Summary

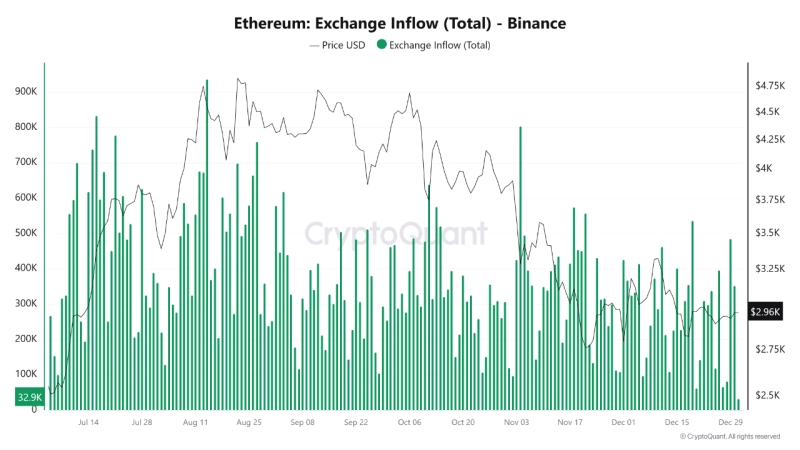

- Arab Chain said that Ethereum deposited into Binance in December totaled about 8.5 million, marking the highest level in the past two years.

- An increase in Binance's Ethereum holdings was emphasized as an indicator of expanded tradable liquidity and potential selling pressure.

- The surge in exchange deposits suggests large investors' market entry and possible expansion of participation in derivatives markets, implying increased market volatility.

Ethereum (ETH) deposited to Binance this month has reached its highest level in two years.

Arab Chain, a contributor to CryptoQuant, said on the 31st (local time) via CryptoQuant, "About 8.5 million Ethereum flowed into Binance in December," adding, "the largest net inflow since 2023." Arab Chain said, "(In December) about 162,000 Ethereum flowed into Binance in a single day," and "(this month) Binance's Ethereum holdings increased to about 4.17 million."

Arab Chain emphasized that "there has been a clear change in investor behavior and liquidity distribution within the market." Arab Chain said, "An increase in Binance's Ethereum holdings means that tradable liquidity within centralized exchanges (CEX) has expanded," and "historically, assets moving from long-term storage wallets or cold wallets to exchanges have been a key indicator that precedes increased trading activity or potential selling pressure." At the same time, it added, "This flow does not necessarily mean immediate downside pressure," and "(exchange deposits) could be part of hedging strategies or risk management strategies rather than actual selling."

Arab Chain noted, "(The surge in exchange deposits) means that many investors or large investors have actively entered the trading environment." Arab Chain said, "This movement could involve not only spot selling but also increased participation in futures and derivatives markets using Ethereum as collateral," and "considering Binance's characteristic high proportion of derivatives trading, it also suggests the possibility of entering a phase of increased market volatility."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)