Summary

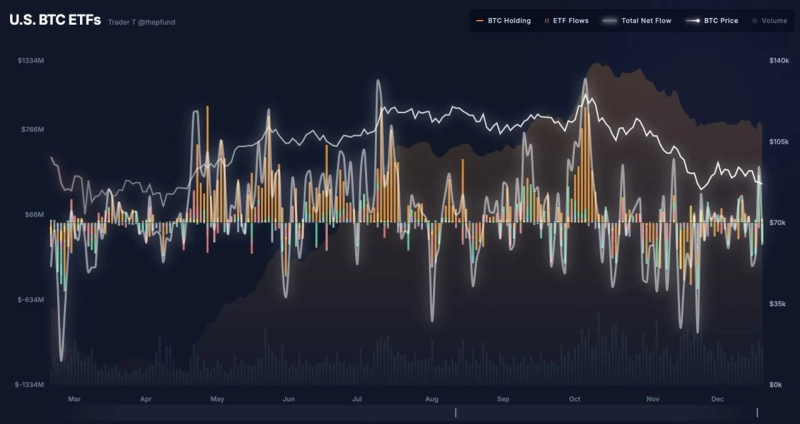

- Reported that U.S. spot Bitcoin ETFs switched to net outflows in one day.

- Notably, Fidelity FBTC led the outflows with $170,280,000 withdrawn.

- By contrast, BlackRock IBIT saw inflows of $33,440,000, while other products had no inflows or outflows.

U.S. spot Bitcoin ETFs reverted to net outflows in one day.

On the 18th (local time), according to data from TraderT, the 11 spot Bitcoin ETFs in the U.S. recorded net outflows totaling $160,650,000 on that day.

The outflow was led by Fidelity's 'Fidelity Wise Origin Bitcoin Fund (FBTC)'. FBTC saw $170,280,000 flow out in a single day. ARK Invest (ARKB) and Bitwise (BITB) also recorded net outflows of $12,270,000 and $11,540,000, respectively.

By contrast, asset manager BlackRock's 'iShares Bitcoin Trust (IBIT)' saw inflows of $33,440,000. Other products, including Grayscale (GBTC·BTC), Invesco (BTCO), Franklin Templeton (EZBC), Valkyrie (BRRR), VanEck (HODL), and WisdomTree (BTCW), had no inflows or outflows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)