20,000 yen per child citing high inflation…Japan government bond yields 'spike'

Summary

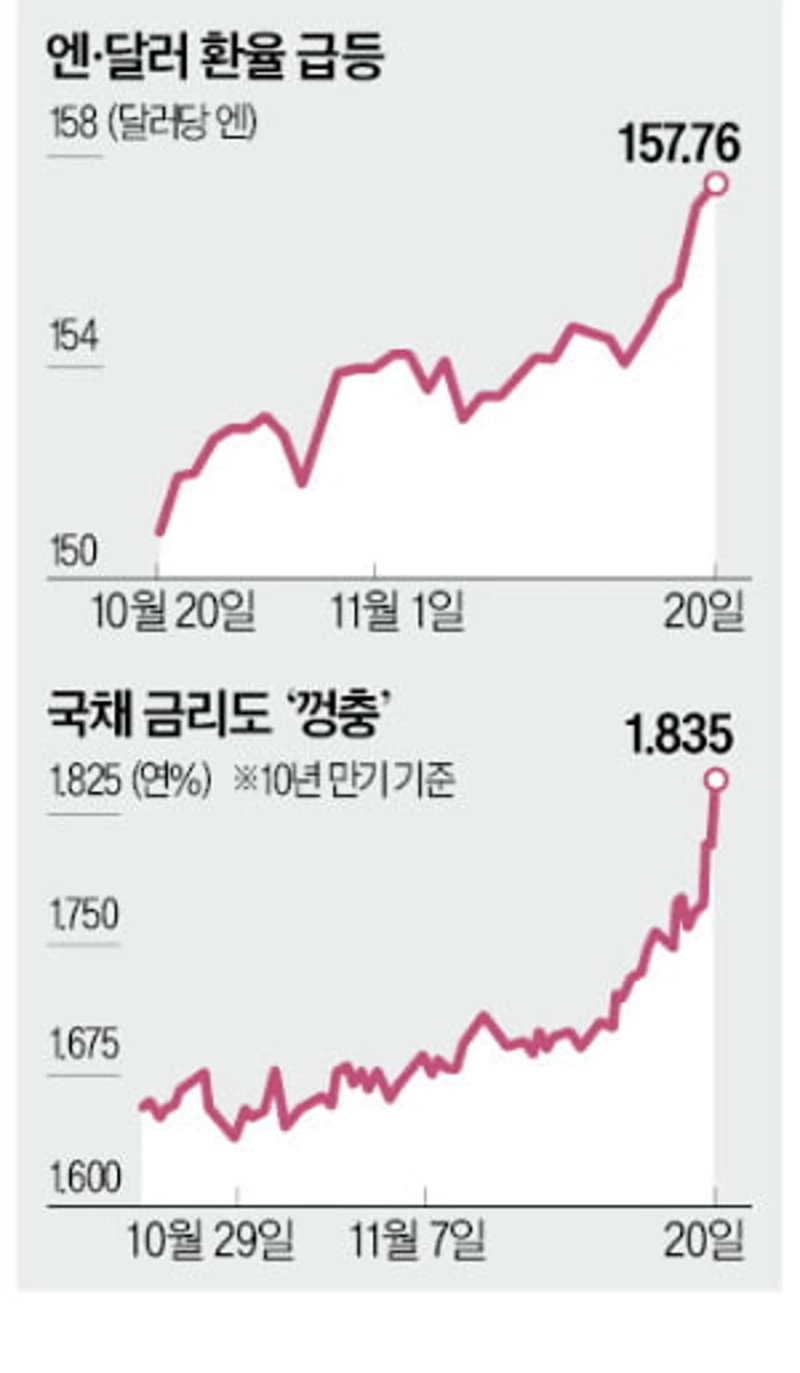

- The Japanese government's large-scale money-printing policy announcement drove the yen exchange rate sharply higher and pushed government bond yields to a 17-year high.

- Concerns over fiscal deterioration caused a simultaneous sharp fall in the yen and bond prices, prompting an exodus of investors from Japanese government bonds.

- Market experts warned that increased fiscal spending by the government could fuel inflation and raise investment risks.

Entrenched high exchange rate

(4) Japan's 'money-printing policy' pushes both the yen and government bonds down

Dollar-yen exchange rate tops 157 yen

10-year government bond yield hits highest in 17 years

Won also unstable…closed at 1467.9 won

As Prime Minister Sanae Takaichi launched a 'money-printing' policy, the dollar-yen exchange rate exceeded 157 yen for the first time in 10 months. Japan's 10-year government bond yield jumped to its highest level in 17 years. Concerns over fiscal deterioration triggered a simultaneous sharp fall in the yen and bond prices.

According to the Nihon Keizai Shimbun and others on the 20th, the Takaichi cabinet is set to announce a comprehensive economic package worth around 21.3 trillion yen on the 21st. It is Takaichi's first economic measure since taking office, under the banner of 'responsible proactive fiscal policy.' The package includes a proposal to provide 20,000 yen per child aged 0–18.

