Editor's PiCK

Digital asset investment products see weekly $446 million net outflow…"Sentiment recovery not yet"

공유하기

- Digital asset investment products saw a weekly $446 million net outflow, and investor sentiment is still considered fragile.

- In particular, $460 million left the U.S., while Germany showed selective buying with a weekly $35.7 million net inflow.

- By asset, XRP and Solana recorded net inflows, while Bitcoin and Ethereum showed strong net outflows.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Large weekly outflows from digital asset investment products have continued, and analysts say investor sentiment remains weak despite year-to-date net inflows.

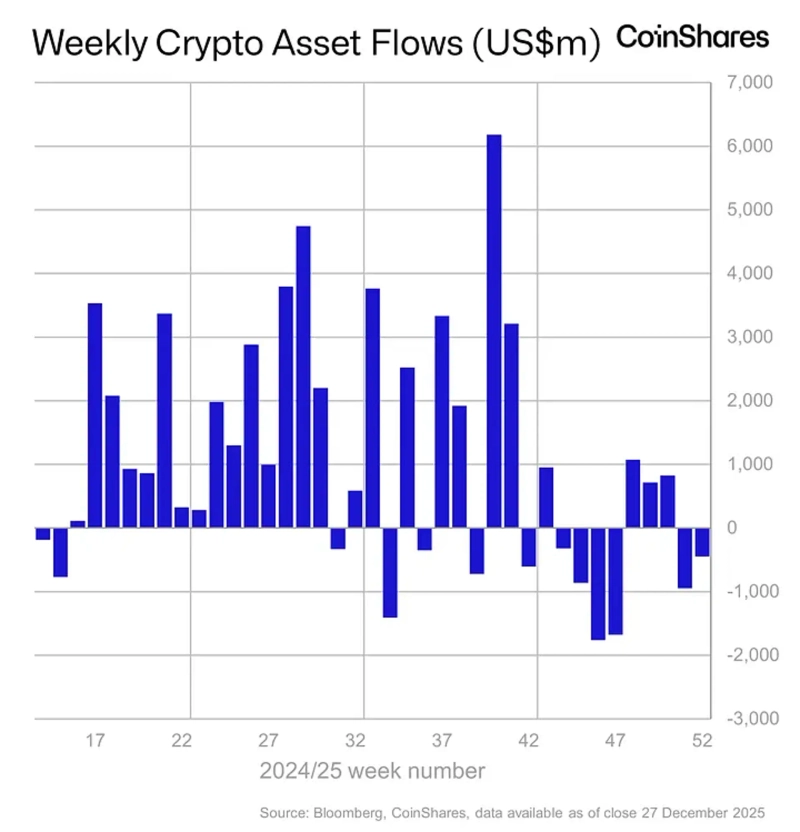

According to CoinShares, a digital asset (cryptocurrency) asset manager, digital asset funds saw a total net outflow of $446 million last week. Since the sharp drop on October 10, cumulative outflows have increased to $3.2 billion. This suggests that investor confidence has not fully recovered despite price rebounds.

However, year-to-date (YTD) fund flows have remained at levels similar to last year. Year-to-date cumulative inflows stand at $46.3 billion, not far from $48.7 billion in the same period of 2024. Assets under management (AuM) increased by only 10% compared with the start of the year, suggesting that average investor returns were limited despite inflows.

By region, the largest share of outflows came from the U.S., where $460 million left. Switzerland also saw $14.2 million withdrawn. In contrast, Germany was an exception, recording a $35.7 million inflow. Germany's cumulative inflows this month totaled $248 million, indicating selective buying that used the recent price weakness as a purchasing opportunity.

Flows by asset were mixed. XRP and Solana recorded weekly net inflows of $70.2 million and $7.5 million, respectively. Since related ETFs were launched in the U.S. in mid-October, cumulative inflows amount to $1.07 billion for XRP and $1.34 billion for Solana. By contrast, Bitcoin and Ethereum saw weekly net outflows of $443 million and $59.5 million, respectively, and cumulative outflows since the ETF launches reached $2.8 billion for Bitcoin and $1.6 billion for Ethereum.

James Butterfill, head of research at CoinShares, said in the report, "Year-to-date inflows are robust, but recent weekly flows show investor sentiment has not fully recovered." He added, "Unlike the broad U.S.-centered outflows, inflows in Germany suggest selective accumulation during the price weakness."

![[Analysis] Bitcoin briefly recovered $90,000… remains range-bound amid thin year-end liquidity](https://media.bloomingbit.io/PROD/news/fac68f0c-39cb-4793-8eac-de269ba2aefb.webp?w=250)