Editor's PiCK

Financial Services Commission: "Reviewing unified framework to manage stablecoins… speeding up preparations for Phase 2 legislation"

Summary

- The Financial Services Commission said it is accelerating efforts to establish an integrated regulatory framework for virtual assets, including stablecoins.

- The government is pursuing an integrated legal framework like the EU's MiCA, and said it is reviewing issuer credibility and financial system stability as core criteria.

- The regulatory approach to stablecoins issued overseas is also an important issue in domestic system design, and the Financial Services Commission said it will faithfully reflect this in the Phase 2 bill.

The Financial Services Commission said it is accelerating efforts to establish an integrated regulatory framework for virtual assets (cryptocurrencies), including stablecoins.

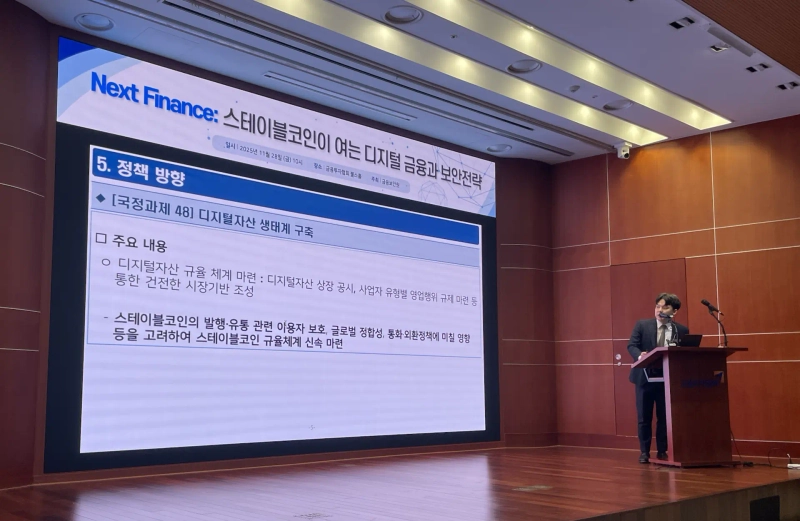

Shim Won-tae, an official of the Financial Services Commission's Virtual Assets Division (photo), made this explanation as the first speaker at the 'NEXT FINANCE: Digital Finance and Security Strategies Opened by Stablecoins' seminar held on the 28th at the Financial Investment Center in Yeouido, Seoul.

Shim introduced the government's direction for promoting the Phase 2 integrated law for the Virtual Asset User Protection Act. He said, "The government plans to establish an integrated legal system that includes stablecoins to govern issuance, distribution, and transactions, similar to the European Union's MiCA," and added, "Stablecoin issuance rules are being reviewed with core criteria such as securing issuer credibility, financial system stability, and global consistency."

He explained that issuer authorization requirements, governance, risk management capabilities, and reserve asset composition standards are being discussed with reference to overseas cases such as the United States, Europe, and Japan.

He also said, "The biggest difference with prepaid electronic payment instruments under the Electronic Financial Transactions Act is that stablecoins can be traded directly on a global distributed ledger without going through an issuer," and added, "Because of this structure, they can circulate regardless of whether they are issued domestically or overseas, so the regulatory design also considers distribution and reserve asset management after issuance."

Regarding stablecoin issuance procedures and redemption structures, he emphasized, "Even for issuers authorized by the Financial Services Commission, key elements such as issuance volume and circulation volume will require separate procedures at the supervisory level." He added, "How stablecoins issued overseas are regulated is also an important issue in domestic system design, and the Financial Services Commission is approaching this as a central matter."

Shim said, "The government announced building a digital asset ecosystem as a national task, and the Financial Services Commission will also proceed at speed accordingly," and added, "Because stablecoins are linked with various areas such as foreign exchange, monetary policy, money laundering, and financial security, we will closely consult with related agencies to faithfully reflect a stablecoin regulatory framework in the Phase 2 bill."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)