A reversal in America’s backyard… Shockwaves from the Canada–China ‘Maple–Yuan Deal’ [Global Money X-File]

Summary

- It said that the Canada–China “Maple–Yuan Deal” cuts tariffs on Chinese EVs and lowers agricultural tariffs, and that major changes are expected for the North American EV market and Canada’s export structure.

- It noted concerns that the agreement raises the possibility of routing China-made EVs— including Tesla—through Canada, potentially undermining North America’s supply chain and the U.S. sanctions regime against China.

- It said that the likelihood is rising that July USMCA renegotiations will tighten rules of origin and security provisions, meaning Korean automotive and battery companies may have to overhaul their Canada and U.S. market strategies.

The so-called ‘Maple–Yuan Deal’ between Canada and China is shaking the global economy. That is because one of the United States’ closest allies—and a member of the G7 (Group of Seven)—has moved to deepen cooperation with China, which remains in conflict with the West. Some analysts say it could even threaten the viability of the United States–Mexico–Canada Agreement (USMCA) and become a catalyst that reshapes the direction of the global economy.

China and Canada’s leaders meet again just two months later

According to Reuters on the 22nd, Chinese President Xi Jinping and Canadian Prime Minister Mark Carney held a summit on the 16th in Beijing. Meeting again just over two months after talks on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit in Gyeongju last October, the two leaders put a long chill behind them, declared a “new strategic partnership,” and agreed on a range of trade policies.

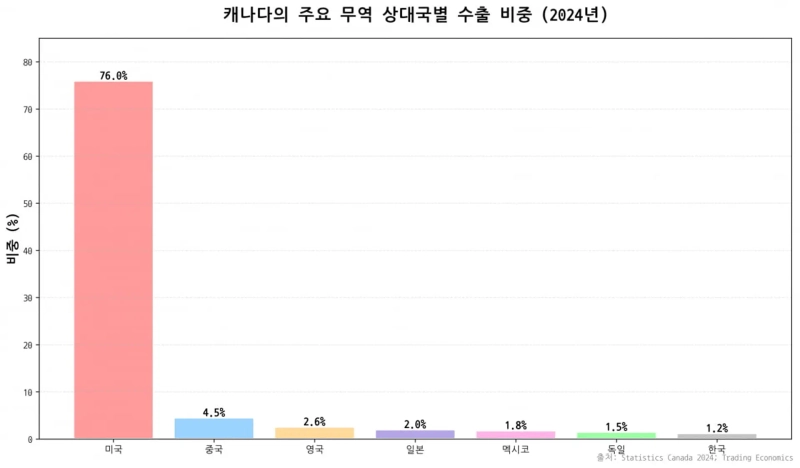

The deal is seen as a product of meticulously calculated “pragmatism” and “survival.” Critics note that Canada’s economy has been isolated in recent years amid high interest rates, low growth, and intense U.S. protectionist pressure driven by “America First.” Statistics Canada said that in 2023, the share of Canada’s exports to the U.S. reached 77.1% of the total. Such a distorted overreliance was a structural risk that could leave the entire economy wobbling depending on the disposition of the U.S. administration.

Immediately after the summit, Prime Minister Carney stressed, “In a somewhat fractured and uncertain world, Canada must build a stronger, more independent, and more resilient economy.” Analysts interpret this as, in effect, a signal that Canada intends to step out from America’s shadow and pursue its own strategy as a “middle power.”

From China’s perspective, the deal was also seen as urgent. To open a lifeline for an economy blocked by weak domestic demand, a property crisis, and Western technology curbs, China targeted resource-rich Canada as both a detour around the U.S. market and a strategic entry point. With interests aligning, the agreement is said to contain sweeping and unconventional provisions spanning electric vehicles, agriculture, finance, and energy.

At its core, the deal has Canada partially unbolt its auto market in exchange for securing export channels for agricultural products. Rather than merely lowering tariffs, the two sides are viewed as having designed a sophisticated model of shared gains that addresses each other’s key pain points.

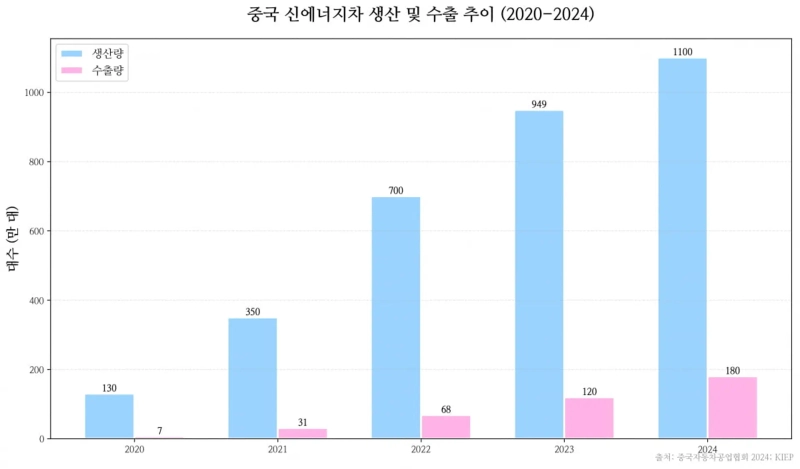

The most far-reaching element is the opening of the EV market. The Canadian government has decided to effectively eliminate the 100% punitive additional tariff it imposed on Chinese EVs in 2024 in step with the U.S. Under the agreement, Canada will apply a 6.1% most-favored-nation (MFN) tariff rate to up to 49,000 Chinese-made EVs annually.

