[Analysis] "In December's fear phase, virtual asset leverage increased by $2.4 billion…stubborn optimism rather than capitulation"

공유하기

- Despite December's fear phase in the virtual asset market, it reported that open interest in Bitcoin and Ethereum futures increased by a total of $2.4 billion.

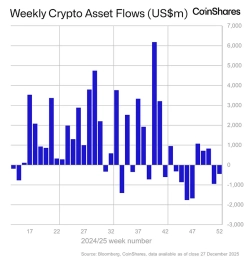

- The report interpreted that while professional money was withdrawing from the market, leverage betting centered on retail investors increased, indicating the market still has a stubbornly optimistic tone.

- The analyst said that although leverage expanded and funding rate remained in positive territory, the market had not reached a final washout stage.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Even during December's market fear phase, leverage in virtual asset (cryptocurrency) derivatives rather increased, leading to analysis that the market has not yet reached a final capitulation phase.

On the 29th, Crazzyblockk's analyst said in a CryptoQuant QuickTake report, "Open interest in the Bitcoin and Ethereum futures markets increased by about $2.4 billion during December."

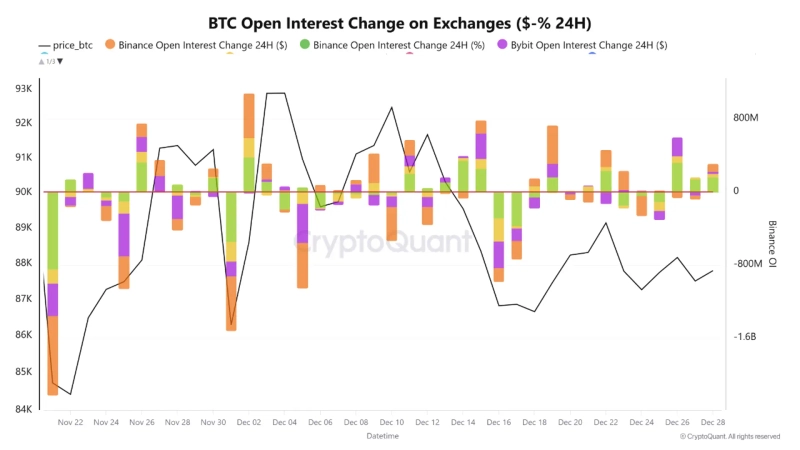

According to the report, despite overall trading activity declining by about 40% in December, the combined open interest for Bitcoin and Ethereum futures rose from about $35 billion to $38 billion, an increase of about 7%. Over the same period, Bitcoin open interest rose from $22 billion to $23 billion, an increase of $1 billion, and Ethereum rose from $13 billion to $15 billion, an increase of $1.4 billion.

This change appeared when the Bitcoin price was hovering around $88,000 and the fear-and-greed index was at a level of 27. Even over the past seven days, new leverage increased by about $450 million, and Bitcoin futures positions expanded by about 2% on a weekly basis.

The analyst evaluated this as investors adding new leveraged positions expecting a rebound rather than closing positions in a bearish phase. By exchange, positions increased on Binance, Bybit, and OKX, with Gate.io showing the largest expansion. The report stated that on all exchanges tracked, position maintenance or expansion was observed instead of risk reduction.

However, the report also presented the interpretation that this trend is far from a typical bottom signal. The Crazzyblockk analyst said, "A true bottom is formed not when leverage accumulates but when it is liquidated," and analyzed that "the fact that open interest is increasing while the fear index remains at 27 means there is still stubborn optimism in the market."

The report characterized December's market as a 'phase of conviction without confirmation.' Funding rates remained in positive territory, creating a cost for holding long positions, and open interest increased while actual trading activity was significantly subdued. At the same time, about 20,000 BTC flowed out of whale wallets, and moves by institutional/professional money to reduce risk were also observed.

The analyst added, "While professional money is retreating from the market, leverage betting centered on retail investors has increased," and said, "It is difficult to say the market has reached the final washout stage (washout)."

Meanwhile, open interest refers to the number of contracts for positions that traders in the derivatives market have not liquidated. An increase in open interest means funds are flowing into the market.

Also, the funding rate represents the extent to which long or short positions dominate on futures exchanges and reflects futures traders' sentiment.

![[Analysis] Bitcoin briefly recovered $90,000… remains range-bound amid thin year-end liquidity](https://media.bloomingbit.io/PROD/news/fac68f0c-39cb-4793-8eac-de269ba2aefb.webp?w=250)