"Caution despite Bitcoin briefly topping $90,000... the real market opens in January"

공유하기

- Adam said Bitcoin surpassed $90,000, but this rise was Asia-led and limited to short-term optimism.

- He said the options market shows strong call buying while skew has moved into negative territory, signaling excessive optimism.

- Adam pointed out the funding cost burden of long-term leveraged long positions, and said the true market direction depends on supply-demand and options position changes after January.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

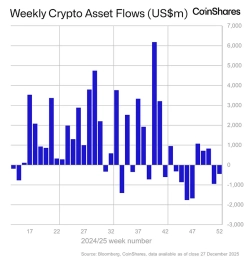

Although short-term optimism is spreading in the virtual asset (cryptocurrency) options market, analysis says definitive trend judgment will likely come after January next year.

On the 29th, Adam, a researcher at options analysis platform Grix.live, said in his daily briefing published on X (formerly Twitter) that "Bitcoin has surpassed $90,000 and Ethereum (ETH) has also risen, leaving overall market sentiment relatively optimistic." He added, "However, this rise was driven by Asian trading hours, and there are many voices concerned about the possibility of a pullback in the U.S. session."

Researcher Adam questioned the reliability of short-term price movements. He said, "Movements during periods when major players are not actively participating, such as weekends and Monday daytime (Asian hours), are difficult to give much meaning to," and "the real market opens only after January begins." He set Ethereum's medium-term target at around $4,000.

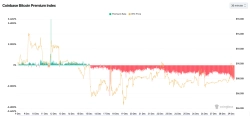

Regarding options market trends, he diagnosed that bullish expectations remain strong. Adam said, "Traders are actively buying call options," while also mentioning warning signs. He pointed out, "Skew in the options market is shifting into negative (-) territory, which requires caution," and added, "This can be interpreted as a sign that excessive optimism is building up."

He also warned about high-leverage positions. Adam said, "One trader maintained a 3x leveraged long position of about 108,000 contracts for two months, but most of the profits were consumed by funding costs," and emphasized, "Long-term leveraged long positions are a highly disadvantageous strategy that must endure a base cost structure of around 10% per year."

He added, "In the current thin liquidity environment, after January, supply-demand and changes in options positions will determine the true direction rather than short-term sharp swings."