'AI bubble' fear… Why Jensen Huang personally stepped in saying "don't worry"

Summary

- NVIDIA said it sent an official rebuttal document to major global investors regarding the 'AI bubble' claims.

- CEO Jensen Huang emphasized that the controversies over inventory increases and days sales outstanding were aimed at new product launches and ensuring smooth product supply.

- NVIDIA sought to allay market concerns about circular financing, share buybacks, and depreciation using objective figures.

NVIDIA systematically rebutted the 'AI bubble' claims

Official letter sent to global investors

NVIDIA sent materials rebutting the so-called 'artificial intelligence (AI) bubble' claims raised by some parties to major global investors. Even after reporting results that exceeded market expectations for the third quarter this year, concerns in the market persisted, so the company prepared materials to confront them directly.

According to the industry on the 24th, NVIDIA distributed a seven-page document titled 'Fact Check FAQ' (frequently asked questions and answers) to major global shareholders, including those in Korea. The distribution timing was reported to be just after CEO Jensen Huang held a private meeting with employees on the 20th.

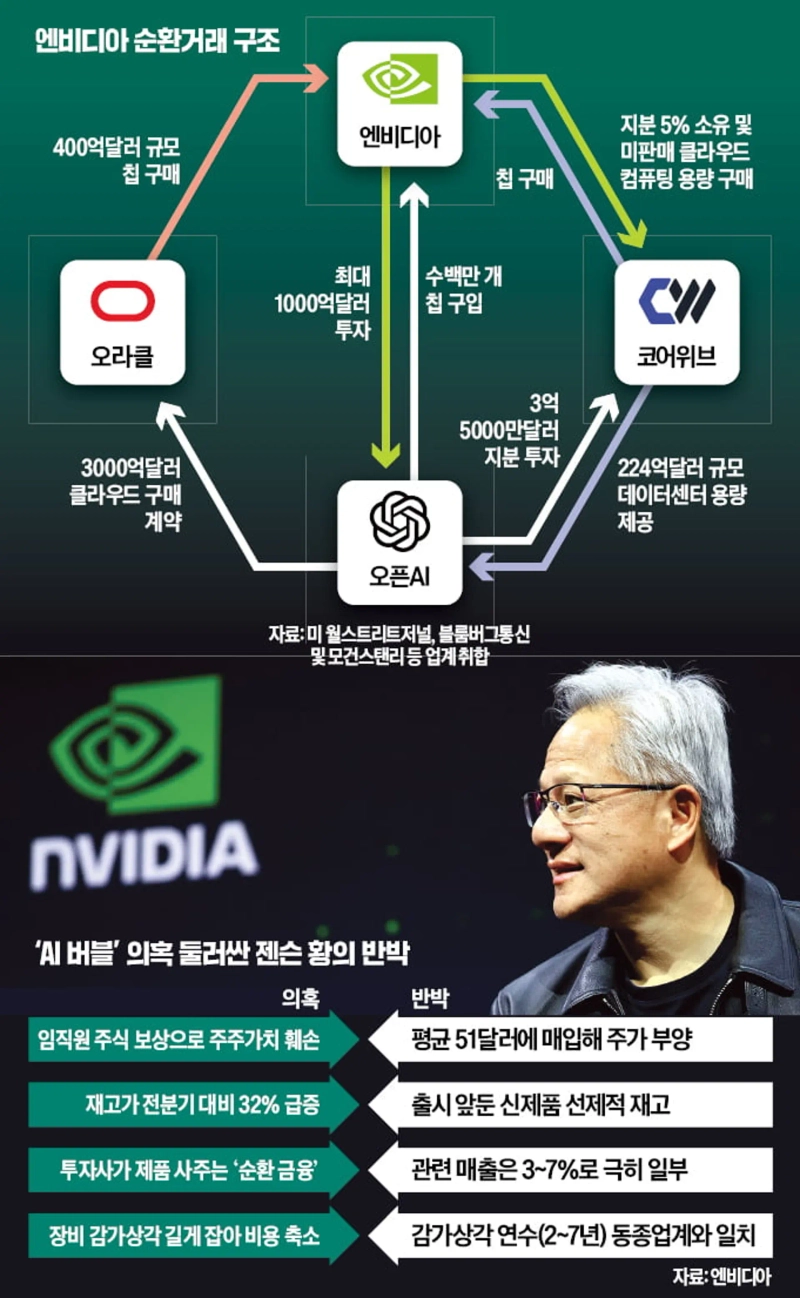

NVIDIA's rebuttal materials are filled with point-by-point refutations of the AI bubble claims raised by figures including Michael Burry, the founder of Scion Asset Management, who is known as a protagonist in the film 'The Big Short.' The materials include NVIDIA's official positions on recent controversies such as increases in days sales outstanding, increases in inventory, and so-called 'circular financing' where companies invested in by NVIDIA repurchase NVIDIA products.

