Chicago Mercantile Exchange paralyzed…stock futures and foreign exchange 'all stop'

Summary

- The trading platform of CME Group, the world's largest derivatives exchange, was paralyzed, halting core futures and options trading across stock indexes, foreign exchange, crude oil, and government bonds.

- The trading halt raised concerns that market volatility could explode and that related ETFs and ETNs for stocks, government bonds, and crude oil could experience price distortions.

- The incident exposed the vulnerability of global liquidity and price formation systems caused by a single data center outage.

Data center cooling problem blamed

Concerns of volatility explosion when trading resumes

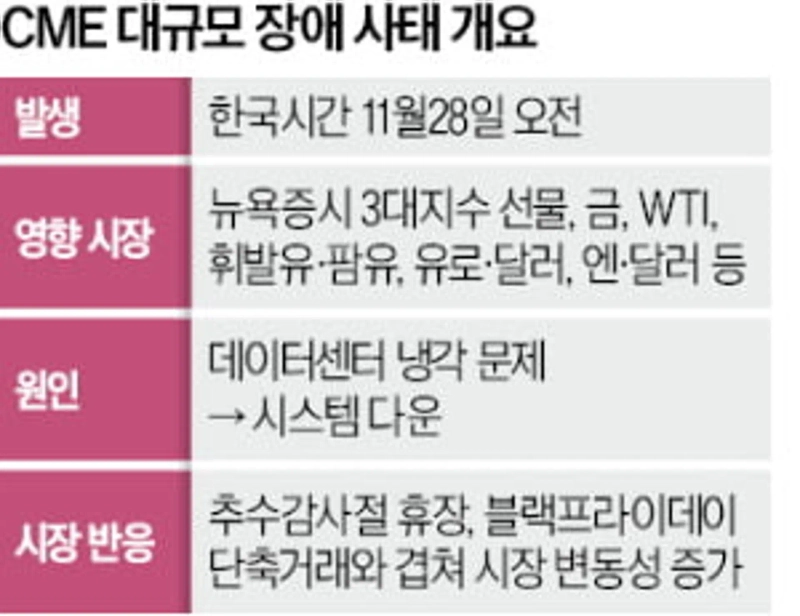

The trading platform of CME Group, the operator of the world's largest derivatives exchange, was paralyzed on the 28th, completely halting trading in stock indexes as well as foreign exchange, crude oil, and government bond futures and options.

According to foreign news outlets such as Reuters and Bloomberg, all futures and options contract trading was halted on CME's electronic trading platform Globex on the morning of that day. The incident froze futures trading for key products including S&P 500, the Dow, Nasdaq index futures, West Texas Intermediate (WTI), gold, copper, and palm oil. With the platform used for foreign exchange trading also paralyzed, exchange rate updates for euro-dollar and yen-dollar halted. The last time an oil futures trade was executed was 11:47 a.m. (Korean time) that day.

CME Group is the world's largest derivatives exchange covering a wide range of underlying asset classes from equities and bonds to currencies and commodities.

Bloomberg said, "This incident occurred at a time when trading volume was expected to be low due to the New York market being closed on the 27th (local time) for Thanksgiving and shortened trading on Black Friday the 28th, which could amplify the market shock."

Charu Chanana, chief investment strategist at Saxo Markets Singapore, said, "If trading is halted even briefly in a low-liquidity situation, prices of commodities, foreign exchange, and government bonds can become distorted," and pointed out, "The biggest risk is that volatility explodes when trading resumes as participants try to catch up on prices."

CME Group said in a statement that the cause of the trading halt was a data center cooling issue. CME Group's data centers number 55 across regions including the United States, Europe, and Japan, and are operated by a company called CyrusOne, headquartered in Dallas, Texas.

System outage from data center cooling failure…Asia and European futures markets thrown into chaos

U.S. Chicago Mercantile Exchange paralyzed…stock futures and foreign exchange 'all stop'

The paralysis of CME Group's trading platform on the 28th is expected to be recorded as one of the worst financial infrastructure incidents ever. There was also a temporary halt to CME agricultural futures trading in 2014, but analysts say this incident differs in scale of damage because it affected trading across core products including major indexes as well as government bonds, gold, copper, crude oil, and currencies.

Asia and European futures markets were thrown into chaos that day. With fixed benchmark prices and liquidity providers gone, there were immediate ripple effects across global financial markets. Brokers removed products from trading lists, and traders traded relying on their own internal calculations as in the pre-2000 era. Reuters reported, "Institutional investors were exposed to position risk without knowing prices."

Futures are a core product of financial markets used by financial firms and companies to hedge or build positions on various underlying assets. The incident raised concerns that substantial price distortions could occur in derivatives such as exchange-traded funds (ETFs) and exchange-traded notes (ETNs) that use government bonds, gold, and crude oil as underlying assets. Products derived from foreign exchange trading, such as yen-dollar and euro-dollar derivatives, are also inevitably hit.

The platform paralysis occurred at a time when trading volume was reduced due to the Thanksgiving holiday on Thursday the 27th and shortened trading on Black Friday the 28th, amplifying the market shock. Christopher Forbes, head of Asia and the Middle East at CMC Markets, said, "In the past 20 years we have not seen such a widespread exchange outage," and added, "When the market reopens it will cause significant volatility."

CME Group is the world's largest derivatives exchange headquartered in Chicago. It covers a variety of asset classes from equities and bonds to currencies and commodities, and oversees exchanges such as the Chicago Board of Trade (CBOT) and the New York Mercantile Exchange (NYMEX).

The incident occurred when CME Group's data center cooling system failed, causing servers to overheat and systems to go down. A CME spokesperson said, "The technical support team is working to resolve the issue as quickly as possible, and will notify customers as soon as details related to after-hours trading are confirmed."

There are also major concerns about recurrence, to the extent that the CME platform outage points to structural vulnerabilities in infrastructure. An IT industry source said, "There have been ongoing warnings that a large-scale shutdown could occur if there is a problem in a data center or cloud," and noted, "As big tech companies that have invested in the artificial intelligence (AI) industry compete to expand data centers, a similar incident could happen again." He added, "It revealed a systemic vulnerability where a failure at a single data center facility can simultaneously halt market liquidity across the entire market."

Reporter Choi Mansu bebop@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)