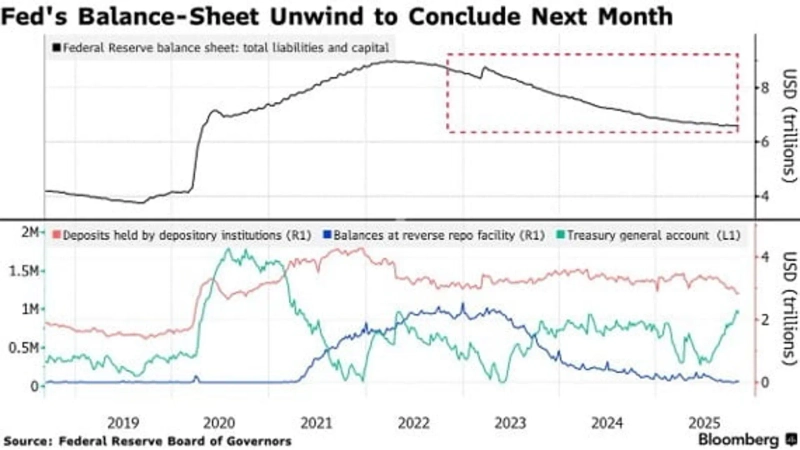

Wall Street summarizes the recent dollar liquidity shortage into four main reasons. ① The Fed's quantitative tightening (QT) has continued. As the Fed has reduced assets on its balance sheet since 2022 via QT, bank reserves have continued to decline. When bank reserves fall, the cash banks can supply to the repo market also decreases.

Fed holdings (top), bank reserves (red), reverse repo balances (blue), Treasury General Account (TGA, green). Source = Bloomberg

Although the Fed announced last month that QT would end, the actual end is effective on December 1. Jedidi Goldberg, head of rates strategy at TD Securities, told Bloomberg, "The Fed is moving too slowly even after seeing the recent reserve shortages and stress situations."

② Since July, the U.S. Treasury has greatly increased short-term debt issuance to fill its cash account (TGA). Money market funds, banks, and institutional investors buying those short-term Treasuries have used up cash in the short-term funding market. The government and the central bank essentially drained market liquidity at the same time. Bitcoin started trading sideways from the summer.

③ The federal government shutdown that lasted more than 40 days also lengthened the period during which government spending was stalled. Since funds the government should have spent to the private sector did not enter the market, this further exacerbated the dollar liquidity shortage. The shutdown ended last week, but there is a lag before the government fully resumes all functions.

The Treasury cash account, which had risen to $95.9 billion, only showed a meaningful decline on the 18th with a $34 billion drop. JP Morgan said, "If the Treasury starts releasing funds again, the market liquidity environment is likely to improve," adding, "This could be a very important indicator for risky assets such as tech stocks and Bitcoin."

The nightmare of yen-carry trade liquidation

④ The increasingly severe yen weakness has also become an unexpected pressure on risky assets. It increases the instability of yen-carry funds that are present throughout global financial markets.

On the 19th, the yen approached 157 per dollar, the weakest level since January. Local reports that Prime Minister Sanae Takaichi is planning stimulus measures exceeding ¥20 trillion, about ¥17 trillion of which would be financed by bond issuance, spread fears that Japan's already massive national debt burden would grow further. As a result, Japanese government bonds were also dumped, and long-term bond yields rose to record highs.

Dollar-yen exchange rate.

Moreover, with wages and inflation already rising in Japan, massive money printing combined with yen weakness would clearly push up import prices and further fuel inflation. Yet Prime Minister Takaichi is pressuring the Bank of Japan (BOJ) not to allow rate hikes. BOJ Governor Ueda has left the possibility of rate hikes open, but the market does not trust it. This has led to a widespread 'Sell Japan' across Japanese assets — the yen, bonds, and stocks all falling. Yen weakness also causes trouble when Japanese institutional investors — major holders of U.S. Treasuries like insurers and pension funds — need to buy U.S. Treasuries: yen alone becomes insufficient and they must procure dollars, contributing to dollar liquidity shortages.

But yen weakness cannot be left unchecked forever. Even U.S. President Trump dislikes an excessively strong dollar. Eventually, whether the BOJ raises rates or the Japanese government intervenes heavily, at some point there will be a brake on yen weakness. If that happens, yen-carry positions could be liquidated, and we could see a replay of last August's U.S. stock market plunge. Last summer, as the yen fell beyond 160 per dollar, it eventually reversed sharply to strength after the BOJ signaled rate hikes, triggering liquidation of yen-carry trades and upsetting U.S. markets.

