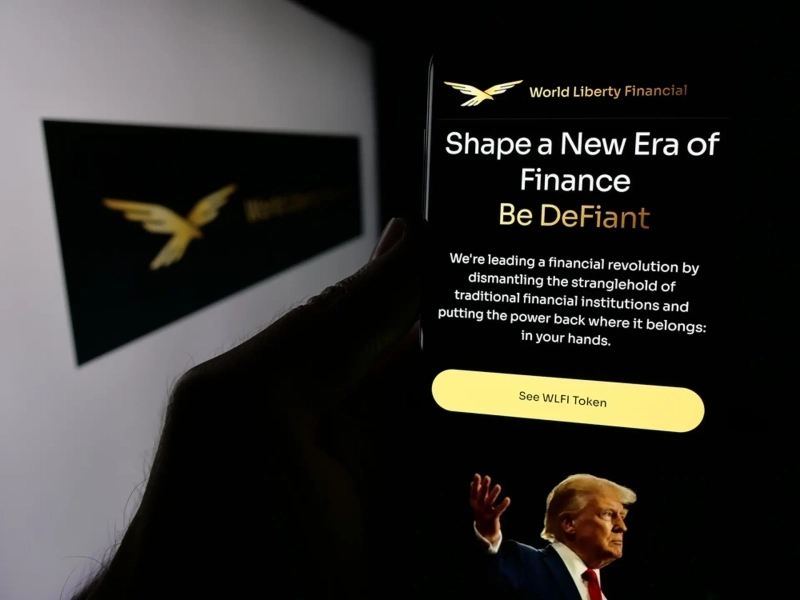

World Liberty Financial (WLFI) Faces Controversy Over Pushing Through USD1 Growth Governance

공유하기

Summary

- World Liberty Financial (WLFI) reported that controversy has emerged after it passed USD1 growth governance while tokenholder voting was constrained.

- It reported that in the recent governance vote, the top nine addresses linked to the team exercised about 59% of total voting power, while participation by locked-up token holders remained limited.

- According to the WLFI white paper, 75% of the protocol’s net profit is allocated to entities affiliated with the Trump family and 25% to entities affiliated with the Witkoff family, and WLFI said it has applied for a banking license.

World Liberty Financial (WLFI) has sparked controversy after passing governance related to the growth of the USD1 stablecoin while tokenholder voting was constrained.

According to Cointelegraph, a digital asset (cryptocurrency) news outlet, WLFI’s recent governance vote showed that the top nine addresses linked to the team exercised about 59% of total voting power. During the process, effective participation by holders of locked-up tokens was reportedly limited.

According to the WLFI white paper, tokenholders are not granted rights to distributions from protocol revenue, and the structure is designed so that 75% of the protocol’s net profit is allocated to entities affiliated with the Trump family, with the remaining 25% allocated to entities affiliated with the Witkoff family.

Meanwhile, WLFI has previously applied for a banking license and continues moves to build a structure that manages issuance, custody, and exchange of USD1 end to end.

![[Market] Bitcoin breaks below $92,000…declines deepen](https://media.bloomingbit.io/PROD/news/4cae954a-d799-4f79-a899-9e51a051cb5d.webp?w=250)