Q4 -0.3% ‘contraction’…domestic demand and net exports both negative for first time in 22 years

Summary

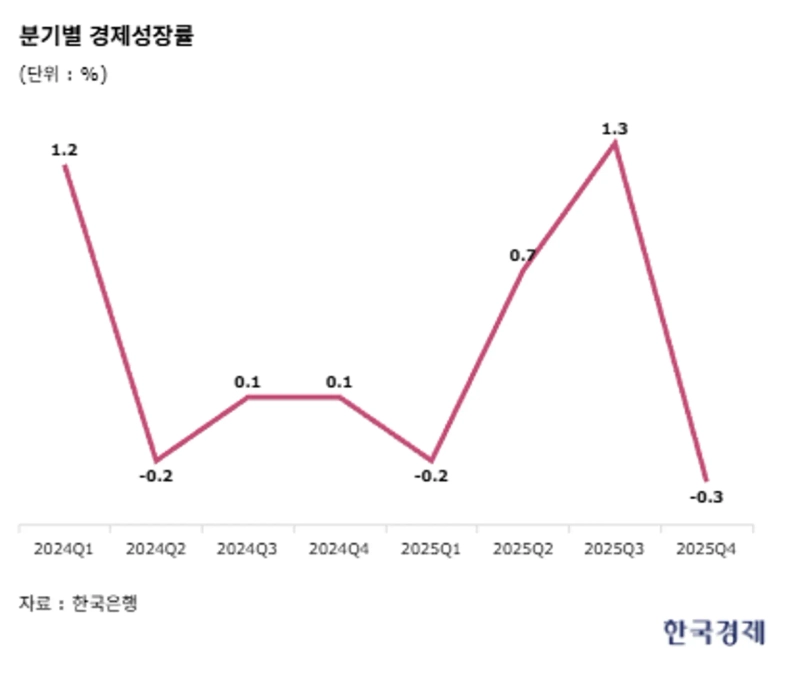

- It reported that real economic growth in Q4 last year came in at -0.3% quarter-on-quarter, returning to contraction after three quarters.

- It said the growth contributions of the private and public sectors, as well as domestic demand and net exports, were all negative, marking a simultaneous slump for the first time in 22 years.

- It reported that annual growth was limited to 1.0%, while construction investment fell 9.9%, the weakest since the foreign exchange crisis.

Annual growth barely holds at 1.0%

Construction posts ‘worst report card’ since the FX crisis

The economy contracted sharply in the fourth quarter of last year. Facility investment and construction investment retreated significantly, and exports also fell. It is the first time in 22 years that the growth contributions of domestic demand and net exports have both turned negative. The Q4 contraction left last year’s growth rate barely clinging to 1.0%.

According to the Bank of Korea’s release on the 22nd, “2025 Q4 (fourth quarter) and annual real gross domestic product (advance estimate),” the economy contracted 0.3% quarter-on-quarter in Q4 of last year. After posting -0.2% in Q1 last year, the economy returned to contraction after three quarters. This is the lowest reading since -0.4% recorded in Q4 2022.

By expenditure category, private consumption rose 0.3%, plunging from 1.3% the previous quarter. Goods consumption, including passenger cars, is understood to have declined. Government consumption also saw its growth pace slow to 0.6% from 1.3%. Both items were at their lowest levels since Q1 last year, when they posted contraction.

Investment fell steeply. Construction investment dropped 3.9% as both building and civil engineering works declined. While it had shown a 0.6% increase the previous quarter, it immediately turned negative. Facility investment decreased 1.8%, led by transportation equipment such as automobiles. Exports fell 2.1%, driven by automobiles and machinery and equipment, while imports declined 1.7% as items such as natural gas and automobiles fell.

In terms of growth contributions, the private and public sectors, as well as domestic demand and net exports, were all negative. Classified by economic agent, the private sector contributed -0.2%p and the government -0.1%p, both contributing to the contraction. By component, domestic demand contributed -0.1%p and net exports -0.2%p, also jointly negative. It is the first time in 22 years that both domestic demand and net exports have posted negative contributions, since Q1 2003 (each -0.3%p).

With the sharp Q4 contraction, the annual growth rate also only managed to hold at 1.0%. It was halved in a year from 2.0% in 2024. This is the lowest level since 2020 (-0.7%), when growth deteriorated sharply due to COVID-19.

As recently as Q3 last year, when growth surprised at 1.3%, some analysis suggested that “1.1% is possible as long as Q4 does not contract,” but expectations were dashed by the Q4 downturn. There is also the possibility that even the 1.0% growth rate was not fully achieved. Given that the Bank of Korea’s stated range for achieving 1.0% annual growth assumed a Q4 growth rate between -0.4 and -0.1%, some analyses suggest that, when considering the second decimal place, the growth rate could end up in the 0.9% range.

The deterioration in construction investment stood out even in the annual figures. Construction investment fell 9.9% last year, the weakest since 1998 (-13.2%), when the International Monetary Fund (IMF) foreign exchange crisis hit. The construction industry also posted -9.6% last year, receiving its worst report card in 27 years.

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.