When exactly a brake will be applied to yen weakness is unknown. But institutions that were badly hit last year are preemptively adjusting yen-carry positions. On Wall Street, there is wariness that even though dollar-yen has broken 155, Japanese authorities are still appearing passive. Arindam Sanyal, head of global FX strategy at JP Morgan, said on the 14th, "Prime Minister Takaichi has tied the BOJ's hands, allowing yen weakness to persist," but added, "around 155 is an 'amber alert' zone where Japanese authorities could intervene at any time." The 155 level has long been breached. In the foreign exchange market, there is strong concern that Japanese authorities could immediately engage in actual intervention to induce yen appreciation.

This not only dampens risk appetite but also increases short-term dollar demand. Hedge funds that borrowed cheap yen to buy U.S. Treasuries or stocks and then used those as collateral to obtain dollar leverage through repo financing, broker loans, FX swaps, etc., must procure dollars to repay borrowed dollars when they unwind yen-carry positions.

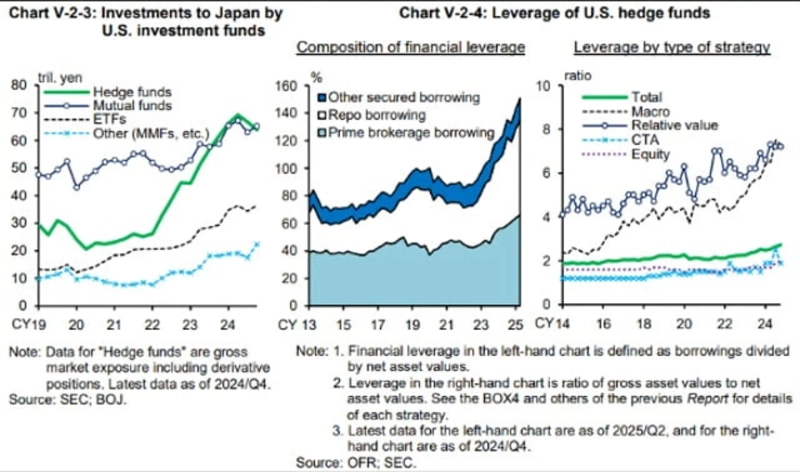

Since 2023, U.S. hedge funds' use of leverage has increased significantly, relying mainly on repo loans. Source = BOJ

Because of this yen-carry dynamic, when yen weakness intensifies, dollar demand rises and repo rates increase — a pattern that repeated in 2018 and 2020. In recent years, the scale of hedge funds engaging in leverage-based yen-carry trades has grown rapidly, amplifying market volatility. Especially as hedge funds increasingly rely on the repo market to obtain dollars, turmoil in the short-term funding market increasingly shakes the entire asset market.

Preconditions for a rebound in tech stocks and crypto

All of this continues to push ultra-short-term dollar rates higher and makes institutions reluctant to sell or newly buy the coins or stocks they hold. Therefore, improvement in the dollar liquidity environment is likely to be a necessary condition for a rebound in risky assets.

Whether NVIDIA's earnings will be strong enough to reignite AI optimism is important, but fundamentally it is equally important to see whether market risk appetite recovers. On Wall Street, one indicator they are watching is whether Bitcoin stabilizes around $100,000.

Fortunately, the shutdown is over and Treasury cash has begun to be released. The Fed's QT will end on December 1 (later than the market wanted, but nonetheless). The odds of a Fed rate cut in December remain 50-50, but Goldman Sachs argues that in response to a slowing jobs market the Fed will inevitably have to cut rates.

Risks around yen weakness are not solved overnight. Still, if U.S. variables alone are resolved, dollar liquidity could improve. Then expectations that markets will finish deleveraging and return to buying risky assets could gain traction.

Nomura strategist McElligott said that "the recent increase in volatility was due to simultaneous deleveraging across system and quant strategies," while adding, "nevertheless, macroeconomic regime has not changed at all — with easing inflation, solid corporate earnings growth, and belief in improved AI profitability among hyperscalers. Institutional investors expect a bull market in 2026."

Tyler, head of JP Morgan Market Intelligence, said ahead of NVIDIA's earnings, "Fundamental economic fundamentals have not changed, and our investment thesis does not depend on whether the Fed cuts rates, so we are buying the dip," adding, "(this week's NVIDIA results and September's nonfarm payrolls) could set the stage for the next rally."

New York = Binnansae, correspondent binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)