NVIDIA announced on the 19th that third-quarter revenue was 57.01 billion dollars (about 83.4 trillion won), a 62% increase year-on-year, and net income (31.91 billion dollars) also rose 60% (based on its fiscal quarter from August to October), but the stock price fell instead.

NVIDIA: "No delinquent accounts receivable or abnormal GPU inventory levels"

Sent 'AI bubble' rebuttal materials to major global investors

The seven-page 'Fact Check FAQ' that NVIDIA sent to global shareholders is filled with point-by-point rebuttals to the AI bubble claims that have shaken global markets recently. After posting third-quarter results on the 19th that beat market estimates yet seeing the stock fall, CEO Jensen Huang held a private meeting with employees on the 20th. The remarks he made to employees are reported to have been included in the rebuttal materials.

◇ "Inventory buildup is necessary before a new product launch"

In response to criticism that third-quarter inventory rose 32% from the previous quarter, NVIDIA said it "stockpiled new products (Blackwell) ahead of launch." It explained that the inventory was produced to ensure smooth supply to customers, not because demand had slowed or because customers failed to pay. NVIDIA emphasized that "to meet fourth-quarter revenue guidance of 65 billion dollars (about 95.92 trillion won), inventory buildup is essential," adding that "inventory increases are unrelated to customers' ability to pay and NVIDIA ships products only after strict credit assessments."

Regarding the increase in days sales outstanding, NVIDIA's official position is that "there is absolutely no issue with collections." Accounts receivable arise when goods are sold but payment has not yet been received. An increase in accounts receivable is often cited as a sign that major customers like Microsoft (MS), Amazon, and Google may not be paying on time and is considered a representative basis for the AI bubble theory. NVIDIA disclosed that "days sales outstanding in Q3 were 52 days, down from the historical average (53 days) and Q2 (54 days)."

◇ "Circular financing is very limited"

Regarding recent sell-offs of shares by SoftBank led by Masayoshi Son and Thiel Macro, the hedge fund run by PayPal co-founder Peter Thiel, NVIDIA dismissed the matter, saying "they (Masayoshi Son, Peter Thiel) are not insiders of the company and these are individual investment decisions."

NVIDIA also said it is "not true" that major customers such as MS, Google, Amazon, and Meta are shortening the useful life of NVIDIA equipment to inflate results. NVIDIA wrote in the materials that "major customers like Google, Amazon, and Meta depreciate equipment over 4–6 years, which is consistent with depreciation periods for similar industry equipment (2–7 years)."

NVIDIA also addressed the issues raised by Michael Burry and Scion Asset Management in the rebuttal materials. On the 'circular financing' structure controversy, it said "only a very small portion (3~7%) of revenue comes from startups." Circular financing refers to a business structure in which companies invested in by NVIDIA use NVIDIA's investment to repurchase NVIDIA chips.

A representative case is ChatGPT operator OpenAI receiving an investment of 100 billion dollars (about 147 trillion won) from NVIDIA and purchasing millions of NVIDIA chips. Founder Burry attacked on X the day after the earnings announcement, on the 20th, saying, "In the future, this will be considered a fraud rather than virtuous circularity."

◇ "Don't pay attention to market reactions"

With AI bubble claims being raised, CEO Jensen Huang reportedly urged employees "not to worry about market reactions and to stay focused" so as not to unsettle staff. It appears he was mindful of claims by founders like Burry that NVIDIA diluted the effect of buybacks on shareholder value by increasing employee compensation through new stock issuance.

NVIDIA operates an employee stock purchase plan (ESPP) that allows employees to buy company shares at a 15% discount. NVIDIA's stock, which was in the $14 range at the end of December 2023, rose about tenfold to $134 by the end of last December, after which the upward trend slowed this year. In the rebuttal materials, NVIDIA emphasized the results of its buybacks, saying, "In 2018 we repurchased shares at an average of $51 per share, increasing earnings per share (EPS) by 5% and achieving a market capitalization increase of over $200 billion."

Reporter Park Eui-myung uimyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)