Yen-exposed U.S. long-term bond ETFs… Could they turn from a 'sore spot' into a 'star performer'?

Summary

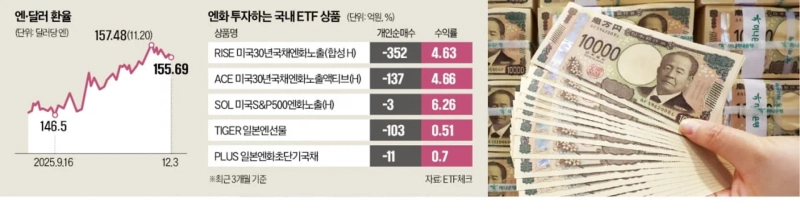

- 'Yen-exposed U.S. long-term bond ETFs' have rebounded, rising by more than 4% over the past three months.

- It reported that the BOJ's hint at a policy rate hike has boosted the yen's value, and expectations of a U.S. policy rate cut have increased the likelihood of rising bond prices.

- Securities firms analyzed that, supported by changes in both countries' rate policies, the ETF's returns will gradually trend upward.

Expecting both currency gains and yields

RISE U.S. 30-Year Treasury Yen-Exposed, etc.

Related products rose more than 4% over 3 months

BOJ signals a policy rate hike

Earn currency gains as the yen strengthens

Bond returns on rise amid expectations of U.S. rate cuts

Exchange-traded funds (ETFs) that invest in U.S. long-term bonds denominated in Japanese yen are rebounding. This is because the value of the yen is rising as the Bank of Japan (BOJ) is increasingly likely to raise its policy rate, while long-term bond yields are also climbing on expectations of U.S. policy rate cuts. Last year, many retail investors flocked in and poor performance turned them into a 'sore spot,' but expectations are growing that they may finally see the light.

Both currency gains and bond capital gains at the same time

According to ETF Check on the 3rd, 'RISE U.S. 30-Year Treasury Yen Exposure (Synthetic H)' rose 4.63% over the past three months. As a representative product that invests in U.S. long-term bonds in yen, it gains when the yen strengthens and U.S. Treasury yields fall (bond prices rise). 'ACE U.S. 30-Year Treasury Yen Exposure Active (H)', designed the same way, also rose 4.66% during this period.

Yen-exposed U.S. long-term bond ETFs have been one of the large names where domestic investors have suffered losses for a long time. This year, with the yen weak and U.S. Treasury yields volatile, returns have been sluggish.

As recent returns have rebounded, more investors are taking profits immediately. Over the past three months, retail investors net sold 35.2 billion won and 13.7 billion won worth of 'RISE U.S. 30-Year Treasury Yen Exposure (Synthetic H)' and 'ACE U.S. 30-Year Treasury Yen Exposure Active (H)', respectively.

Securities firms are analyzing that, with U.S. policy rates falling and Japanese policy rates rising, yen-exposed U.S. long-term bond ETFs have room to rise. As the gap between the two countries' policy rates narrows, the yen strengthens, and in a phase of U.S. rate cuts long-term bond prices also rise, so they could capture both benefits.

"Expect gradual upward trend in returns"

The value of the yen has been rising gradually. Expectations have strengthened that the BOJ will raise the current policy rate of 0.5% by 0.25% percentage points at the Monetary Policy Meeting to be held on the 18th–19th. If the BOJ raises rates, it would be the fourth increase since lifting negative interest rates last March and the first in 11 months since January.

BOJ Governor Kazuo Ueda said on the 1st, "Uncertainty over U.S. tariff measures is diminishing, and wage increases are spreading, with the minimum wage rising to an all-time high," and added, "We intend to make an appropriate judgment on whether to raise rates." Following such hawkish remarks, the yen–dollar exchange rate, which had surged to the 157-yen range at the end of last month, has recently fallen to the 155-yen range.

Expectations that the U.S. central bank (Fed) will cut policy rates this month have also strengthened significantly. According to the Chicago Mercantile Exchange (CME) FedWatch, the probability that the Fed will cut the policy rate by 0.25% percentage points at the Federal Open Market Committee (FOMC) meeting on the 9th–10th is 89.2%. U.S. long-term bond ETFs are highly sensitive to the policy rate; if the policy rate falls by 1% percentage point, their returns can reach double digits.

However, experts generally analyze that the yields of yen-exposed U.S. long-term bond ETFs are more likely to show a gradual upward trend rather than a sharp rebound. A representative from an asset management firm said, "It is true that the directional trends of the two countries' policy rates have become favorable for yen-exposed U.S. long-term bond ETFs," but added, "Because accommodative fiscal policies of both governments are also in play, we view returns as gradually trending upward."

Goldman Sachs said, "Prime Minister Sanae Takaichi's fiscal expansion policy will act as a negative factor for the yen in the short term," but added, "Considering growing resistance to inflation, Japan's monetary policy could gradually normalize, and over the next 10 years the yen could strengthen to around 100 yen per dollar."

Reporter Maeng Jin-gyu maeng@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)