"Bitcoin long-term holders' selling pressure eases…sign of reduced supply burden"

공유하기

- Analysis says that Bitcoin long-term holders' selling pressure has eased and supply burden is reduced.

- The market noted that after long-term holders' selling exit, it is focusing on the possibility of reduced price volatility and bottoming rather than an immediate rise.

- The long-term holders' cessation of selling is interpreted as a signal that the adjustment phase is ending, and conditions for price stability and mid-term base formation are improving rather than a short-term surge.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Analysis shows that selling pressure from Bitcoin (BTC) long-term holders is slowing and signs of a change in the supply structure are emerging.

On the 4th, crypto asset (cryptocurrency) specialized media CryptoDNES said, "The 30-day net position change of long-term holders (long-term holder) has returned to a net buying zone." This is interpreted as a signal that the selling flow has effectively entered a calming phase after a strong distribution phase that continued in recent years.

On-chain data show that long-term holders recorded the strongest selling pressure since 2019 and then halted further distribution. The market notes that the selling exit of long-term holders is more likely to lead to a phase where downward pressure weakens and price volatility gradually shrinks, rather than an immediate rise.

In past cycles as well, after long-term holders stopped selling, there were many cases where sideways movement and bottoming occurred first rather than sharp rises. The structure is such that, rather than new buying inflows, the disappearance of selling entities naturally forms the price floor.

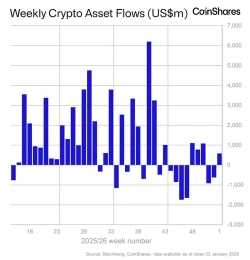

These supply-side changes are occurring in tandem with Bitcoin absorption through spot exchange-traded funds (ETF) and buying flows by some corporate financial entities during adjustment periods. On the other hand, individual investor participation remains limited, and market sentiment indicators are assessed to be closer to caution than optimism.

The market views this combination as a characteristic often observed at the onset of a trend reversal rather than an overheating phase. It is explained as a stage where supply burden is resolved first before expectations of price increases take hold.

The outlet said, "The fact that long-term holders, considered the participants with the strongest conviction in the Bitcoin market, have stopped selling suggests that the adjustment phase may be approaching its final stage," adding, "Although it is difficult to conclude a short-term surge, conditions for price stability and mid-term base formation have improved compared to before."