Editor's PiCK

Coinbase "Fed effectively shifts to 'stealth QE'... positive for crypto assets"

Summary

- Coinbase Institutional said that the Federal Reserve (Fed)'s expansion of short-term liquidity provision could create a favorable environment for the crypto asset market.

- An analysis found that the Fed is supplying liquidity totaling $40 billion through Reserve Management Purchases (RMP), and as a result is transitioning to a net liquidity supply phase.

- Coinbase said that the Fed's action combined with expectations of rate cuts is likely to create a positive environment in the medium term for risk asset markets including crypto assets.

An analysis has emerged that the U.S. Federal Reserve (Fed) expanding short-term liquidity provision is creating a favorable environment for the crypto asset (cryptocurrency) market.

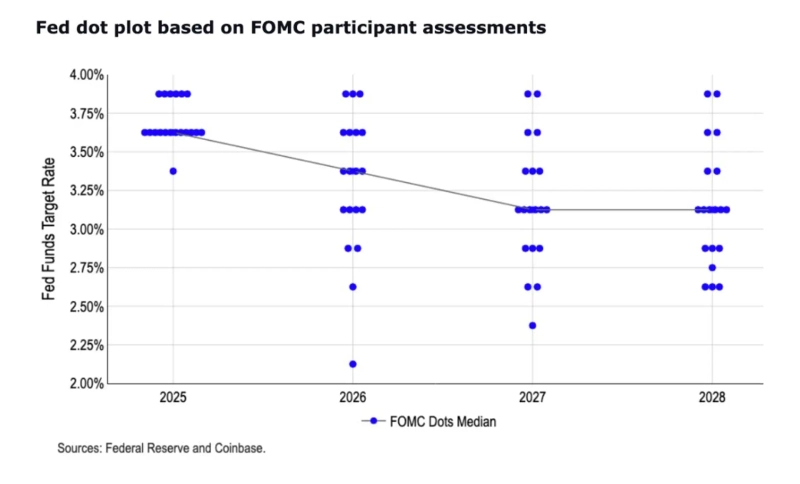

Coinbase Institutional said on the 12th (local time) on its official X, "This rate cut was an expected step, but the fact that the Fed has embarked on Reserve Management Purchases (RMP) to buy U.S. Treasuries over the next 30 days is a more important signal for the market."

The Fed plans to start RMPs totaling $40 billion from that day. Coinbase Institutional analyzed that this measure is being implemented faster than originally expected and that the increase in reserves could continue until April next year.

The report noted the Fed's change in policy stance. The Fed is moving away from the balance sheet reduction (QT) phase it had been pursuing and is effectively transitioning to a net liquidity supply stage.

Coinbase Institutional explained, "The Fed has already returned to mild quantitative easing (light QE) or stealth QE," and "this can provide a positive environment for risk assets in general (such as crypto assets)."

It added, "Liquidity provision through RMPs and expectations of future rate cuts are coinciding," and "there is a high possibility that a favorable macro environment will form in the medium term for risk asset markets including crypto assets."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