PiCK

[Analysis] "Ethereum institutional demand weakens… limited upside for a break above $3,300"

Summary

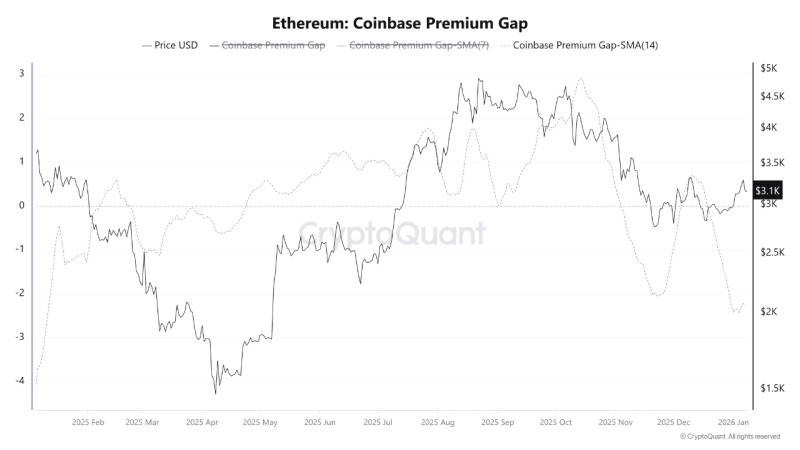

- CryptoOnChain said Ethereum’s Coinbase Premium Gap has turned negative, indicating weakening demand from US institutional investors.

- It said this is acting as a key resistance factor to Ethereum’s price regaining the $3,300 range, and analyzed that selling pressure is stronger on Coinbase.

- CryptoOnChain said that until the Coinbase Premium Gap turns positive again and a demand recovery is confirmed in the US spot market, the odds of a break above the $3,300 resistance are limited and the risk of additional downside corrections could rise.

Forecast Trend Report by Period

An analysis suggests demand for Ethereum (ETH) is weakening, led by US institutional investors.

A CryptoOnChain contributor to CryptoQuant said on the 8th (local time) via CryptoQuant that “Ethereum’s ‘Coinbase Premium Gap’ plunged and entered negative territory.” CryptoOnChain noted that “this is a signal indicating weakening demand from US institutional investors,” adding that “it is acting as a key resistance factor for Ethereum prices in regaining the $3,300 level.”

The Coinbase Premium Gap is a market indicator that measures the price difference between the US crypto exchange Coinbase and the world’s largest crypto exchange Binance. It is used to gauge the gap between US institutional demand for a particular cryptocurrency and global investor sentiment. CryptoOnChain analyzed that “the 14-day simple moving average (SMA) of the indicator sank to -2.285, marking the lowest level since early February 2025,” and that “this shows selling pressure is markedly stronger on Coinbase than on Binance.”

CryptoOnChain said, “In the past, sustained Ethereum rally phases were mostly formed when the premium gap was positive, with Coinbase prices higher than Binance,” adding that “the current negative premium gap suggests US institutional investors—often referred to as ‘smart money’—are not actively accumulating Ethereum at current levels.” It continued, “Even as Ethereum attempts to stabilize, institutional inflows via Coinbase are not accompanying the move.”

The analysis says the likelihood of Ethereum breaking above $3,300 is limited. CryptoOnChain said, “Until the Coinbase Premium Gap turns positive again and a tangible recovery in demand is confirmed in the US spot market, the chances of Ethereum breaking through the $3,300 resistance line are limited,” adding that “the longer the negative trend persists, the greater the risk of additional downside corrections.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)