The Canadian government seeks to downplay the significance, noting that this volume amounts to less than 3% of Canada’s annual new-vehicle market (about 1.8 million units). But a closer look at the fine print suggests greater disruptive potential. The agreement stipulates that “by 2030, more than 50% of this quota will be allocated to low-priced EVs with a vehicle price of 35,000 Canadian dollars or less.”

A win for Tesla?

This is interpreted as handing the “entry-level” EV segment—currently a gap in the North American market—directly to Chinese makers. If ultra-low-priced models such as BYD’s ‘Seagull’ enter under the low 6.1% tariff, they could dominate the market on price competitiveness alone. The Canadian government said it would “offer affordable green vehicle options for working-class consumers and create jobs through joint ventures with China within the next three years.”

China, for its part, addressed a long-standing demand of Canadian farmers in the West. China agreed to cut the combined tariff on Canadian canola seed from about 84% to around 15% starting March 1. This implies improved conditions for the canola export market worth about 4 billion Canadian dollars a year (about 390 billion won).

Analysts see it as Prime Minister Carney’s gambit to soothe Canada’s agricultural heartland, which had faced a potential collapse due to Chinese retaliation after the Meng Wanzhou affair in 2019. In addition, additional tariffs on about $2.6 billion worth of agricultural and seafood products, including lobster and peas, will be exempted through the end of this year.

Reactions at home are mixed. Canada’s agriculture and mining industries welcome the deal, while the auto and parts sectors fear a “supply-chain breakdown.” The industry is watching Tesla. Some analyses suggest the biggest beneficiary of the loosened EV quota may not be Chinese brands but Tesla. Tesla is likely to use the quota to route exports to Canada of Model Y and Model 3 vehicles produced at its Shanghai Gigafactory.

In fact, Tesla previously test-exported Shanghai-made Model Y vehicles to Canada in 2023, a move that drove Chinese auto imports through the Port of Vancouver up 460% year on year. With profitability deteriorating amid intensifying competition in China’s domestic market, Canada could become an attractive outlet for Tesla to clear inventory and secure margins. Major foreign media outlets including Reuters analyzed that “the deal will give Tesla an opportunity to resume exports of China-produced vehicles.”

By contrast, North America-based auto-parts makers are on alert. If Chinese-made EVs flowing into Canada cross borders through an integrated North American supply chain, tracing parts’ country of origin could become difficult. That could serve as a “back door” that weakens the dense web of U.S. sanctions against China.

The two countries also strengthened cooperation in finance and energy. Their central banks extended a 200 billion yuan currency-swap agreement by five years. The People’s Bank of China said it would “expand the use of local currencies and promote trade and investment.” Analysts say Canada, as a G7 country, has lent support to China’s “yuan internationalization” strategy that challenges the dollar’s dominance. The yuan’s share in settlements for Canadian energy exports could also expand going forward.

“Economic diversification” vs “a self-inflicted security goal”

The deal has drawn sharply divergent reactions, from praise as a “bold declaration of economic independence” to criticism as “a self-inflicted security goal that sold out the alliance.” Supporters argue Canada should enhance consumer welfare in an era of high inflation and diversify export markets to reduce dependence on the U.S.

However, U.S. and security experts take a harsh view. The biggest concern is “data security.” As connected-car technology advances, vehicles have become “rolling data centers” rather than mere means of transport. There are fears that software and sensors installed in Chinese EVs could collect Canada’s geographic information, user data, and network information and transmit it to China.

The U.S. has been enforcing stringent rules since January last year banning the sale of connected vehicles equipped with Chinese software and hardware. Canada’s decision can be seen as punching a hole in North America’s cybersecurity perimeter. U.S. Transportation Secretary Sean Duffy warned, “Canada’s decision to bring Chinese cars into its market will ultimately be something it bitterly regrets,” adding, “Not a single one of these vehicles will be allowed into the United States.”

