They said it would reach '5,000-pt' next year… Korean wealthy 'betting on the Korean market instead of the U.S. market'

Summary

- Wealthy Koreans most frequently named stocks as the most promising short-term and mid- to long-term investment.

- The wealthy's total financial assets surpassed 3,000 trillion won for the first time, and asset growth was driven by the recovery of the domestic stock market.

- Preference for domestic stocks over overseas stocks remains higher for future investments, and virtual assets are also being noted as alternative investments.

KB Financial Group Research Institute '2025 Korea Wealth Report'

55% of wealthy investors "Stocks are the No.1 short-term high-return investment"

Wealthy 'Stocks more promising than real estate'

Total financial assets surpass 3,000 trillion for the first time

Wealthy Koreans holding financial assets of 1 billion won or more identified stocks as a promising investment for the future. The total financial assets held by Korea's wealthy exceeded 3,000 trillion won for the first time in history. This is analyzed as a result aided by the recovery of the stock market.

According to the "2025 Korea Wealth Report" published on the 14th by KB Financial Group Research Institute, 4 out of 10 Korean wealthy people said they "made a profit" (40%) from stock investments over the past year. The response that they "suffered a loss" was only 9.8%. The average number of holdings by the wealthy was 8.9, an increase of 0.7 from the previous year. Semiconductor and display accounted for the largest share of investment sectors both domestic and overseas. They were followed by information technology (IT)·software and artificial intelligence (AI) related stocks.

Korean wealthy people viewed stocks, rather than real estate, as the most promising short-term high-return investment within the next year and also as the most promising mid- to long-term investment over 3–5 years.

A KB Financial Group official explained, "The result reflects expectations for AI-led technological growth and a recovery in the global economy."

470,000 plus with assets of 1 billion won or more…55% still focused on real estate

It appeared that nearly 480,000 people in Korea hold financial assets of 1 billion won or more. This corresponds to about 1% of the total population. The number of ultra-high-net-worth individuals with financial assets of 30 billion won or more reached 12,000, doubling in five years.

