Summary

- CryptoQuant said the recent recovery in Bitcoin is merely a temporary bounce within a downtrend—a 'bear market rally.'

- The report said the rise is not strong enough to change the trend due to weakening demand and Bitcoin remaining below the 365-day moving average.

- CryptoQuant warned that the current pattern is similar to the 2022 downturn, cautioning that Bitcoin could face resistance near the 365-day moving average and urging investor vigilance.

Forecast Trend Report by Period

While Bitcoin has recently shown signs of recovery, a pessimistic view has emerged that it is merely a temporary bounce within a downtrend—a so-called 'bear market rally.' The reasoning is that there is a lack of fundamental demand to underpin the market.

On the 16th, CryptoQuant, an on-chain data analytics firm for digital assets, said in its weekly report that "Bitcoin is up about 20% compared with November 21 last year, but this appears to be a textbook bear-market bounce."

CryptoQuant assessed that the current upswing is not strong enough to change the market’s trend. Julio Moreno, head of research at CryptoQuant, said, "Demand conditions have improved somewhat, but they remain weak," adding, "Behind this rebound lies an ongoing trend of contracting demand." In other words, it is only a technical rebound within an overall downtrend and does not overturn the market’s fundamentally bearish structure.

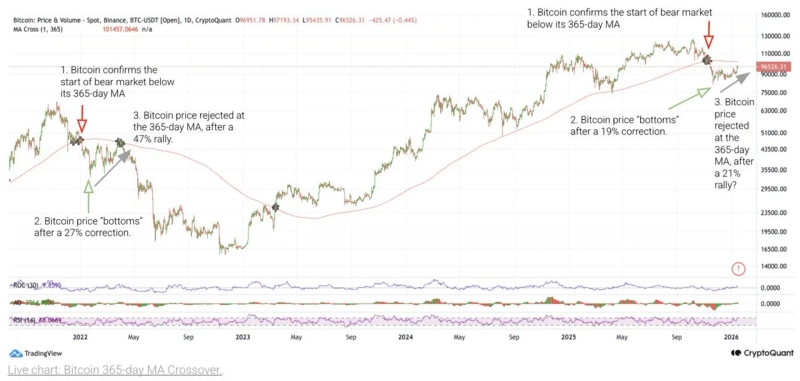

Technical indicators are also flashing warning signs. CryptoQuant pointed to the '365-day moving average' as a key threshold that separates bull and bear markets. According to the analysis, Bitcoin previously signaled entry into a bear market by falling below the 365-day moving average. It then rebounded on perceptions that the sell-off had been excessive, but the firm said it is still too early to be confident of a trend reversal.

In particular, concerns are growing that the current pattern resembles the 2022 downturn. CryptoQuant cautioned investors, noting that "in 2022, Bitcoin also broke below the 365-day moving average and then attempted a strong rebound, but it met resistance around that moving average and returned to a broader downtrend."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)