"The FX market is awash with dollars"—yet the won slips to the 1,470s per dollar

공유하기

Summary

- It said that even as dollar supply has increased in the FX funding market—driving the add-on spread down to near “zero”—the won-dollar exchange rate is rising.

- It noted that the Bank of Korea emphasized it is hard to view the current situation as an FX crisis because it is not a situation in which it is difficult to borrow dollar funding.

- With expectations for the exchange rate rising—such as NH Investment & Securities raising its forecast for this year’s average annual exchange rate—the BOK raised the need to manage expectations related to the exchange-rate increase.

When borrowing dollars in the FX funding market

Add-on spread falls to 'near zero'

But dollars are scarce in the spot FX market

Bank of Korea: "Not an FX crisis, but a supply-demand imbalance"

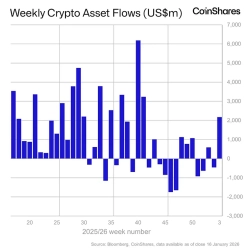

The add-on spread that must be paid to borrow dollars in Korea’s domestic foreign exchange market has fallen to a level close to “zero.” This comes as dollar supply has increased in the FX funding market, where dollars are lent. In contrast, the spot FX market—where dollars are actually bought and sold—has seen the exchange rate continue to climb as demand for dollars rises.

On the 19th, the Bank of Korea (BOK) posted an article on its blog titled, “If there are plenty of dollars in the FX funding market, why is the exchange rate rising?” Yoon Kyung-soo, director-general of the BOK’s International Department, said, “It is somewhat paradoxical that the exchange rate is rising even though dollars are abundant in the FX market,” adding, “It is difficult to call the current situation—where dollar liquidity is ample and it has become easier to borrow dollars—an FX market crisis.”

The FX funding market is where financial institutions such as banks lend dollars and receive interest. Transactions are mainly conducted through “FX swaps,” in which dollars are borrowed against won collateral, used for a certain period, and then repaid in dollars while the won is returned.

Currently, the interest rate for borrowing won is about 2.4% per year (based on a three-month maturity), which is lower than the 3.6% per year rate for borrowing dollars in the United States. At a minimum, swap transactions require paying interest equal to this difference of 1.2 percentage points. In addition, because the U.S. is the issuer of the key reserve currency, demand for dollars is high, and a premium above the rate differential is added. The “swap rate” is calculated by adding this add-on spread corresponding to that premium.

Recently, however, the add-on spread in the FX funding market has fallen to near-zero levels, reflecting an increase in dollar supply in the funding market. On the 15th, the add-on spread stood at 0.004 percentage points. After narrowing from 0.041 percentage points at the end of June last year to 0.022 percentage points at year-end, it has declined further this year. A large current account surplus, an increase in corporate foreign-currency deposits, and FX hedging of foreign investors’ bond investment funds were seen as having boosted dollar liquidity in the funding market. Yoon emphasized, “An FX crisis occurs when external payment capacity weakens and it becomes difficult to borrow dollar funding,” adding, “We are far from a crisis now.”

The issue lies in the spot FX market, where the exchange rate is determined through actual dollar trading. On the day, the won-dollar exchange rate in the Seoul FX market ended daytime trading at 1,473.70 won per dollar, up 10 jeon from the previous session. Analysts are also raising their exchange-rate benchmarks. In a report released the same day, NH Investment & Securities raised its forecast for this year’s average annual exchange rate to 1,440 won per dollar from 1,420.

The BOK believes that to narrow the gap between ample dollars in the FX funding market and a shortage in the spot FX market, it is necessary to manage expectations surrounding the exchange rate. Yoon said, “If the perception spreads that a rising exchange rate immediately implies deteriorating economic fundamentals, it could create a self-fulfilling vicious cycle that fuels capital outflows and further exchange-rate increases,” adding, “Over the medium to long term, we should improve fundamental factors, while in the short term we should focus on easing supply-demand imbalances and preventing one-way expectations from forming.”

Reporter Kang Jin-kyu josep@hankyung.com