PiCK

"A startup nurtured for seven years is out"… controversy over fairness of FSC STO licensing

Summary

- Lucentblock said the fairness of the financial authorities’ licensing process was compromised in the review for an STO OTC exchange license, and that it has been pushed to the brink of shutdown by entrenched interests.

- Lucentblock said it reported Nextrade to the Korea Fair Trade Commission, alleging it unilaterally violated a non-disclosure agreement (NDA) and stole technology that was used for its STO OTC exchange licensing application.

- Lucentblock said it effectively failed to secure preliminary approval despite operating the STO platform 'Soyo' for about four years and delivering results of 500,000 members and KRW 30 billion in cumulative transaction volume.

Forecast Trend Report by Period

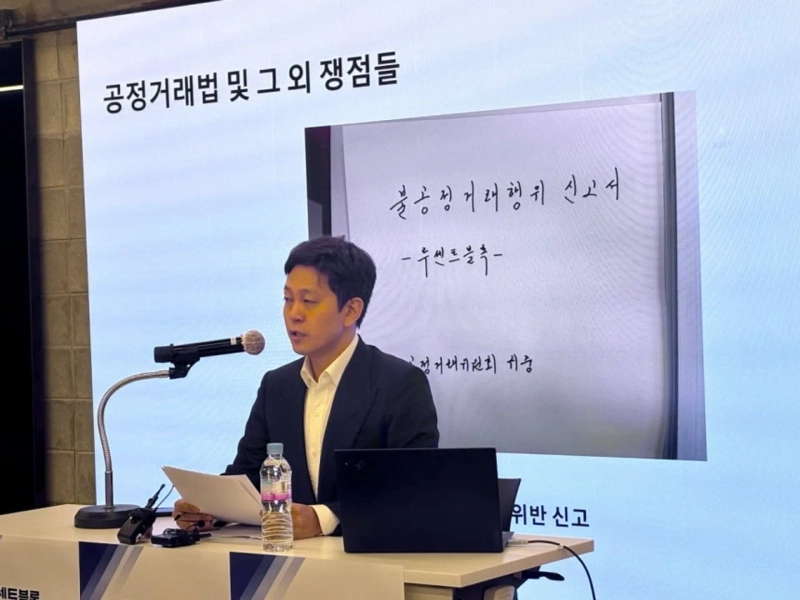

Huh Se-young, CEO of Lucentblock, press briefing

STO OTC exchange bid headed for rejection

Concerns raised over fairness of financial regulators’ licensing process

"Pushed to the brink of shutdown by entrenched interests"

"Nextrade stole our technology"

Lucentblock, a domestic fintech startup, has criticized the fairness of regulators’ review process related to licensing for a token securities (STO) over-the-counter (OTC) exchange. The company also reported alternative trading platform Nextrade (NXT) to the Korea Fair Trade Commission (KFTC), alleging technology theft during the OTC exchange licensing application process.

Huh Se-young, CEO of Lucentblock, said at a press briefing held on the 12th at Maru180 in Gangnam-gu, Seoul, that "it has been reported that companies with no experience in the STO business received higher evaluations in the FSC’s STO OTC exchange licensing than Lucentblock, which has operated its platform for four years serving 500,000 customers in the market."

Earlier, the Securities and Futures Commission under the Financial Services Commission (FSC) on the 7th approved the agenda items for preliminary licensing applications for an STO OTC exchange financial investment business submitted by the Korea Exchange (KRX) and Nextrade. Lucentblock, by contrast, is reported to have effectively been eliminated at the preliminary licensing stage.

Huh pointed out that unlike Lucentblock, which has operated an STO business for about seven years since its establishment in 2018, KRX and Nextrade have no track record in the area. He said, "This shows that greater value was placed on the on-paper plans and signage submitted by massive institutions packed with former FSC officials, and it seriously undermines the fairness of the screening process," adding, "While Lucentblock built the STO market from scratch for seven years, those institutions have not made a single contribution to the industry."

NXT reported to the KFTC

Lucentblock reported Nextrade to the Korea Fair Trade Commission (KFTC) on the day. The company claims Nextrade unilaterally violated a non-disclosure agreement (NDA) and stole its technology. Huh said, "What we reported to the KFTC includes acts such as obstructing (Nextrade’s) business activities and violations of merger notification obligations," adding, "We plan to disclose the (specific) details of the report within this week."

Huh believes Nextrade appropriated Lucentblock’s internal information and used it for its STO OTC exchange licensing application. He said, "Nextrade approached us under the pretext of reviewing investment and consortium participation ahead of the (STO OTC exchange) licensing application, signed an NDA, and then received sensitive internal information such as Lucentblock’s financial data, business plan, and core technical materials," adding, "But without any subsequent investment or consortium formation, it applied directly for a license in the same business area in just 2–3 weeks." Allegations of technology theft by Nextrade were also raised at last year’s National Assembly audit by the National Policy Committee.

He also questioned the rationale for selecting the Korea Exchange. Huh said, "KRX was able to operate an STO on-exchange marketplace for two years through a regulatory sandbox, but its actual distribution performance remained at 'zero (0)'," adding, "A public institution that had the opportunity but failed to prove a single result trying to enter the OTC exchange market is a clear case of 'free-riding'—snatching the fruits of innovation that the private sector has arduously cultivated."

"Pushed to the brink of shutdown by entrenched interests"

Huh stressed that the core of the OTC exchange business is the "institutionalization of an existing business." He said, "(The current situation) is not dissatisfaction over being unable to enter a new business, but a disaster in which an ongoing business is halted overnight, pushing us to the brink of shutdown," adding, "This is a case where a company that pioneered innovation and has continued operating is being forced out during institutionalization, and its place is being filled by entrenched interests."

He also argued that the licensing decision runs counter to the intent of the Special Act on Support for Financial Innovation. Huh said, "The main purpose of the Special Act is to ease regulations on a temporary basis and lay an institutional foundation for innovative fintech startups to grow," adding, "But in the actual institutionalization process, not only was there no protection for the achievements and leadership accumulated during the designation period as an innovative financial service—we are now facing the risk of being expelled after even our operating rights are stripped away."

Lucentblock was designated as an FSC innovative service in 2021 and operated the STO platform "Soyo" for about four years. According to Lucentblock, as of the end of last year, Soyo had about 500,000 members and cumulative transaction volume of about KRW 30 billion. The industry considers it a case of having structured an STO business for the first time in Korea.

Huh said, "In effect, the mechanisms to protect innovative financial operators that took on the greatest institutional risk and conducted testing without issues have disappeared, producing results that directly clash with legislative intent," adding, "The fundamental purpose pursued by the Special Act is being neutralized on the ground."

Meanwhile, the FSC plans to hold its regular meeting on the 14th and finalize the preliminary licensee(s) for the STO OTC exchange. It is rare for an agenda item that has passed the SFC to be overturned at a regular meeting. Huh said, "I know the probability (of the result changing) is slim," adding, "Starting on the 13th, I will hold a one-person protest in front of the Government Complex Seoul."

In response, an FSC official said, "Nothing has been finalized regarding the STO OTC exchange licensing."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![Will the Iran war drag on… Soaring oil prices freeze risk appetite [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/6dcbb4c5-634b-422e-aa22-d301a1c13934.webp?w=250)