Nickel prices surge on Indonesia output-cut news… highest in 15 months

공유하기

Summary

- Nickel prices jumped above $17,000 per ton (t) for the first time in 15 months, driven by Indonesia—the world’s top producer—announcing output cuts.

- Indonesia said it will reduce nickel production in 2026 to support prices, and cut this year’s mining production quota (RKAB) by 34% year on year.

- Experts said the near-term impact of Indonesia’s cuts may be limited, and prices could cool if nickel supply from the Philippines’ Surigao region resumes.

Nickel prices, which had fallen on slowing EV demand and China’s construction downturn, have staged a sharp rebound, breaking above $17,000 per metric ton (t) for the first time in 15 months. The move follows an announcement by Indonesia—the world’s top nickel producer—that it will cut output this year to rein in prices.

On the 13th (local time), nickel futures on the London Metal Exchange (LME) settled at $17,681 per ton. While down 4.1% from the year-to-date high of $18,440 recorded on the 7th, the rally that began last month has continued, with prices jumping 25.3% over the past month alone.

After Russia’s invasion of Ukraine, nickel traded at a monthly average of $33,300 per ton in April 2022. But as EV demand gradually cooled and Indonesia expanded supply, prices began to fall. After last touching the $17,000 range in mid-October 2024, nickel traded consistently between $14,000 and $16,000 through the end of last year.

In response, the Indonesian government decided to curb nickel output to improve market balance. Bahlil Lahadalia, Indonesia’s Minister of Energy and Mineral Resources, said last month that the country would cut nickel production in 2026 “to support nickel prices, secure government fiscal revenue, and crack down on environmentally harmful mining operations.” Indonesia, backed by Chinese capital investment, has supplied large volumes of low-cost nickel and built market dominance; it now plans to manage prices through annual output adjustments. This year’s nickel mining production quota (RKAB) was set at 250 million tons, a 34% cut from the previous year.

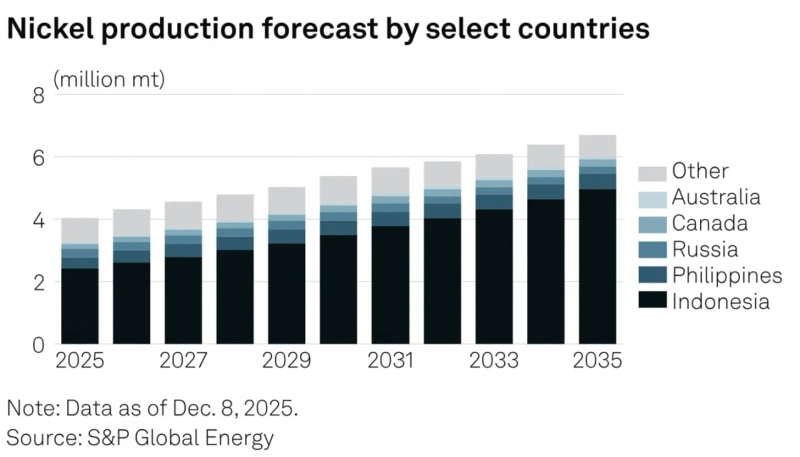

According to S&P Global Market Intelligence, Indonesia’s share of the global nickel market rose from 31% in 2020 to 60.2% in 2024, and is projected to expand to 74.1% by 2035.

Nickel is also drawing expectations that demand from downstream industries such as stainless steel could recover as China—its largest consumer—rolls out measures to stabilize the property market. Industrial metals such as nickel and copper are currently strengthening amid a global shift toward greater liquidity.

Still, some analysts say further gains in nickel prices may be limited until the Indonesian government releases concrete details. Benjamin Mikhael of UOB Kay Hian Holdings told Bloomberg, “It remains uncertain unless production cuts are implemented in a meaningful and consistent manner,” adding that “most investments already approved will be exempt (from cuts) for the next 1–2 years, so the impact of the government’s reductions is likely to be limited in the short term.”

The resumption of supply from the Philippines, the world’s second-largest nickel source, is another variable. Choi Jin-young, an analyst at Daishin Securities, wrote in a report that “in the Surigao region, which accounts for 78% of nickel supply in the Philippines, mining and export-port operations are restricted each year during the rainy season from October through the following March,” adding that “this is also why nickel prices reacted unusually strongly to Indonesia’s output-cut announcement.” The implication is that once Philippine supply resumes from March, the current price uptrend could ease.

Reporter Han Gyeong-je