"Dreamed of a windfall but ended up broke"… '77,850 won→5,000 won' then mass 'cut losses'

Summary

- Reported that the metaverse market's ETFs and related stocks plunged significantly, with delistings and platform service shutdowns continuing.

- Stated that virtual real estate and major metaverse-related stocks have lost 80~95%% or more in value compared to 2021–2022 peaks.

- Reported that amid a pullback from metaverse businesses, Meta cut its business budget by 30%%, which led to a rise in its stock price.

Sharply reduced metaverse market

ETFs and platforms exiting one after another

Once-leading stocks down 94%

'Self-proclaimed No.1' Meta also "cut next year's budget by 30%"

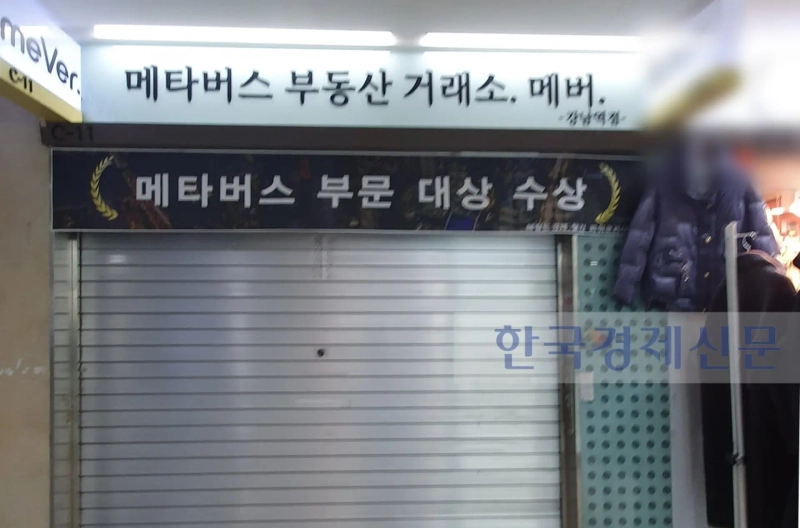

At one time it rode a global craze and drew massive amounts of capital. Investments from global companies, university and public institution events, and fan meetings of stars all gathered here. Brokers emerged owing to retail investors' interest. Related stocks rose more than 300% in half a year, and ETFs were launched one after another.

But now the mood is completely different. Most related assets have effectively fallen to a value of 'zero.' ETFs have been delisted, and even global conglomerates that continued investing hoping they would 'take off someday' are withdrawing. This is about the online-based virtual world metaverse market.

Metaverse ETFs delisted one after another

According to the Korea Exchange on the 6th, many of the ETFs delisted from the domestic market through the end of last month this year were metaverse ETFs. △SOL Korea-style Global Platform & Metaverse Active △RISE Global Metaverse △ACE Global Metaverse Tech Active △HANARO US Metaverse iSelect △PLUS Global AI, among others, exited the market one after another.

If you include cases where ETF names or constituent holdings were changed from metaverse to other themes like AI, the number of 'metaverse exits' increases. Samsung Asset Management previously changed 'KODEX US Metaverse Nasdaq Active' to 'KODEX US Nasdaq AI Tech Active.' Instead of previously held metaverse companies like Roblox, it composed the ETF with Palantir, Broadcom, etc.

Samsung Asset Management also changed 'KODEX China Metaverse Active' to 'KODEX China AI Tech.' Mirae Asset Global Investments changed 'TIGER Global Metaverse Active' to 'TIGER Global AI Platform Active' in April.

Related stocks also plunged… 'metaverse era' peaked and fell 80%

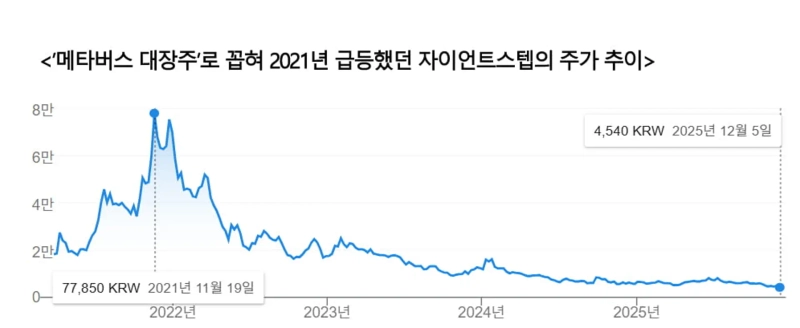

Metaverse-related stocks behaved the same. After peaking in November 2021, stock prices fell more than 80%. Giantstep, which was considered the leading stock in the metaverse theme in 2021 and saw its price surge, dropped 93.85% from its November 2021 peak through the 5th of this month. Its price once rose to 77,850 won but has been hovering below 5,000 won over the past month.

Wemade, which promoted a metaverse game ecosystem, also fell. From mid-November 2022 through the 5th, its decline reached 88.23%. Com2uS, which recruited a famous architect professor through a subsidiary and promoted the metaverse 'Com2Verse' project, saw its stock fall 82.40% from a November 2021 high of 173,900 won to the 5th. Com2Verse halted service in March last year.

Most of the domestic metaverse platforms that sprouted like mushrooms are gone. Nexon wound down the metaverse platform 'Nexon Town' in March. SK Telecom also closed 'ifland' the same month. KT terminated metaverse services 'Meta Lounge' and 'Genever se' last year.

Colorverse, which was in charge of Kakao's metaverse services, entered bankruptcy proceedings in May. Naver significantly sold down its stake in ZEPETO, the only surviving domestic metaverse service, in March last year. Previously it held 78.9% through subsidiaries Snow and Naver Webtoon, but it reduced its stake to below half at 49.9%.

