Summary

- Bitcoin prices slumped to the $85,000 range, marking the lowest since April.

- Shrinking expectations for rate cuts and deteriorating crypto investor sentiment have increased investors' sell-off pressure.

- JPMorgan said that after the recent large-scale liquidation, retail investors' net selling of spot Bitcoin ETFs is spreading.

Slumps to the $85,000 range

Investor sentiment weakens as rate cut expectations shrink

Bitcoin prices have slumped to the $85,000 range. In the domestic market they also plunged to the 120 million won range. The surprise earnings effect from NVIDIA, the world's largest by market capitalization, caused a slight rebound in Bitcoin prices the previous day, but shrinking expectations for rate cuts and a renewed spread of AI bubble concerns pushed prices back into a downward trend within a day.

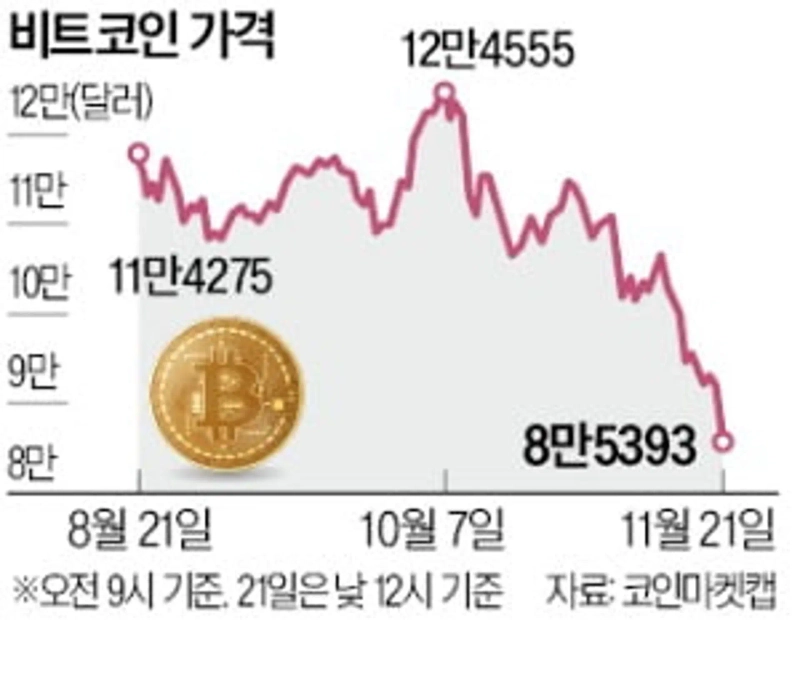

On the 21st, according to CoinMarketCap, Bitcoin was recorded at $85,393 at 12:00 p.m., down 7.7% from 24 hours earlier. It fell more than 30% from its peak in just over 40 days after hitting an all-time high ($126,000) on the 6th of last month. NVIDIA's record quarterly earnings had helped recover the $90,000 level the previous day, but it immediately dropped back to the $85,000 range. It is the first time Bitcoin has fallen into the $85,000 range since April. Ethereum and XRP were trading at $2,782.52 and $1.97, down 8.5% and 7.2%, respectively.

In the domestic market, Bitcoin fell into the 120 million won range for the first time since April. According to Upbit, it recorded 127.5 million won at 12:00 p.m., down 1.5% from 24 hours earlier.

The 'Fear and Greed Index,' a crypto investor sentiment indicator, stood at 11 out of 100 points (extreme fear). The closer this index is to 0, the more likely investors are to panic sell.

The crypto market is understood to have shrunk rapidly as expectations of rate cuts declined. This is because many members of the U.S. Federal Reserve (Fed) said at last month's Federal Open Market Committee (FOMC) meeting that keeping the policy rate unchanged in December would be desirable.

There are also views that it will be difficult for cryptocurrency prices to rebound for the time being. In particular, analysis suggests that the largest forced liquidation event last month has heightened crypto investors' fear. Global investment bank JPMorgan said, "The shock from large-scale crypto liquidations is spreading net selling of spot Bitcoin exchange-traded funds (ETFs) by retail investors."

Reporter Jang Hyun-ju blacksea@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)