1 billion won or more holders, 0.9% of the total population

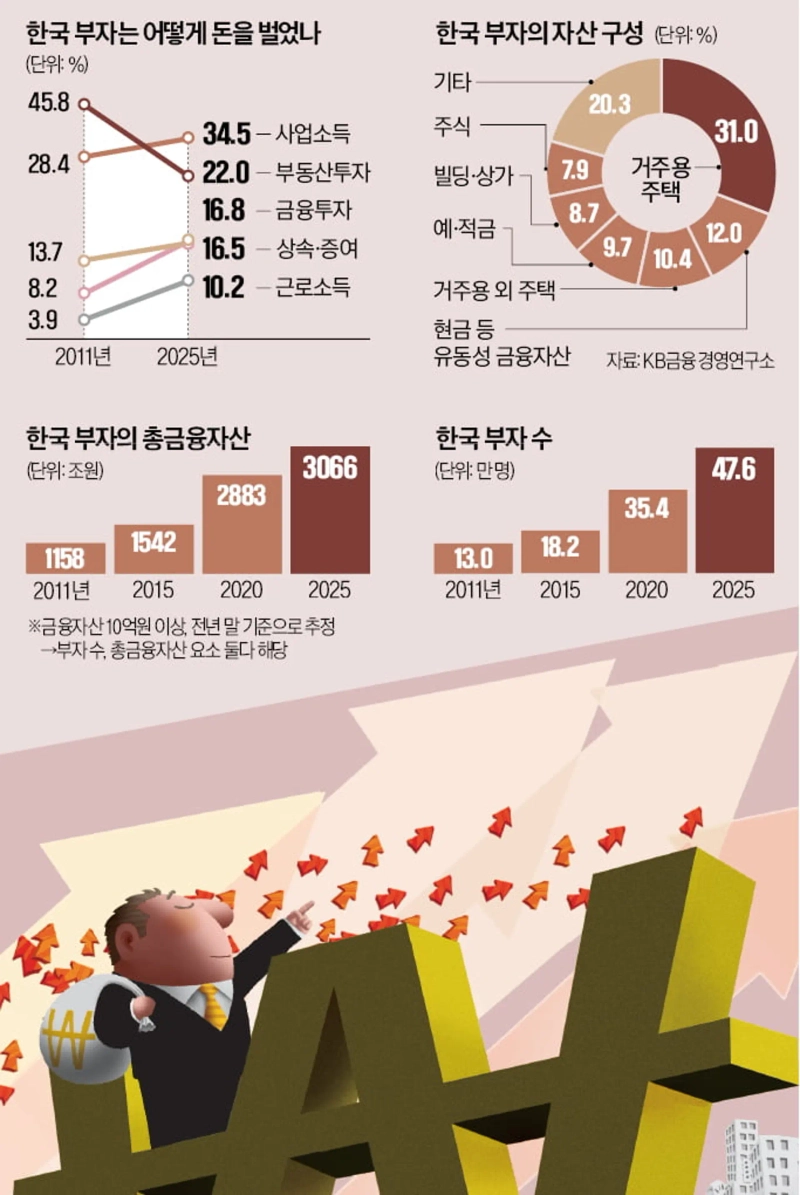

According to the "2025 Korea Wealth Report" published on the 14th by KB Financial Group Research Institute, as of the end of last year, 476,000 Koreans held financial assets exceeding 1 billion won. This corresponds to 0.92% of the total population. It is a figure that increased 3.2% from the previous year. Compared with 2011, when this survey began (130,000 people), it has nearly quadrupled. The annual average growth rate was 9.7%.

The total financial assets held by Korea's wealthy amounted to 3,066 trillion won, up 8.5% from the previous year. This is interpreted as an effect of the booming domestic and overseas stock markets. In particular, the wealthy's financial asset growth rate (8.5%) was nearly double the overall household financial asset growth rate (4.4%), indicating that the asset accumulation speed of the wealthy was faster than that of general households.

The share of ultra-high-net-worth individuals (financial assets of 30 billion won or more) in the total financial assets held by Korea's wealthy was 46% (1,411 trillion won). This was 4.2 percentage points higher than 41.8% (901 trillion won) in 2020. Over the same period, the number of ultra-high-net-worth individuals surged from 6,000 (1.8%) to 12,000 (2.5%). Total financial assets increased by 510 trillion won. Their annual average asset growth rate (9.4%) exceeded the average for all asset holders. A KB Financial Group official said, "Polarization has appeared even among Korea's wealthy and is expected to deepen in the future."

Assets concentrated in real estate

Total assets of Korea's wealthy were concentrated in real estate assets (54.8%). Financial assets accounted for 37.1%. Compared with the previous year (real estate 55.4%·financial 38.9%), both asset shares slightly declined. This is interpreted as diversification into other assets such as gold and virtual assets attracting attention.

The top interest in asset management among the wealthy was, as last year, "domestic real estate investment" (37.3%). This year, aided by the domestic stock market's rally, "domestic financial investment" (37.0%) rose one rank from 3rd to 2nd, narrowing the gap with real estate.

Looking at asset composition in detail, residential housing (31.0%), liquid financial assets such as cash (12.0%), non-primary residence housing (10.4%), savings and deposits (9.7%), buildings·commercial properties (8.7%), and stocks (7.9%) followed. Due to a wait-and-see attitude in the real estate market, the shares of housing and buildings·commercial properties decreased. The shares of liquid financial assets, savings and deposits, and stocks slightly increased.

Preference for domestic stocks over overseas

Despite high interest in real estate assets, Korea's wealthy chose "stocks" as the top future high-return investment. For short-term high-return investments within the next year, they chose stocks (55%). The wealthy also viewed stocks (49.8%) as the most promising mid- to long-term investment over the next 3–5 years. Among stocks, domestic stocks (48.5%) were preferred to overseas stocks (37.0%). A KB Financial Group Research Institute official said, "This means that the majority view is that favorable conditions for the stock market will continue in the mid- to long-term."

Meanwhile, uncertainty in the real estate market caused primary residences to fall to 2nd place. Virtual assets (12.8%) rose 9.5 percentage points from last year, receiving high expectations as an alternative investment.

Reporter Mihyeon Jo mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)