Summary

- Bitcoin was said to be extending a sluggish trend below $91,000 and under resistance at the 50-day exponential moving average (EMA).

- It noted that about $680 million in net outflows from U.S. spot Bitcoin ETFs and a sell-side bias in the futures market are weighing on investor sentiment.

- It analyzed that upside to $94,588 is possible if the $90,000 support holds and the 50-day EMA is reclaimed, but if it breaks, a pullback toward around $86,420 also remains on the table.

Bitcoin (BTC) is struggling below $91,000 as exchange-traded fund (ETF) outflows coincide with bearish signals from the futures market. Having failed to break through near-term technical resistance, investor sentiment also appears somewhat subdued.

According to FXStreet on the 12th, Bitcoin rose to as high as $92,519 early in the session before turning lower and falling back below $91,000. It is currently searching for direction while facing resistance near $91,548, the 50-day exponential moving average (EMA).

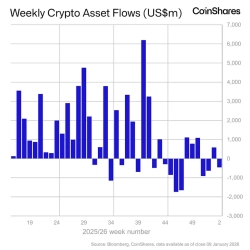

Softening institutional demand is also weighing on the market. U.S. spot Bitcoin ETFs saw net outflows of about $680 million last week. With funds exiting for four consecutive days, there is growing assessment that institutional buying via ETFs is weakening.

The derivatives market is also showing a sell-side bias. Over the past 24 hours, about 50.9% of Bitcoin futures positions were tallied as bets on declines, with the long-to-short ratio at around 0.96. This suggests market participants are maintaining a cautious stance in the near term.

The macro backdrop is also not supportive for Bitcoin. As geopolitical tensions between the United States and some countries persist, uncertainty ahead of a U.S. Supreme Court ruling related to tariffs, along with President Trump's remarks about capping credit card interest rates, are also stoking broader risk-off sentiment.

Still, potential near-term catalysts remain. The U.S. December consumer price index (CPI), due this week, is a key focus for markets. Some in the market are discussing the possibility that core CPI could cool to around 2.8%, and if inflation pressures ease, expectations for a policy-rate cut by early 2026 could revive. In general, expectations of rate cuts tend to be positive for high-risk assets such as Bitcoin.

The outlet said, "If Bitcoin holds the $90,000 support level and reclaims the 50-day EMA, an upside attempt could extend to around $94,588." On the other hand, it added that "momentum indicators have yet to show a clear recovery signal," warning that "if $90,000 breaks, the door is open to a pullback toward around $86,420."