Editor's PiCK

Ownership-cap limits on crypto exchanges add uncertainty… Digital assets bill ‘in the fog’

공유하기

Summary

- The Financial Services Commission’s submission of the government draft of the Digital Assets Basic Act has been tentatively postponed to next month due to the issue of limits on controlling shareholders’ ownership of exchanges.

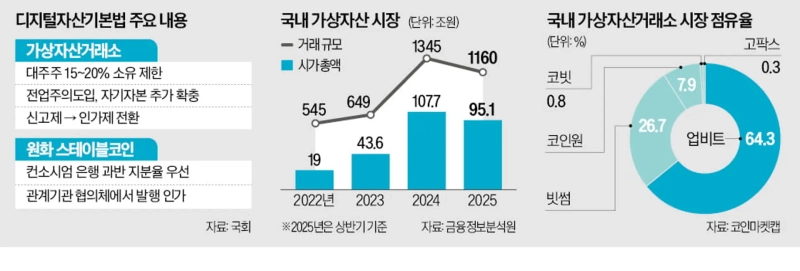

- The government is pushing a plan to overhaul governance by capping controlling shareholders’ stakes at 15–20%, with five major won-based exchanges including Upbit and Bithumb cited as regulatory targets.

- While the industry is fiercely opposing forced, artificial stake sales as an infringement of private property rights, the government says the measure is a minimum safety device to ensure exchanges’ public nature and transparency.

FSC repeatedly delays submission of the bill

‘Dispersed ownership’ emerges as a new flashpoint

Pushing to cap controlling shareholders at 15–20%

Five major exchanges including Upbit targeted by regulation

Industry: “Forced, artificial stake sales

violate private property rights” — fierce backlash

Government mood: “They must accept public responsibility”

The enactment of the Digital Assets Basic Act, intended to regulate South Korea’s virtual-asset market with trading volume exceeding 1,000 trillion won, has fallen into a “zero-visibility” situation. Discussions that were expected to gather momentum have run into an unexpected variable: limits on controlling shareholders’ ownership of crypto exchanges. On the surface, the delay is attributed to the Financial Services Commission (FSC) being slow to submit the bill to the National Assembly, but analysts say a tug-of-war among the government, the industry and political circles over regulation is at work.

The won-denominated coin debate has been settled, but…

According to the government and industry on the 22nd, the FSC’s submission of the government draft of the Digital Assets Basic Act—previously expected to take shape this month—has been tentatively postponed to next month.

While key issues related to won-based stablecoins have effectively been wrapped up, the question of dispersing exchange ownership has surged as a new flashpoint. Earlier, the FSC shared with the ruling Democratic Party of Korea’s Digital Assets Task Force (TF) a plan to cap major shareholders’ stakes in exchanges at 15–20% under the Digital Assets Basic Act. It signaled an intention to overhaul governance structures 13 years after crypto exchanges first emerged in South Korea. Currently, Song Chi-hyung, chairman of Dunamu (operator of Upbit), holds 25.52%, while Bithumb Holdings owns 73.56% of Bithumb. All five major won-based exchanges—Coinone (CEO Cha Myung-hoon 53.44%), Korbit (NXC 60.5%) and GOPAX (Binance 67.45%)—would fall within the regulatory net.

Backlash then erupted from parts of the industry and even within the ruling party, calling it “excessive regulation that ignores reality and an infringement of private property rights.” In particular, the industry was jolted when the government floated measures seen as effectively inducing stake sales. Many say it has also surfaced as an obstacle to previously anticipated big deals such as Naver–Dunamu and Mirae Asset–Korbit. Speculation ran rampant, including claims of involvement by a senior government official. A senior industry official said, “Applying an artificial dispersal of ownership to private companies inevitably clashes with constitutional values such as property rights,” adding, “Ultimately, there is a significant risk of undermining the stability of the market-economy model that Korea has maintained steadily for a long time.”

“Must meet qualification requirements”

However, a firm current within the government holds that limiting major shareholders’ stakes is a “minimum safety device” to bring digital assets into the institutional fold. It is said that many in the government view the backlash as an attempt by incumbent operators to protect vested interests. A senior ruling-party figure familiar with the legislative process said, “With 10 million people holding virtual-asset accounts, exchanges have grown into public infrastructure,” adding, “There is broad consensus that we can no longer leave in place a governance structure where a specific individual or major shareholder calls the shots.”

As for criticism that this amounts to forced stake sales, the government argues it is not pressuring specific operators but presenting objective qualification requirements tied to the introduction of a licensing regime. The idea is that to secure a legitimate license (permit) and be guaranteed business continuity, exchanges must undertake corresponding structural improvements and accept public responsibility. Another ruling-party official said, “If they are to be incorporated into institutional finance and receive protection under the law, it is only natural that they have the appropriate level of public interest and transparency.”

Election calendar may also become a variable

The political situation and schedule are also variables. The Democratic Party’s Digital Assets TF, which is leading discussions on the bill, was launched by former floor leader Kim Byung-kee. With Han Byung-do recently taking office as the new floor leader, concerns are emerging that the discussions accumulated so far could return to square one.

Another hurdle is the imminent 8th Nationwide Simultaneous Local Elections to be held on June 3. Typically, as elections approach, lawmakers turn to constituency activities and the National Assembly effectively grinds to a halt. Even if the bill is introduced, it is expected to take considerable time to pass the plenary session. Rep. Ahn Do-geol of the Democratic Party, a member of the TF, said, “It is not yet a finalized bill, so it is difficult to disclose,” adding, “We are supplementing views on issues between the government and the ruling party, and once a compromise is prepared, a single bill will be introduced.”

Cho Mi-hyun / Kim Hyung-kyu / Lee Si-eun, reporters mwise@hankyung.com

![Bitcoin capped despite easing of Trump’s ‘Greenland risk’…downside pressure builds [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/2d34a988-f3f1-4f64-b9ab-236c352e3812.webp?w=250)