Summary

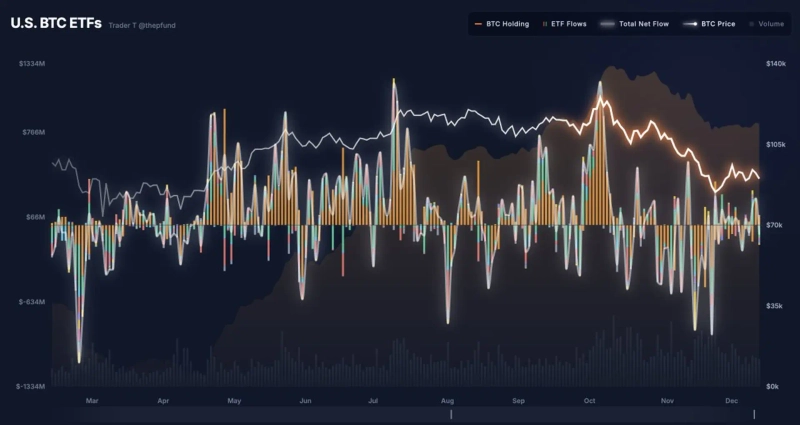

- TraderT's data indicated that a net outflow of 78,350,000 dollars occurred in the U.S. Bitcoin spot ETF market in a single day.

- Among major asset managers, particularly Fidelity FBTC saw a net outflow of 103,550,000 dollars, with investor departures standing out.

- In contrast, BlackRock IBIT and Bitwise BITB recorded net inflows of 75,700,000 dollars and 8,440,000 dollars respectively, showing differentiated fund flows.

More than 70,000,000 dollars flowed out of the U.S. Bitcoin (BTC) spot exchange-traded fund (ETF) market in a single day. While redemptions continued across major asset managers, only BlackRock and Bitwise products recorded net inflows.

On the 11th (local time), according to data from TraderT, the total net outflow of U.S. Bitcoin spot ETFs that day was 78,350,000 dollars.

The largest outflow occurred at Fidelity's FBTC. FBTC recorded a net outflow of 103,550,000 dollars in one day. Funds also flowed out from Ark Invest's ARKB (-16,380,000 dollars), VanEck's HODL (-19,380,000 dollars), Grayscale's GBTC (-12,210,000 dollars), and Grayscale's Mini Bitcoin ETF (-10,970,000 dollars).

By contrast, BlackRock's IBIT recorded a net inflow of 75,700,000 dollars, showing a clear contrast. Bitwise's BITB also saw an inflow of 8,440,000 dollars. Invesco's BTCO, Franklin's EZBC, Valkyrie's BRRR, and WisdomTree's BTCW had no fund changes that day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