Cryptocurrency derivatives trading volume this year nears $86 trillion…Binance holds 30%

Summary

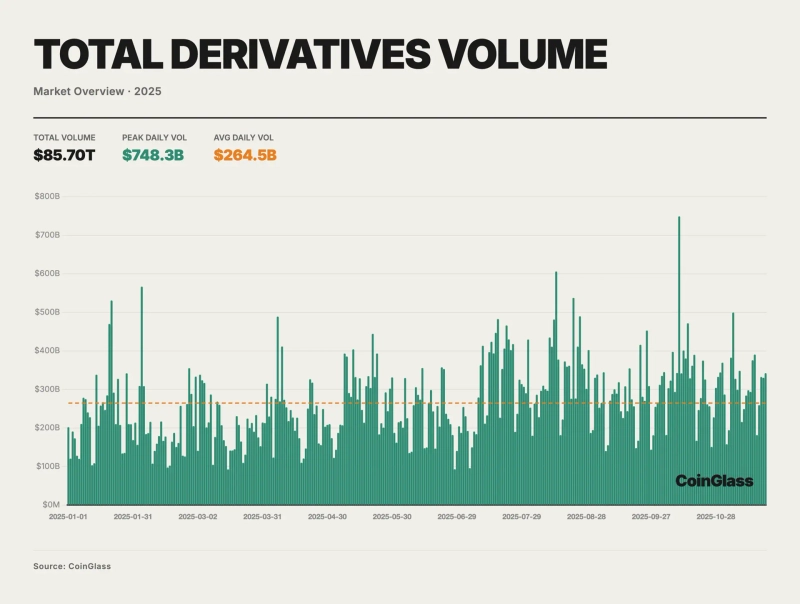

- CoinGlass reported that this year's centralized exchange (CEX) cryptocurrency derivatives trading volume approached $86 trillion.

- Global exchange Binance accounted for the largest share at 30%.

- They said that with institutional investors increasing use of complex derivatives strategies, the liquidity barriers between regulated markets and offshore markets have effectively collapsed.

This year, the cryptocurrency derivatives trading volume on centralized exchanges (CEX) approached $86 trillion (about 125 quadrillion won).

According to CoinGlass's "2025 Annual Report on the Cryptocurrency Derivatives Market," published on the 25th (local time), the total trading volume in the cryptocurrency derivatives market this year was $85.7 trillion. The average daily trading volume was about $264.5 billion (about 383 trillion won). CoinGlass said, "On October 10, one-day trading volume reached about $748 billion, well above the average," and added, "This shows that derivatives have become the main stage for leveraged speculation during market rallies."

About 30% of the derivatives market share was taken by the global cryptocurrency exchange Binance. Specifically, Binance's cumulative derivatives trading volume this year was $25.09 trillion, and its average daily trading volume was $77.45 billion. Its market share was 29.3%. CoinGlass said, "It means that for every $100 traded in the global derivatives market, about $30 occurs on Binance," and added, "OKX, Bybit, and Bitget, along with Binance, account for about 62.3% of the overall (derivatives) market."

CoinGlass noted, "2025 will be a year in which the exchange-listed derivatives market becomes more advanced." CoinGlass said, "This year there has been a trend of institutional investors' capital shifting from passive investing to active asset management using complex derivatives strategies," and "As a result, the liquidity barriers between regulated exchange-listed markets and unregulated offshore markets have effectively collapsed."

It also mentioned the decentralized prediction market industry. CoinGlass said, "Cryptocurrency prediction markets experienced explosive growth this year," and predicted, "The cumulative trading volume for prediction markets from January to November this year is about $52 billion, which is expected to significantly exceed the peak recorded during last year's U.S. presidential election." It observed that the world's largest prediction market platform, Polymarket, is expected to record a cumulative trading volume of $23 billion this year.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)