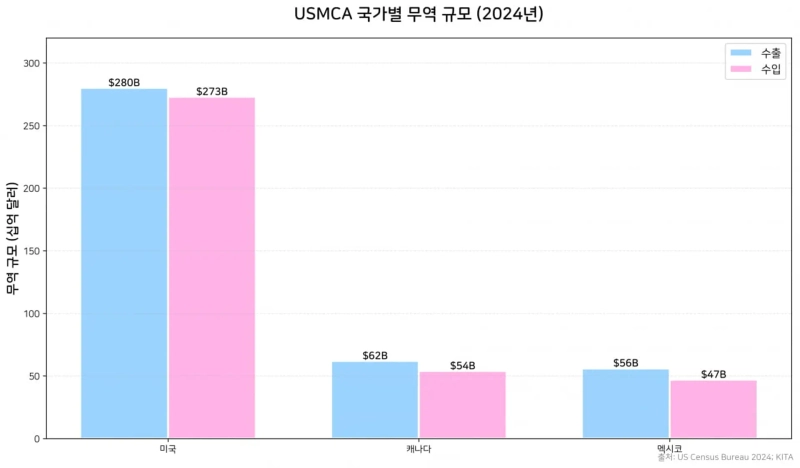

Two major macroeconomic impacts are cited. First is the risk to the USMCA framework. July 1 marks the sixth anniversary of the USMCA’s entry into force, and the three countries (the U.S., Mexico, and Canada) are scheduled to conduct a “joint review” to decide whether to extend the pact. Under Article 34.7, if any one of the three opposes extension, the agreement moves into an unstable state in which, instead of being extended for 16 years, it must undergo annual reviews.

In this review, items such as rules of origin, emerging technologies, and security provisions—where measures to contain China could be strengthened—are expected to be key flashpoints. U.S. hardliners may seize on Canada’s unilateral move to press hard for scrapping the pact or reopening negotiations. If U.S.-bound trade—Canada’s economic lifeline—were shaken, expanding trade with China would be unlikely to make up for the loss.

Canada’s pro-China tilt is also changing flows of Asian capital. Signs are emerging of an “exodus” in which Taiwan-linked capital and ethnic Chinese funds, sensitive to geopolitical risk, leave Canada for Singapore or the United States. Taiwan’s top representative in Ottawa recently publicly criticized, saying, “China is not a trustworthy partner.”

According to the Monetary Authority of Singapore (MAS), as of 2024 the number of single family offices (SFOs) in Singapore surged to 2,000—indicating that Greater China funds are moving in search of a geopolitically safe haven. Taiwan’s Ministry of Economic Affairs data likewise show that in 2024, the number of Taiwan’s investments in China fell 5.49%, but outward investment rose 90.57%. If Canada leans toward China, a “Canada exit” by Taiwan-linked capital driven by security anxiety could accelerate.

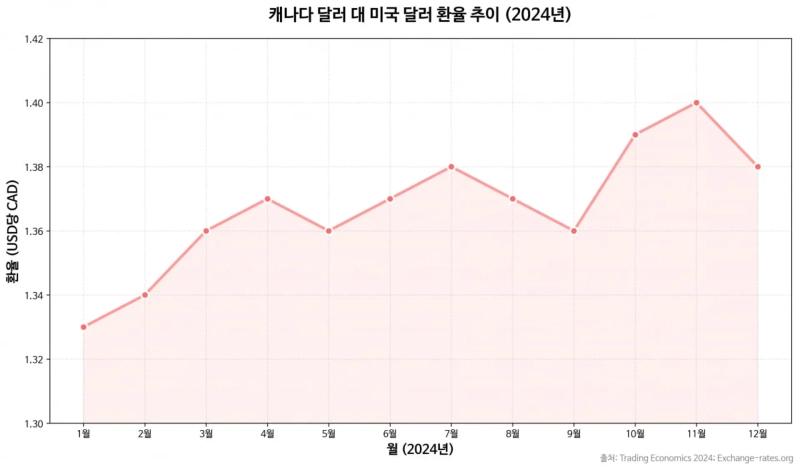

Financial markets also reacted immediately. On the day the agreement was announced, the 16th, the Canadian dollar fell 0.2% against the U.S. dollar to 1 USD = 1.3928 CAD, slumping to its lowest level in six weeks. Shaun Osborne, chief FX strategist at Scotiabank, said, “Market concerns that the U.S. will not welcome this agreement were reflected in the exchange rate.”

Korean companies will also be affected by the ‘Maple–Yuan’ agreement. Korean automakers and battery manufacturers may face “double pressure” from intensified price competition in the Canadian market and higher barriers to entering the U.S. market. The U.S. may also tighten USMCA rules of origin to pressure Canada. The U.S. is already banning the use of Chinese minerals and parts through the Inflation Reduction Act (IRA) foreign entity of concern (FEOC) rules.

If the July USMCA renegotiation strengthens “origin verification” or adds “poison pill” clauses that strip duty-free benefits from batteries containing even a small amount of Chinese materials, the strategies of Korean companies building battery plants in Canada will inevitably require a wholesale overhaul.

By Kim Joo-wan, kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.