[Analysis] "Bitcoin buying pressure at bottom... Reversal likelihood increases"

Summary

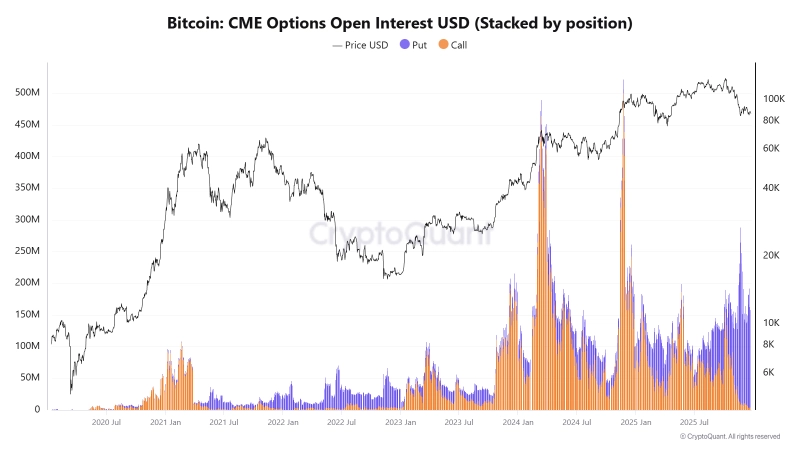

- Contributor CW8900 of CryptoQuant said Bitcoin CME options open interest has entered a bottom range for buying pressure.

- He analyzed that while call option open interest is decreasing, put option open interest is rapidly increasing, raising the possibility of a market reversal.

- He reported that large investors' Bitcoin accumulation continues, and since rally expectations in the options market have diminished, the possibility of a reversal has increased.

The trend of open interest (OI) for Bitcoin (BTC) options on the U.S. Chicago Mercantile Exchange (CME) has prompted analysis suggesting the possibility of a price rebound.

Contributor CW8900 of CryptoQuant wrote on the 24th (local time) via CryptoQuant, "Bitcoin CME options open interest indicates that buying pressure has entered a bottom range." CW8900 said, "Generally, call option open interest reaches its peak near the top of a price rally," adding, "in this cycle it peaked in December 2024 and then gradually declined."

He also mentioned the trend of put option open interest. CW8900 said, "While call option open interest has reached bottom levels, put option open interest is rapidly increasing," and analyzed, "An increase in put options typically means expanding downward pressure, but it can also be interpreted as a signal suggesting the possibility of a market reversal."

According to open interest indicators, the likelihood of a Bitcoin price rebound is increasing. CW8900 said, "Currently, whales (large investors) are accumulating Bitcoin on a large scale," and added, "Considering that participants in the options market currently have extremely low rally expectations, it can be interpreted that the likelihood of a market reversal is rather increasing."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)