Summary

- It reported that in the crypto asset market, major assets such as Bitcoin and Ethereum experienced a short-term rebound, causing large-scale forced liquidations of short-position investors.

- It said that for both Bitcoin and Ethereum, short-position liquidation amounts and the number of traders liquidated were overwhelmingly higher compared with long positions.

- This phenomenon was said to have led to high volatility during short-term rebounds in areas heavily skewed toward short positions.

As the crypto assets (cryptocurrencies) market staged a short-term rebound, short sellers who had bet on declines were largely forced into liquidation. Although the price gains were limited, heavy concentrations of short positions meant liquidations concentrated even on the brief rebound, increasing volatility.

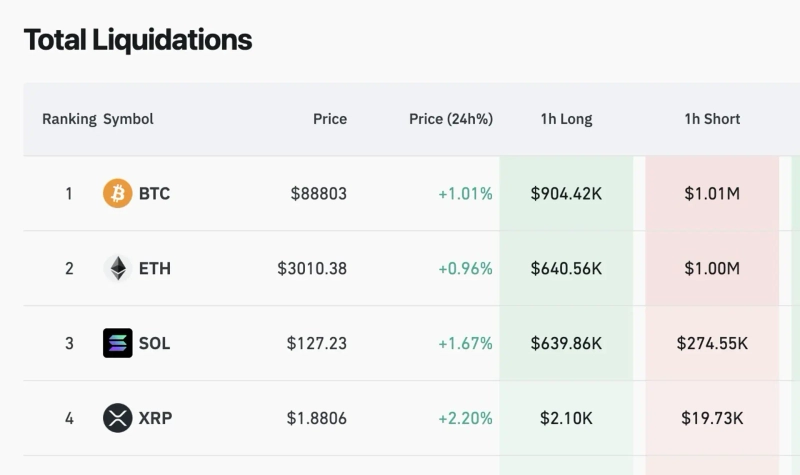

According to a crypto asset data platform, on the 1st (local time) during the past hour, large-scale futures liquidations centered on short positions occurred across major assets such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP (XRP). In both liquidation amounts and number of traders liquidated, short positions were overwhelmingly dominant.

Bitcoin, in the process of recording $88,777, up 0.89%, saw short-position liquidations of about $1.01 million and 132 traders liquidated. During the same period, long-position liquidations amounted to about $900,000, but only 10 traders were liquidated.

Ethereum showed a similar trend. Ethereum rose about 1% and briefly surpassed the $3,000 level intraday. Short-position liquidations amounted to about $1.00 million and 207 traders were liquidated. By contrast, long positions were about $640,000, with only 6 traders liquidated.

Solana (SOL) rose 1.6% to reclaim the $127 level, during which short-position liquidations amounted to about $270,000 and 94 traders were liquidated. Long-position liquidations were about $630,000, but only 5 traders were liquidated. XRP also rose 2.17%, with short-position liquidations totaling $19,730 and 37 traders liquidated — far more than long positions ($2,100, 3 traders).

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)