[Analysis] "Ethereum demand contraction… sensitive to capital flows such as ETFs"

Summary

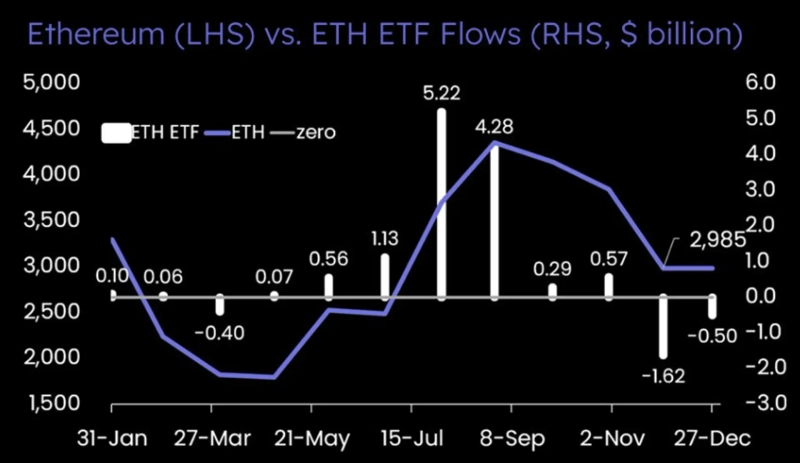

- Matrixport analyzed that Ethereum has recently become more sensitive than before to capital flows such as ETFs due to a contraction in 'underlying demand'.

- It said previous bull runs were driven by adoption expansion and network growth, but this cycle's key is capital inflows and the speed of movement.

- It reported that U.S. Ethereum spot ETFs recorded a one-day net inflow after 7 consecutive trading days of net outflows but then reverted to net outflows.

Ethereum (ETH) prices have become more sensitive than before to capital flows such as exchange-traded funds (ETFs), an analysis found.

Cryptocurrency analytics firm Matrixport said on its official X account on the 24th (local time), "Currently, with 'underlying demand(underlying demand)' contracted, Ethereum and the cryptocurrency market as a whole have become very sensitive to capital flows," and analyzed, "Previous bull markets were driven by narratives such as adoption expansion and network growth," adding, "(In contrast) this cycle's key is where capital moves, how quickly it accelerates, and when it suddenly stops."

Matrixport emphasized that capital flows such as ETFs should be closely watched for the time being. Matrixport said, "Ultimately what moves cryptocurrency prices is capital inflows, not adoption or real use cases," noting, "This was clearly seen in the case where Ethereum spot ETFs attracted $10 billion in funds and Ethereum's price surged from $2,600 to $4,500."

It added, "Understanding and proactively identifying the dynamics of such capital flows will be at the center of future research," and "(capital flows) are an important analytical point as we move toward next year."

Meanwhile, U.S. Ethereum spot ETFs returned to net outflows on the 23rd (local time). After 7 consecutive trading days of net outflows, they briefly returned to net inflows on the 22nd before switching back to net outflows the next day.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)