Summary

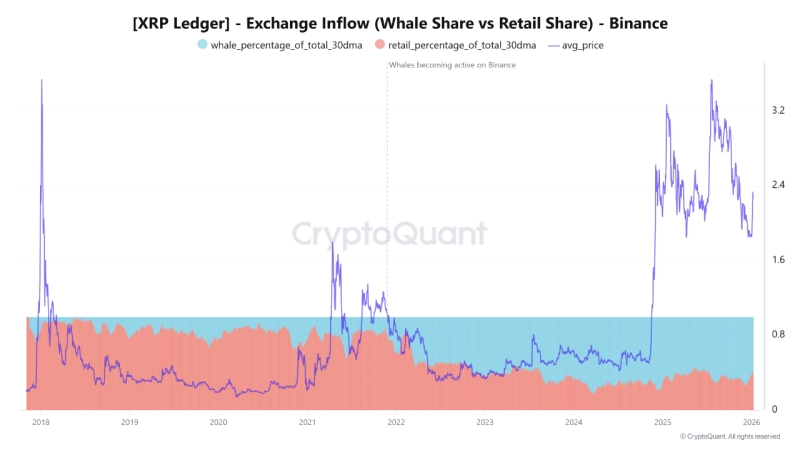

- Arab Chain said the whale share of XRP inflows to Binance has been declining since mid-December after peaking in November–December last year.

- It said that as XRP fell from about $3.2 to around $2.26, the drop in whale inflows suggests easing selling pressure from large investors.

- It emphasized that retail inflows have been stable with no panic selling, and that while the decline in whale inflows is a positive medium-term signal, a renewed spike in whale volumes could be an early warning of a shift in market direction.

Forecast Trend Report by Period

XRP inflows to global crypto exchange Binance have been trending lower since mid-last month.

In a CryptoQuant contribution, Arab Chain said on the 8th (local time), “XRP flow data into Binance shows that whales (large investors) account for about 60.3% of total inflows,” adding, “After peaking above 70% in November and early December last year, whale participation has shown a clear, gradual decline since mid-December.”

Arab Chain noted that “this decline in whale inflows coincides with a price correction.” It said, “XRP has fallen from around $3.2 near late last year’s highs to roughly $2.26 now,” and analyzed that “historically, a decrease in whale volumes flowing into exchanges suggests that direct selling pressure from large investors is easing.”

It also mentioned retail inflows. Arab Chain said, “Retail investors’ share of inflows to exchanges has remained relatively stable since mid-December last year,” adding, “No sharp surge in inflows was observed.” It continued, “This means there was no ‘panic selling’ in the retail market,” and added, “Given that both whales and retail investors are moving in a balanced manner, it is also possible that XRP is entering a ‘re-accumulation’ phase after a strong rally.”

Arab Chain stressed that “the drop in whale inflows since mid-last month is a positive signal in the medium term.” It said, “This reduces the likelihood of a sudden wave of selling,” while adding, “However, if whale volumes flowing into Binance spike again, it could serve as an early warning signal of a shift in market direction.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)