Summary

- It reported that the U.S. spot Ethereum ETF market saw net outflows of $42.38 million in a single day.

- Outflows were concentrated in Grayscale products, and Fidelity's FETH also experienced net outflows.

- Meanwhile, 21Shares' CETH recorded net inflows, and some ETF products reportedly saw no fund movements.

More than $40 million flowed out of the U.S. spot Ethereum (ETH) exchange-traded fund (ETF) market in a single day.

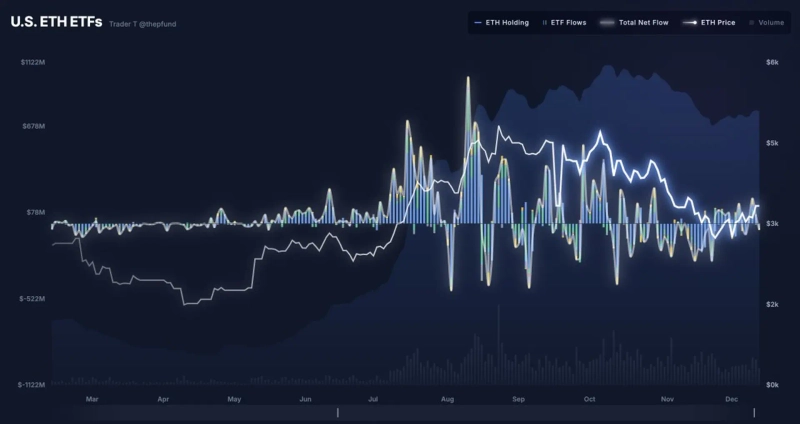

On the 11th (local time), according to TraderT's data, the total net outflows of U.S.-traded spot Ethereum ETFs were $42.38 million. The recent inflow trend appears to have reversed.

Outflows were concentrated in Grayscale products. Grayscale's ETHE saw net outflows of $31.22 million, and Grayscale's Mini Ethereum ETF saw $10.03 million flow out. Fidelity's FETH also recorded net outflows of $3.21 million.

Meanwhile, 21Shares' CETH recorded net inflows of $2.08 million. BlackRock's ETHA, Bitwise's ETHW, Invesco's QETH, Franklin's EZET, and VanEck's ETHV had no inflows or outflows that day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