U.S. Ethereum ETFs extend net inflows for a fifth straight session, but total falls sharply to $4.6 million

Summary

- U.S. spot Ethereum ETFs extended net inflows for a fifth straight session, but the total amount fell sharply from the previous day.

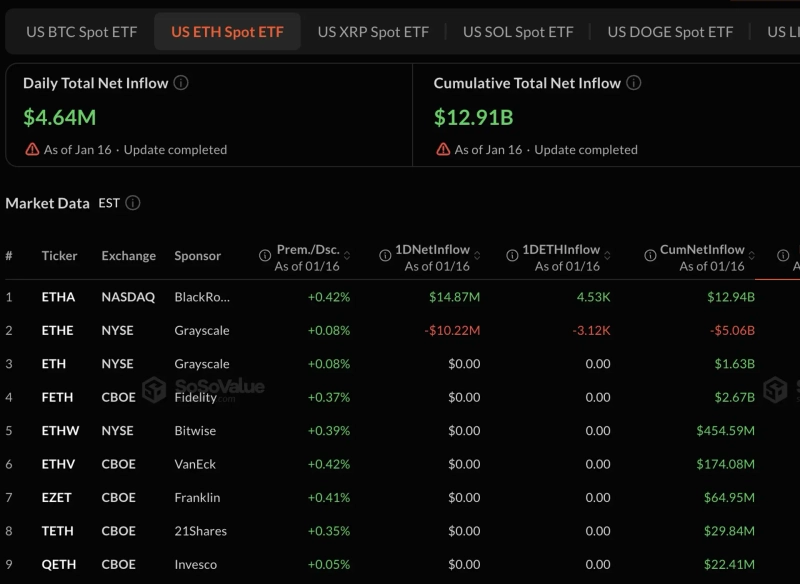

- On the 16th, the nine U.S. spot Ethereum ETFs posted $4.64 million in net inflows, down about 97% from the prior session.

- BlackRock’s ETHA logged $14.87 million in net inflows, while Grayscale’s ETHE saw $10.22 million in net outflows; the other seven funds were flat.

Forecast Trend Report by Period

U.S. spot Ethereum exchange-traded funds (ETFs) posted net inflows for a fifth consecutive trading session, but the amount of new money dropped sharply from the previous day.

According to SosoValue, a crypto-asset data analytics platform, the nine U.S. spot Ethereum ETFs saw total net inflows of $4.64 million on the day. However, momentum weakened noticeably, plunging about 97% from the prior session ($164.37 million).

BlackRock’s ETHA led buying with $14.87 million in net inflows. In contrast, Grayscale’s ETHE saw $10.22 million in net outflows, giving back most of the gains.

All other funds were flat. The remaining seven products—including Fidelity (FETH), Bitwise (ETHW) and VanEck (ETHV)—recorded no inflows or outflows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin gives up $68,000… “Stronger dollar and rate uncertainty dampen risk appetite”](https://media.bloomingbit.io/PROD/news/ef579f67-01bc-4cbe-a82c-11065e9f3f10.webp?w=250)