To fund this, the Japanese government plans to prepare a supplementary budget of 17.7 trillion yen, the largest since the COVID-19 period (31.6 trillion yen). This is far larger than last year's 13.9 trillion yen. The Ministry of Finance initially considered an economic package of about 17 trillion yen and a supplementary budget of around 14 trillion yen, but the scale grew during political discussions.

In the Tokyo foreign exchange market that day, the dollar-yen rate exceeded 157 yen. Market observers said it was only a matter of time before the yearly high of 158.84 yen per dollar was breached. Analysts also noted that widespread expectations that the Bank of Japan would find it difficult to raise its policy rate under the Takaichi government further encouraged yen weakness.

Chief Cabinet Secretary Minoru Kihara said, "We are concerned about the one-sided and rapid movement (of the yen)" and added, "We will watch with tension," signaling verbal intervention. The 10-year government bond yield rose to the 1.8% range, the highest since June 2008. The 30-year bond yield hit an all-time high of 3.37%. The Nihon Keizai Shimbun reported that "concerns about fiscal deterioration are intensifying again."

Due to yen weakness and dollar strength, the won-dollar rate in the Seoul foreign exchange market closed the weekly session at 1,467.9 won, up 2.30 won from the previous day. Yen weakness leading to dollar strength in the international foreign exchange market is likely to translate into won weakness (a rise in the won-dollar rate) in the Seoul market.

'Sanaenomics' put to the test…17.7 trillion yen supplementary budget, market issues a 'warning'

"If the Takaichi cabinet, which pledged proactive fiscal policy, fails to make a striking impression with its first economic package, support will evaporate in an instant."

A close aide to Prime Minister Takaichi said this regarding the cabinet's plan to include a uniform payment of 20,000 yen per child aged 0–18 in the economic package to be released on the 21st. The aide said the government judged that distributing cash regardless of income if households have children would make a clear mark. The Japanese government plans to spend 400 billion yen on this item alone.

Local experts warned that the Takaichi cabinet's 'money-printing' could boomerang. Increasing fiscal spending amid rising prices is likely to accelerate inflation. The simultaneous sharp drop in the yen and bond prices on the 20th has been interpreted as a market warning against profligate fiscal policy.

Record-scale 'money-printing'

According to the Nihon Keizai Shimbun and others, the Takaichi cabinet set the size of its first economic package at about 21.3 trillion yen. To finance this, it plans a supplementary budget of 17.7 trillion yen—the largest since COVID-19. The Asahi Shimbun predicted, "Large-scale deficit government bond issuance will be inevitable."

The Takaichi cabinet justified this mainly by citing high inflation. After a long period of deflation, Japan has recently seen rising prices. Japan's consumer prices exceeded the government and Bank of Japan target of 2% continuously from April 2022 through September this year. Prime Minister Takaichi has repeatedly stated that price measures will be her top priority before and after the election.

Of the 21.3 trillion yen, the Takaichi cabinet plans to allocate the largest share—11.7 trillion yen—to price measures, including a payment of 20,000 yen per child, and expanded winter electricity and gas subsidies. It will allocate 7.2 trillion yen to promote investment in artificial intelligence (AI) and semiconductors, and 1.7 trillion yen to strengthen defense capabilities. Tax cuts, such as raising the tax-free annual income threshold and lowering gasoline taxes, are also included.

The market sounded an immediate warning

The market issued an immediate warning. In Tokyo's FX market that day, the dollar-yen rate at one point surged to 157.76 yen per dollar. It jumped by about 2 yen from the previous day, bringing the yearly high of 158.84 yen per dollar into view. Concerns over fiscal deterioration prompted broad yen selling, causing the yen to tumble. Reports that discussions at a meeting between Finance Minister Satsuki Katayama, Economic and Fiscal Policy Minister Minoru Kiuchi, and Bank of Japan Governor Kazuo Ueda did not include in-depth discussion on the recent yen weakness also contributed to the yen's fall.

In the government bond market, a Japan-style 'bond vigilante' began to show its strength. Bond investors, anticipating an increase in deficit government bond issuance, started to shun Japanese government bonds, long considered a safe asset. This is why the 10-year yield soared to 1.835%, the highest in 17 years, and the more fiscal-sensitive 30-year yield climbed to a record 3.370%. Locals recall the 2022 'Truss shock.' Then-Prime Minister Liz Truss's unfunded tax-cut package immediately led to stock, bond, and pound weakness, and Truss resigned after 44 days.

"It will sap the administration's stamina"

The Takaichi cabinet argues that if fiscal spending keeps demand persistently above supply, long-term growth rates will rise, advocating 'high-pressure economics.' The ruling Liberal Democratic Party's approval rating remaining in the 20–30% range is also cited as a reason for pumping money. Critics also point out that during the 'lost 30 years' the LDP has no experience managing an economy under inflation, which has lowered vigilance on fiscal discipline.

Experts say that given the current situation in Japan where demand exceeds supply, an economic package accompanied by massive fiscal spending is not reasonable. They warn that pumping money under the pretext of price measures will fuel inflation. Professor Harugata Takenaga of the National Graduate Institute for Policy Studies commented, "Prime Minister Takaichi should recognize that inflation will sap the administration's stamina."

Tokyo — Correspondent Il-gyu Kim black0419@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)