"Consumers feel prices are so tight"…Consumer prices hit a 5-year low, why? [Kwang-sik Lee's One-bite Prices]

공유하기

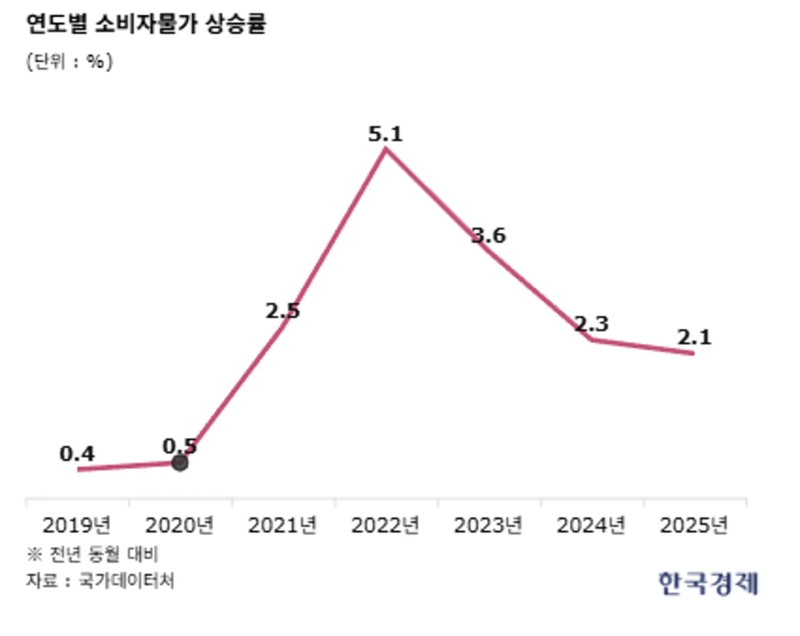

- Last year the consumer price inflation rate was 2.1%%, the lowest in five years, but due to the high exchange rate and accumulated high prices, consumers' perception was different.

- In particular, petroleum products, processed foods, and dining-out reacted sensitively to the exchange rate and market conditions, rising about 24–25%% over five years.

- This year, inflation is expected to be heavily influenced by a high exchange rate, weather conditions, and geopolitical risks.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Accumulated high prices compounded recently by exchange rate rise

International oil prices fall but domestic fuel prices rise

Processed food and dining-out prices rose by nearly 25% over 5 years

Fruit and vegetable prices fell, but base effects are large

This year's inflation: exchange rate and weather conditions are 'variables'

Last year, the consumer price inflation rate was recorded at 2.1%. It is the lowest level in five years since COVID-19 became widespread in 2020. It is also not far from the authorities' target of 2%. However, very few people felt that "prices are quite stable" last year. Prolonged high prices had accumulated, and the high exchange rate caused petroleum products and imported agricultural product prices to fluctuate.

The National Data Office announced the 'December 2025 and annual consumer price trends' on December 31, the last day of last year. The consumer price inflation rate in December last year was recorded at 2.3%. The exchange rate was the main factor again. Petroleum product prices rose by 6.1%, marking the largest increase in 10 months since February last year (6.3%).

Although international oil prices fell, domestic fuel prices rose after passing through the 'high exchange rate filter.' A National Data Office official explained, "Dubai crude-based international oil prices slightly declined from $64.5 per barrel in November last year to a $62.1 per barrel average for December 1–24, but the won–dollar exchange rate rose from 1,457 won to 1,472 won during the same period, offsetting that decline."

Imported fruit prices such as bananas (6.1%), mangoes (7.1%), and kiwis (18.2%) were not immune to exchange rate effects. Imported beef rose by 8% as a result of the high exchange rate combined with poor harvests in major exporting countries such as the United States. In addition, domestically produced agricultural product prices such as rice (18.6%), apples (19.6%), and tangerines (15.1%) also rose, with agricultural-centered prices increasing by 4.1%.

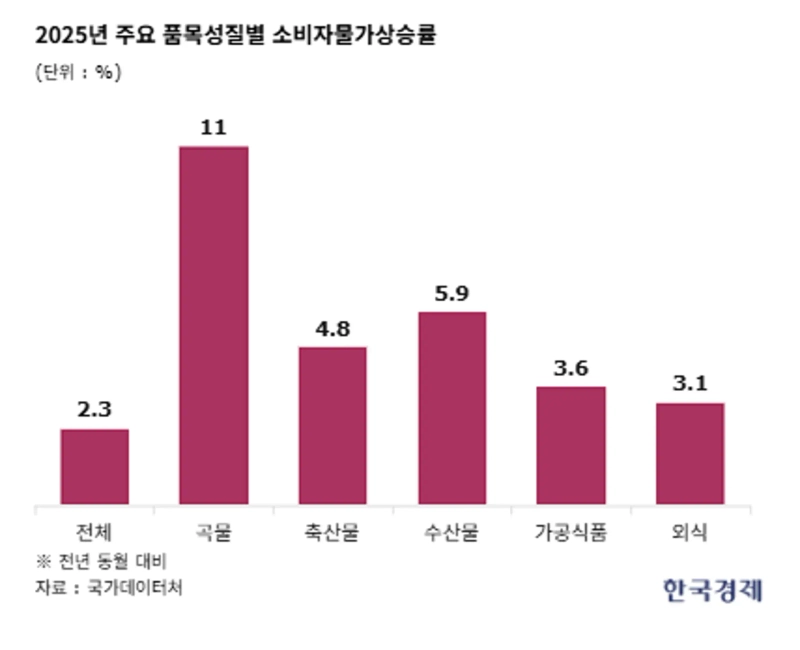

Among agricultural products, grain prices rose by 11%, showing the largest increase in seven years since 2018 (21.9%). The government's excessive market isolation had a large impact, causing rice prices to jump 7.7%. The public stockpiled grain purchase price, which is determined based on harvested rice prices, reached a record high last year at 81,600 won per 40 kg (grade 1 basis).

Vegetable (-3.4%) and fruit (-1.3%) prices fell year on year, but analysts say this is an optical illusion due to base effects. In 2024, when a heatwave struck, vegetable and fruit prices rose by 25% and 16.9% respectively. Livestock and seafood prices also rose by 4.8% and 5.9% last year, respectively, far exceeding the overall inflation rate.

Processed foods rose by 3.6% last year, and dining-out prices rose by 3.1%, both recording levels in the 3% range. Dining-out prices have recorded an increase above 3% for four consecutive years since 2022 (7.7%). Processed foods and dining-out prices are sensitive indicators for urban office workers, and they have risen by about 24–25% over the five years since 2020.

Petroleum products rose by 2.4% last year, reversing to an upward trend for the first time in three years since 2022 (22.2%). The National Data Office explained, "Separate from the overall price index, there are many individual items whose prices have risen sharply," and added, "A gap can occur between official price indicators and the prices consumers feel."

How will prices move this year? The price authorities again point to the exchange rate as a major variable. A high exchange rate is likely to first be reflected in petroleum products and imported raw material prices and then spread broadly to processed foods and dining-out prices. The Bank of Korea stated last month in its '2026 Monetary and Credit Policy Direction' that a high exchange rate and domestic demand recovery could be upward pressures on this year's inflation. A Ministry of Economy and Finance official said, "Geopolitical risks or price fluctuations in agricultural, livestock and fishery products due to weather conditions could act as variables."

Kwang-sik Lee reporter bumeran@hankyung.com