Summary

- BlackRock has filed an S-1 registration for a new exchange-traded fund (ETF) based on Ethereum staking yields with the SEC.

- The product is BlackRock's fourth crypto asset ETF, following its previously launched Bitcoin spot ETF, Ethereum spot ETF, Bitcoin Income ETF.

- Analysis noted that BlackRock structured a separate product that includes staking yields according to investor preferences.

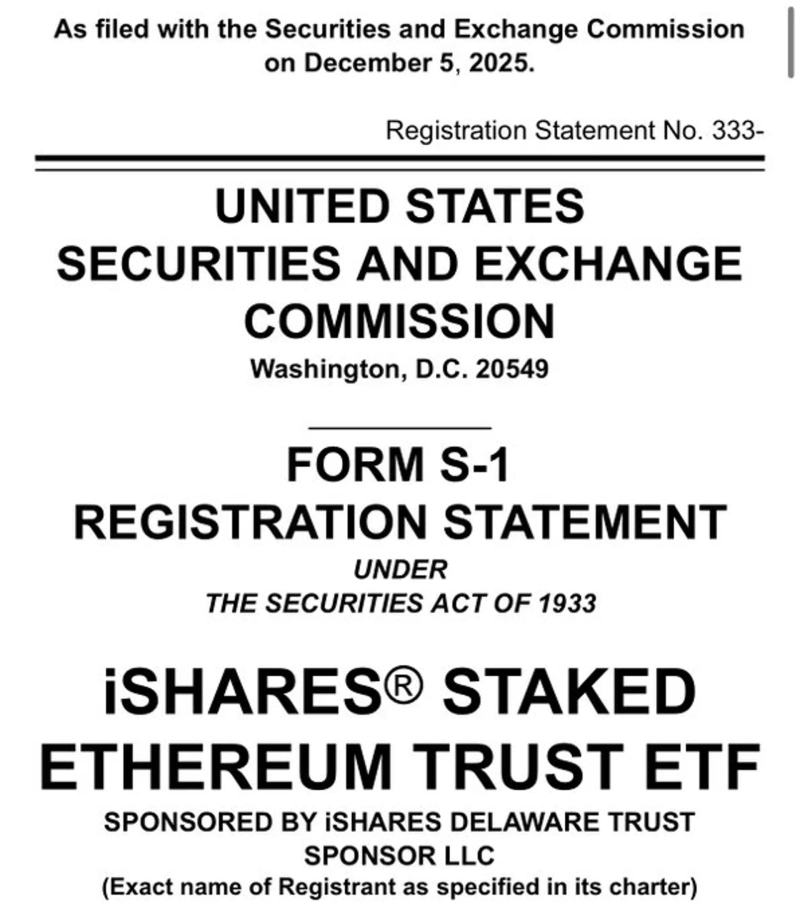

BlackRock has officially submitted to the U.S. Securities and Exchange Commission (SEC) an application for a new exchange-traded fund (ETF) based on Ethereum staking yields.

On the 8th (local time), Eric Balchunas, a Bloomberg ETF analyst, said on X (formerly Twitter), "BlackRock has filed the official prospectus for an Ethereum staking ETF," adding, "This product is BlackRock's fourth crypto asset ETF." He said the new product follows the previously launched Bitcoin spot ETF, Ethereum spot ETF, and Bitcoin Income ETF.

According to an image Balchunas released, BlackRock submitted S-1 registration documents to the SEC on the 5th under the name 'iShares Ethereum Staking Trust.'

Balchunas also said, "It is intended to broaden investor choice," and, "Some investors do not prefer products that include staking yields, so this product was structured separately."

BlackRock did not officially comment on the filing.

![[Today's Key Economic & Crypto Calendar] U.S. Dallas Fed Manufacturing Index, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![Is the ‘Mar-a-Lago Accord’ being put into action?…US may jointly intervene to support the yen and won [Issue+]](https://media.bloomingbit.io/PROD/news/3ce368de-a9c1-413f-bedb-6d835ff96051.webp?w=250)