Metaverse real estate values plunged 95%… "Only early investors profited"

The global market shows a similar mood. According to the financial investment industry, the virtual real estate markets of major global metaverse platforms have collapsed to about one-tenth of their 2021–2022 peaks.

The minimum trading price of virtual real estate on major metaverse platform The Sandbox dropped 95% from 2.86 ETH in 2021 to 0.13 ETH last year. Trading has become so thin this year that market research firms that previously analyzed price trends are not even publishing related statistics. This contrasts with the time when global companies like Adidas, Binance, and Gucci rushed to open metaverse stores.

Decentraland shows a similar pattern. According to a Carnegie Mellon University study earlier this year, real estate prices on that platform reached as high as $15,000 per unit (about 15,000 dollars) but later plunged to below $1,000 (about 1,000 dollars), a drop of more than 93%.

The Carnegie Mellon research team analyzed that "investors who entered the virtual real estate market on this platform early made an average profit of $15,000 per plot, but most retail investors who entered after 2022 are incurring large losses," and added, "even those who managed to sell with a 'cut loss' likely lost an average of $1,000 per plot."

The team said, "A typical bubble market formed as investors flocked to make money on metaverse platforms," and "in the end only early investors made money and exited."

An 'alternative world' during outing restrictions… later failed to offer differentiation

During COVID-19, the metaverse emerged as an alternative space for work, shopping, and entertainment because many governments limited the number of people who could gather in one space and imposed lockdown measures that greatly restricted outdoor activities.

But after lockdowns eased, users quickly declined. This was largely because most platforms failed to offer meaningful content beyond 3D avatars and spaces. Users also responded that even the 3D avatars and spaces of metaverse platforms were no different from existing MMORPGs.

An IT industry source said, "Most metaverse platforms experienced online-style gentrification, leaving only pointless 3D spaces." He explained that major platforms focused on large brand events or public institution events instead of providing differentiated creator-centered content through the metaverse. He added, "Roblox, which was considered a representative metaverse stock in 2021–2022, did not fall behind in the market because users continuously produced content."

Another industry source criticized, "Attaching asset trading functions to immature platforms too early was also a problem," adding, "A large number of people entered hoping to make money through the platform, driving away real users who wanted to enjoy content, and as real users left, platform utilization fell into a vicious cycle."

Meta, which changed its corporate name, also… $70.9 billion loss leads to eventual "scaling back"

Big tech Meta, which claimed to be the 'global metaverse No.1,' is also progressively scaling back operations. The company changed its corporate name from its flagship service Facebook to Meta in October 2021. In December of the same year it launched the VR-based metaverse platform Horizon Worlds.

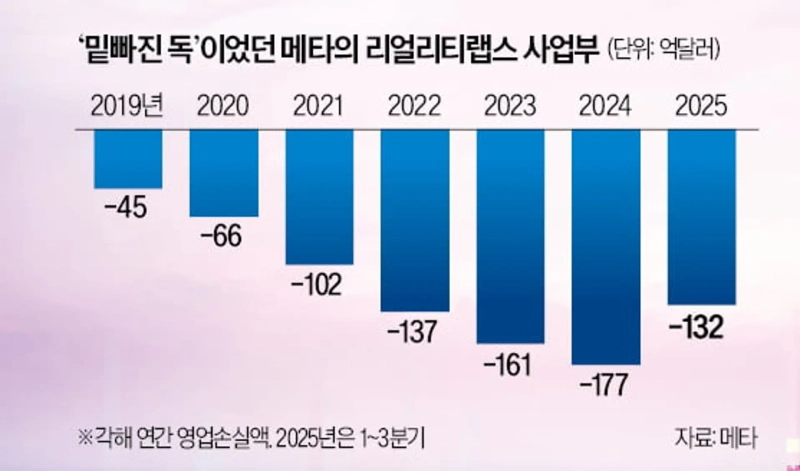

In 2022, the Reality Labs unit had more than 10,000 employees. CEO Mark Zuckerberg repeatedly expressed certainty that the metaverse would be the next big revenue source.

But reality was the opposite. Horizon Worlds' monthly users were around 200,000 at the end of 2022, falling far short of the original target of 500,000. Meta then made related metrics private.

From 2023, global companies such as Disney and Microsoft sharply reduced metaverse operations, but Meta remained different. Reality Labs' annual operating losses grew every year. The cumulative loss from 2021 through the third quarter of this year reached $70.9 billion (about 104.202 trillion won). Reality Labs' revenue last year was only $2.1 billion (about 3.085 trillion won).

Having poured money into a 'bottomless pit' for a while, Meta is reportedly moving toward restructuring. Bloomberg reported that CEO Zuckerberg held a business planning meeting last month to discuss a plan to cut Reality Labs and Horizon Worlds' related budgets by up to 30% next year.

Bloomberg quoted internal Meta sources on the 4th as saying, "Reality Labs and others could begin workforce reductions starting in January next year."

Stock rose after business cut announcements… "Pursuing profit over virtual-world illusions"

The budgets Meta cut for metaverse-related businesses are expected to be redirected to Reality Labs' AI glasses, wearables, and other technologies. The market believes that even if the metaverse market regains attention in the future, it will take the form of services that provide practical utility by adding AR and AI features rather than the previous simple platform formats.

The stock market welcomed this decision. On that day, Meta closed at $661.53, up 3.43% on the Nasdaq on news of possible restructuring. The next day, the stock rose an additional 1.80%.

Business Insider evaluated, "Investors are relieved that Meta is withdrawing from the 'money-dumping experiment.'" Tech outlet The Verge analyzed, "Meta appears to be betting on AI and wearable technologies that can generate near-term profits rather than the illusions of virtual worlds."

Reporter Seon Hangyeol always@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)