PiCK

U.S. Bitcoin and Ethereum ETFs both saw net outflows… $1,700,000,000 withdrawn in a month

Summary

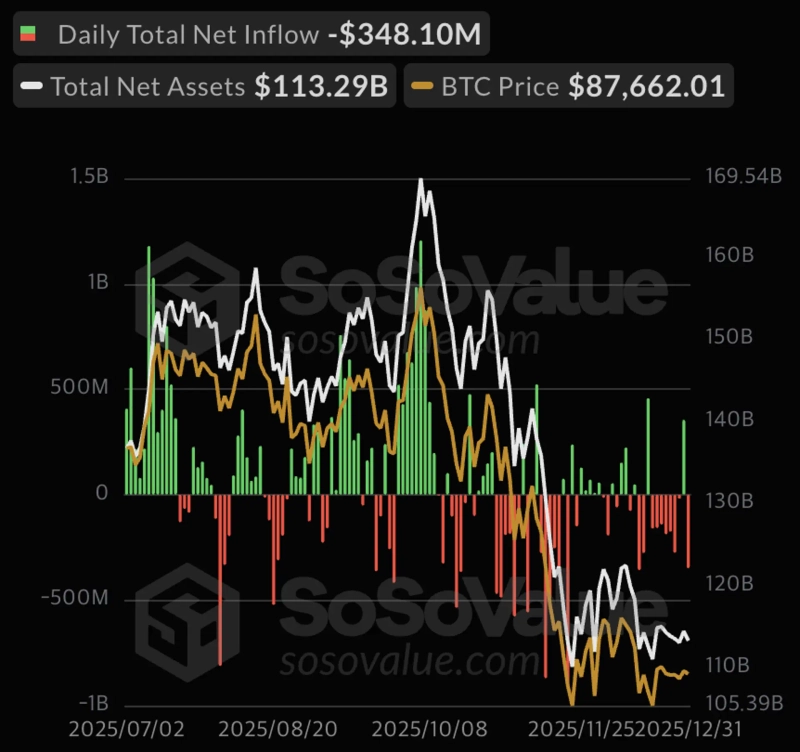

- SoSoValue said the U.S. Bitcoin spot ETF and Ethereum spot ETF reverted to net outflows just one day after switching to net inflows.

- Over the past month, the Bitcoin spot ETF saw $1,090,000,000 and the Ethereum spot ETF saw $616,800,000 in outflows, totaling about $1,700,000,000 from the two products.

- It reported large net outflows from major ETFs such as BlackRock IBIT, Ark Invest ARKB, and Grayscale GBTC.

U.S. Bitcoin (BTC) and Ethereum (ETH) spot exchange-traded funds (ETFs) reversed to net outflows just one day after switching to net inflows.

On the 1st (local time), according to crypto analytics firm SoSoValue, the U.S. Bitcoin spot ETF recorded net outflows of $348,000,000 on the previous day (31st). It reverted to net outflows just one day after switching to net inflows on the 30th of last month. The Bitcoin spot ETF saw net outflows of $1,090,000,000 during last month alone.

Specifically, $99,300,000 flowed out of BlackRock IBIT alone. Ark Invest ARKB and Grayscale GBTC saw net outflows of $76,530,000 and $69,090,000, respectively. Fidelity FBTC also recorded net outflows of $66,580,000.

The situation is similar for Ethereum spot ETFs. Ethereum spot ETFs saw $72,060,000 flow out on the previous day. Like the Bitcoin spot ETF, it switched back to net outflows just one day after returning to net inflows on the 30th of last month.

Ethereum spot ETFs recorded net outflows of $616,800,000 last month. Combined, Bitcoin and Ethereum spot ETFs have seen $1,700,000,000 flow out over the past month.

Specifically, $31,980,000 flowed out of the Grayscale Ethereum Mini Trust ETF, leading the net outflows. BlackRock ETHA also saw net outflows of $21,560,000.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)