[Analysis] "Bitcoin trapped in a 'high-volatility box range'... lacking structural momentum"

Summary

- XWIN Research Japan said Bitcoin still remains in a high-volatility box range and lacks structural momentum.

- ETF inflows and economic recovery could see Bitcoin fluctuate between $80,000–$140,000 this year.

- They also analyzed there is a risk it could fall to the $50,000s if a recession and ETF outflows coincide.

An analysis suggested Bitcoin (BTC) prices are likely to remain range-bound this year as well.

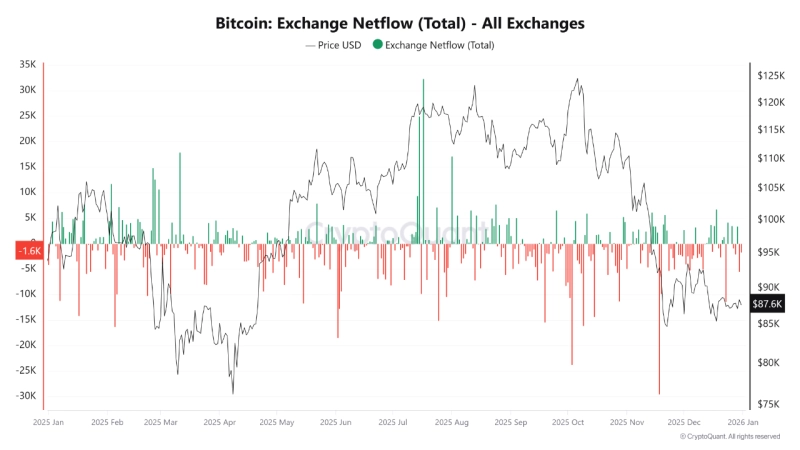

A CryptoQuant contributor from XWIN Research Japan said on the 1st (local time) via CryptoQuant, "As 2026 begins, it is still difficult to say that Bitcoin has clearly entered a new bullish phase," adding, "The market remains in a 'high-volatility' box range." XWIN Research Japan said, "Wider adoption of exchange-traded funds (ETFs) and supply constraints act as long-term supportive factors," but added, "Macroeconomic uncertainty, political variables surrounding the U.S. midterm elections, and derivative-driven price formation continuously limit (Bitcoin's) directional movement."

XWIN Research Japan predicted that Bitcoin prices this year are likely to show a 'Twisted Range' flow. It said, "At this point, the market is conditionally neutral or in a mild bear market," and, "There is still a lack of structural confirmation to support strong upward momentum."

It continued, "Expectations for interest rate cuts persist, but real economic recovery has not fully materialized, and capital inflows are being driven by short-term ETF flows," adding, "In this case, Bitcoin is likely to move within a wide range of $80,000–$140,000." It also noted, "The $90,000–$120,000 band is likely to become the core trading zone."

It also mentioned the possibility of falling below $80,000. XWIN Research Japan said, "If recession risks increase, deleveraging and ETF capital outflows could coincide and push Bitcoin below $80,000," adding, "In extreme cases, a drop to the $50,000s cannot be ruled out." It added, "If ETF inflows and other factors proceed steadily, Bitcoin could rise further to the $120,000–$170,000 range," but cautioned, "Prices above that level would require several favorable conditions to be met simultaneously."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)