Even as the KOSPI, 'No. 1 in the world,' goes on a tear, "it’s still cheap"…why the bold call

Summary

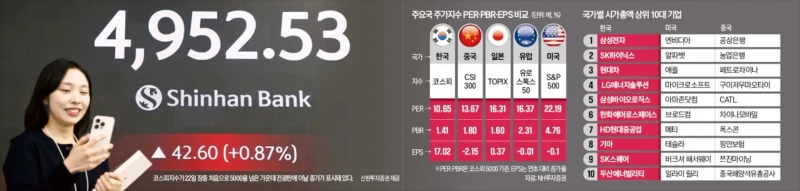

- Experts said the market remains undervalued, citing the KOSPI at 5,000, a PER of 10x, and a PBR of 1.41x.

- They said profit growth in semiconductors, autos and defense, along with future industries such as secondary batteries, robotics and autonomous driving, plus MSCI inclusion and a third Commercial Act revision, are additional drivers for further gains.

- Some advised caution, warning of a correction due to the sharp short-term rally and geopolitical risks, and recommended building up cash and buying blue chips in tranches when the index falls.

KOSPI makes new history for the first time in 46 years…experts’ outlook

"Korea premium— even 5,000 is cheap" vs. "up 1,000 points in three months—overheated"

Profit outlook improving for semiconductors, autos and defense

PER of 10x signals undervaluation…Japan 16x, China 13x

Potential tailwinds from MSCI inclusion and a third Commercial Act revision

Trump tariffs and geopolitical risks still linger

Build up cash to brace for a correction

Buy blue chips in tranches on every dip

As the KOSPI index broke above the “dream level” of 5,000, attention is turning to how long the bull market can last. Many experts point to rising profit estimates for semiconductors—highly influential on the market—along with autos and defense, and expect the market to maintain a strong trend for some time.

Even after the KOSPI’s surge, "it’s still cheap"

According to the Korea Exchange on the 22nd, the KOSPI has risen 17.52% so far this year—the highest gain among major equity markets. After setting a record with a 75.6% sprint last year, it is pressing the accelerator again this year. It far outpaces the performance of major indices across 30 countries, including Taiwan’s TAIEX (9.65%), Japan’s Nikkei 225 (6.68%) and the U.S. S&P 500 (0.44%).

Experts say it is hard to view 5,000 as overvalued, given that expectations for a rapid increase in listed companies’ earnings per share (EPS) are driving the rally. The KOSPI’s 12-month forward price-to-earnings ratio (PER) currently stands at around 10.65x. That is lower than the U.S. (22.19x), Europe (16.37x) and Japan (16.31x), and even below China (13.67x), indicating undervaluation. The price-to-book ratio (PBR) is also just 1.41x, meaning it trades cheaper than Japan (1.60x) and China (1.80x).

Baek Young-chan, head of the research center at SangSangIn Securities, said, “This year’s peak forecast for operating profit in the main board market is as high as KRW 600 trillion—double the previous estimate,” adding, “Even if the momentum in semiconductor bellwethers such as Samsung Electronics and SK hynix slows, growth engines in future industries such as physical AI will lift the index.”

Among the top 10 companies by market capitalization in Korea are semiconductors—seen as a future industry—along with robotics (Hyundai Motor), secondary batteries (LG Energy Solution), biotech (Samsung Biologics), defense (Hanwha Aerospace), and nuclear power (Doosan Enerbility). Many view them as more attractive than the U.S., which is tech-heavy, and China, which is tilted toward traditional industries.

Over the medium to long term, there are also forecasts that the index could gain additional upside momentum if inclusion in the MSCI Developed Markets Index and a third revision to the Commercial Act become reality. Lee Chae-won, chairman of Life Asset Management, said, “If corporate results come in as expected and reforms such as changes to the inheritance tax system are implemented, Korea’s stock market could command valuations comparable to Europe and Japan.” She also expected previously neglected sectors such as secondary batteries to ride a rotation-driven market. Baek added, “After robotics, companies linked to autonomous driving could emerge, leaving room for further gains in secondary-battery-related stocks,” saying, “Tailwinds outweigh headwinds.”

Major brokerages have been steadily raising their KOSPI targets. Korea Investment & Securities (5,650) and Hana Securities (5,600), Samsung Securities (5,400), SK Securities (5,250), and Kiwoom Securities and Yuanta Securities (5,200) have successively lifted their KOSPI index ranges.

"Build up cash to brace for a correction"

Even as expectations for a bull market rise, some are cautiously urging prudence. After an unprecedented short-term surge, the risk of a deep correction has increased. Geopolitical risks surrounding Venezuela and Iran earlier this year, along with the recent U.S. push to annex Greenland, are cited as factors that could amplify volatility in financial markets.

Some also predict that the KOSPI will follow a front-loaded pattern this year. Lee Jin-woo, head of the research center at Meritz Securities, said, “After the KOSPI overshoots in the first half, it could start to pause and consolidate in the second half,” adding, “From an investment perspective, it is positive to build up cash and buy quality stocks in tranches when the index declines.”

By Jo Ara / Ryu Eun-hyeok, reporters rrang123@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.